Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : December 15, 2018

Market Action

US equities fell along with global stocks on Friday, rounding out a week of volatile trading as investors waded through trade dispute developments and other geopolitical events. Yields on the US 10-year Treasury note were unchanged at 2.89% while the price of a barrel of West Texas Intermediate crude oil fell nearly 3% to $51.08. Volatility, as measured by the CBOE Volatility Index (VIX), rose to 21.3 from 20.2 a week ago.

British Prime Minister Theresa May, having overcome a leadership challenge from her own party, ran into fresh trouble in Brussels on Thursday with her efforts to persuade her European Union counterparts to sweeten the Brexit deal effectively running aground. UK lawmakers are concerned that – if activated – the controversial Irish backstop would keep the UK trapped in the EU’s customs union indefinitely, with a limited ability to negotiate new trade deals.

China resumed purchases of US soybeans and crude oil while rolling back tariffs on US-made autos to their pre-trade war level of 15% from 40%. China’s desire to engage more deeply with the US on trade may be driven by a sharp decline in domestic economic activity. Auto sales have fallen for five straight months and could post their first year-over-year decline in sales since the early 1990s. The pace of industrial production slowed more than expected in November, rising at a 5.4% year over year pace compared with October’s 5.9%. Retail sales reflected the slump in auto sales, rising 8.1% year over year in November compared with forecasts for a 9.0% pace. Meanwhile, the White House this week announced that tariff rate hikes originally scheduled to come into place 1 January will be delayed until 1 March, when talks with China are set to conclude.

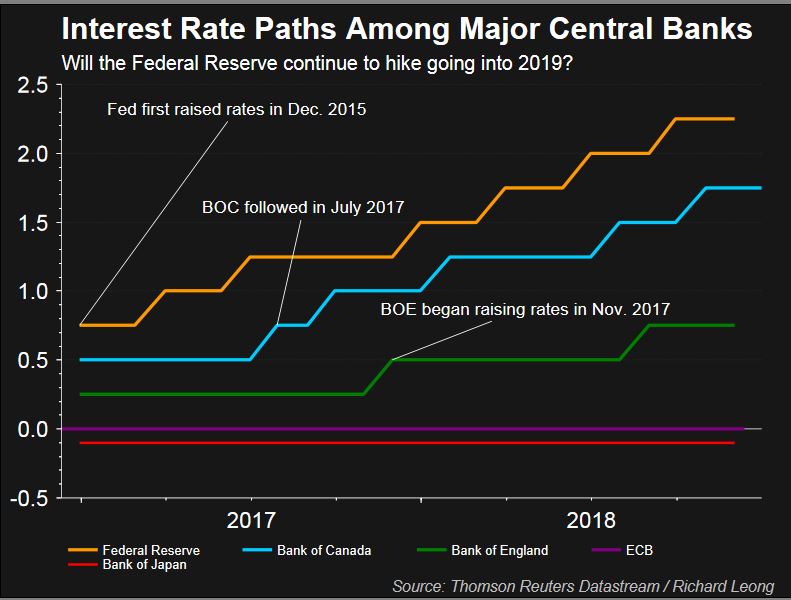

The European Central Bank formally announced the end of its three-year, €2.6T monetary stimulus scheme. The economic picture is still fragile, however, and the ECB could struggle to bring interest rates back up to zero percent, especially if the US Federal Reserve pauses its rate hike cycle. The Swiss National Bank kept its ultra-loose monetary policy in place, citing a delicate exchange-rate situation, weakening inflation and international tensions as reasons to maintain its expansive course into a fourth year.

After four weeks of violent protests in the streets of Paris and other large French cities, French president Emmanuel Macron announced he will roll back a fuel tax hike and a tax on pension benefits while introducing monthly bonuses of €100 to minimum-wage workers. That package will add approximately €10 billion to France’s budget deficit, pushing it well above the EU limit of 3% of gross domestic product. The moves come at a time when Italy is struggling to reduce its deficit to below 2% at the behest of the EU or face disciplinary measures.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

The US Federal Reserve is almost certain to hike interest rates for the fourth time this year to 2.25-2.50% on Wednesday but it will be ‘What they say, not what they do’ that matters to investors. Expectation is building that the US Fed will pause after one more hike next year. Money markets have swung dramatically in recent months and are now only fully pricing one more hike in 2019, after having expected another two or three at least earlier in the year.

With sterling set for its biggest weekly drop in seven weeks after a tumultuous week in British politics, markets are slowly digesting the possibility that the UK could crash out of the European Union at the end of March without a deal. Though the majority of analysts think that an iteration of Prime Minister Theresa May’s current deal will ultimately be passed by parliament, some investors say signs of stress are emerging in British assets, similar to what was seen during the dark depths of the euro zone crisis. For example, 90-day correlations between the benchmark UK stock index and the British pound have strengthened in recent days whereas normally these assets move inversely to each other. The cost of insuring against a UK debt default is at the highest since the 2016 vote and some big banks say a lurch into a ‘hard’ Brexit where ties are badly severed would hack another 5-10 percent off sterling.

MSCI’s emerging currency index is down 25% from its January highs but signs of a modest rebound in recent weeks have suggested hope for next year. Huge dollar borrowings in EM means the fate of many is still in the hands of the Fed, but local central bankers do have some sway and a multitude of rate meetings are coming up. Following another hike from Russia, markets reckon more hikes are possible in Indonesia which has upped rates six times already in 2018, the Czech Republic where policy has tightened four times in a row, and in Mexico which raised rates in November for the third time to a decade high. Thailand may deliver a rise for the first time in seven years and there are also rate-setting meetings in Colombia, Taiwan to watch too.

This Week from BlackSummit

Assessing the Prospects of 2019: Part II

John Charalambakis

Recommended Reads

GE Powered the American Century-Then It Burned Out – WSJ

Our end-of-year awards celebrate the worst in politics – Bagehot

Russia Tries to Strangle Ukraine in New Maritime Strategy – SPIEGEL ONLINE

What Happens When a World Order Ends