Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : November 10, 2018

Market Action

US equities regained some ground this past week while European and Asian benchmarks closed fairly flat on the week. The US 10-year Treasury note slightly declined to 3.19% while the price of WTI crude oil continued to fall, dropping to $59.91 a barrel from last Friday’s $62.90. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), decreased slightly to 18.06 from 19.85 last Friday.

Following the US midterm elections on Tuesday, on Wednesday US stocks rallied to their highest levels since the October selloff as investors’ fears about the elections and potential radical economic policy changes diminished. The divide in Congress may lead to legislative gridlock for the rest of US president Donald Trump’s term; in addition, a Democratic House means that the Trump administration is likely to face an onslaught of congressional investigations. However, history has shown that mixed party control is generally good for equities under normal circumstances. The question of course is if we are still operating under normal circumstances.

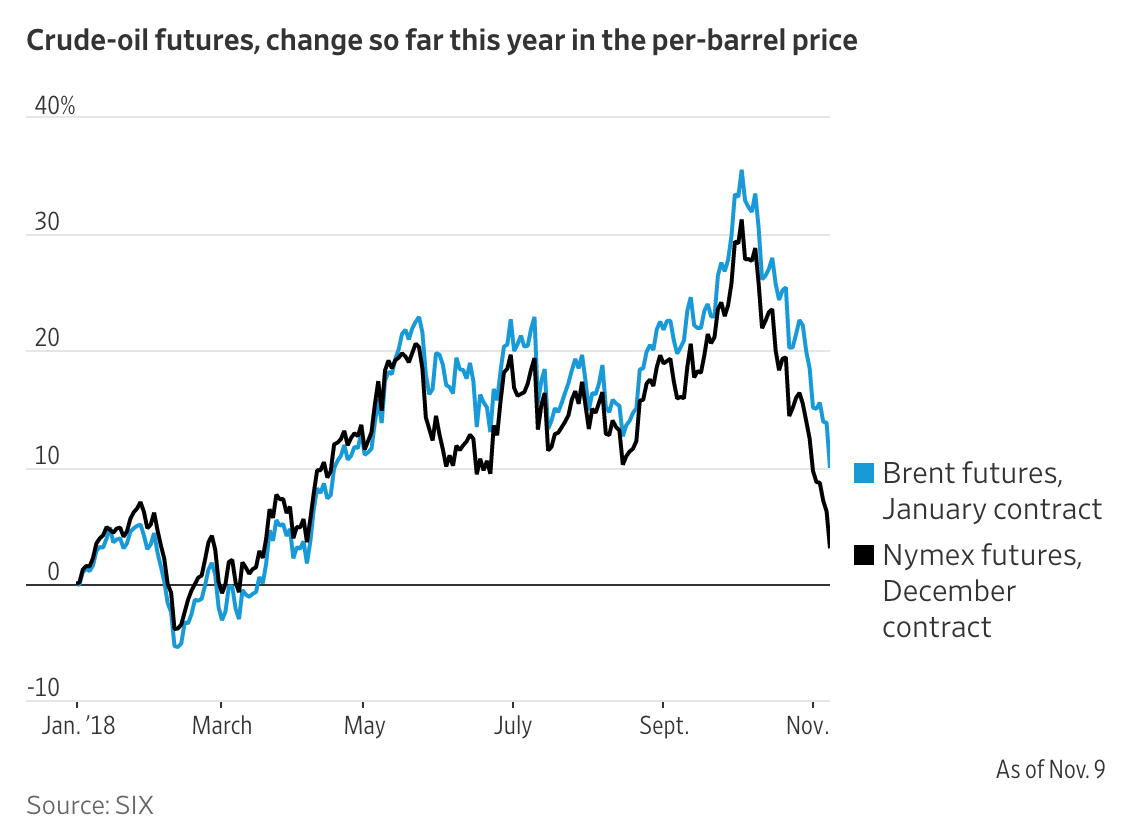

US oil prices fell from their previous peak of $76.41 a barrel to $60.67, roughly a 21% decline, which placed them in a bear market. After reaching four-year highs in early October, oil prices went into a downward spiral due to uncertainty surrounding global economic growth and rising production. In addition, the Trump administration’s recent decision to issue temporary Iranian oil import sanction waivers to eight countries and recent data showing a rise in US oil inventories put downward pressure on US oil as fears of oversupply increased. Following suit, Brent crude oil is also moving closer to bear market territory, recently falling 19.2% from its four-year high in October.

China’s total exports increased 15.6% year-over-year in October, beating economists’ expectations of a slowdown due to the trade fight with the United States. The strong growth indicates that China is benefiting from healthy global demand and a weaker yuan. Many economists believe that the recent growth in exports is due to increased orders before the tariffs went into effect and is likely to wane in the coming months. China’s imports came in strong at 21.4% year-over-year, up from September’s 14.3%.

On a year-over-year basis, Turkey reported an increase of 25% in headline inflation in October, the highest rate in 15 years and well above the central bank’s 5% target; core CPI (Consumer Price Index) rose to similar levels. Turkey’s currency depreciation significantly added to the country’s inflationary pressures, with the lira falling 30% against the dollar since year to date. Concerns over central bank independence and the spat between the US and Turkey also contributed to the rising inflation.

North Korea cancelled talks to discuss its nuclear program with US Secretary of State Mike Pompeo, lowering hopes for progress towards denuclearization. No reason for the postponement was given, but many view it as North Korea’s attempt to pressure the US into granting some early relief from sanctions before any nuclear talks resume.

Click here for this week’s updated market returns table.

What could affect markets in the week ahead?

Italy has until Tuesday to submit a new draft budget to Brussels. EU rules require it to revise its 2019 structural deficit, so that it falls by 0.6 percent of GDP versus this year, rather than rise by 0.8 percent as planned now. So far, markets and politicians have taken heart from S&P’s recent decision not to downgrade Italy’s credit rating. Talk of a fresh round of cheap ECB bank loans has helped too. Both factors have helped the Italy-Germany yield gap to hold below 300 bps. The question now is how long can that last in the face of the budget standoff?

The US Fed is keeping a steady course for a December rate rise, and another two moves are likely next year. Could that become three? Data on Wednesday may show. October inflation is expected at 2.4 percent (2.3 percent in September) but labor markets are tightening – average hourly wage inflation of 3.1 percent is the highest since 2009; some sectors report 5-10 percent wage growth.

Trump’s trade tantrums and Beijing’s own credit clampdown are cooling growth in China, possibly more so than Chinese authorities had expected. Factory inflation slowed in October for the fourth month and the car market, the world’s largest, may be heading for an annual contraction, its first since at least 1990. Beijing therefore looks likely to unveil some stimulus, weakening the yuan further. Retail sales and industrial data ahead may show if existing measures have had any impact. However, each bout of weak data raises more stimulus exceptions, keeping the pressure on the yuan – the currency just had its worst week since July and is down 6.5 percent year-to-date. Beijing will be hoping to plot some kind of middle course to take pressure off President Xi Jinping when he comes face-to-face with Trump at a G20 summit later in November.

Growing expectations of a Brexit deal by end-November have lifted sterling for two straight weeks. Because of a large number of short sterling positions held in options markets, the currency has tended to rise more sharply on signs of a breakthrough than it falls when talks reach impasse.

Reserve Bank of India Governor Urjit Patel could resign at the central bank’s next board meeting on November 19, according to online financial publication Moneylife. At issue are pressing demands by the government for the RBI to relax lending curbs and hand over “excess” reserves to shore up public finances. A resignation could create uncertainty and undermine India’s already-weak financial markets.

This Week from BlackSummit

The Financial Ecosystem and the Dollar Trajectory: International Reserves, the Eurodollar Market, and Fiscal Policies

John E. Charalambakis

Recommended Reads

Investors start to fret about ballooning US public debt

U.S. Oil Enters Bear Market on Rising Inventories, Worries of Oversupply

How to Tell a Bear Market Is About to Hit

China Will Do “Whatever It Takes” to Stop Its Falling Stock Market

How the War in Yemen Became a Bloody Stalemate – and the Worst Humanitarian Crisis in the World

Iran sanctions: 5 things to know

Video of the Week

Famine stalks Yemen as warring parties block aid, UNICEF warns