Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : September 23, 2018

Market Action

Global equities extended their recent advance, with the S&P 500 and the Dow Jones Industrial Average both posting record highs on Thursday. Helping to sustain the advance were solid high-frequency economic data, such as regional Fed indices, a modest decline in the value of the dollar and a continued drop in jobless claims to a fresh 49-year low. The yield on the US 10-year note continued to rise, coming in at 3.08%, eight basis points above last week’s reading and near the top of this year’s trading range. The price of a barrel of WTI crude oil rose $3.50 a barrel amid concerns over supply disruptions from Venezuela and Iran. Click here for this week’s update on market returns.

The US implemented tariffs this week on a further $189bn-worth of Chinese imports, including furniture and car parts. A rate of 10% will apply from September 24th, rising to 25% from January 1st if there is no peace deal by then. China retaliated, placing duties on another $60bn-worth of American goods.

Russia experienced its first interest-rate rise in four years, an increase of 0.25 percentage points to 7.5%. The country’s central bank blamed inflation of 3.1% in August. Britain also saw higher inflation than expected, 2.7%, in August. House prices in London moved in the opposite direction, falling by 0.7% in the year to July, the largest drop since September 2009.

North Korea pledged on Wednesday to take additional steps toward denuclearization, starting with the permanent dismantlement of its main missile range and nuclear facility under the observation of independent observers. In response, US secretary of state Mike Pompeo said that the US was ready to resume talks and called on North Korea to complete its denuclearization by January 2021.

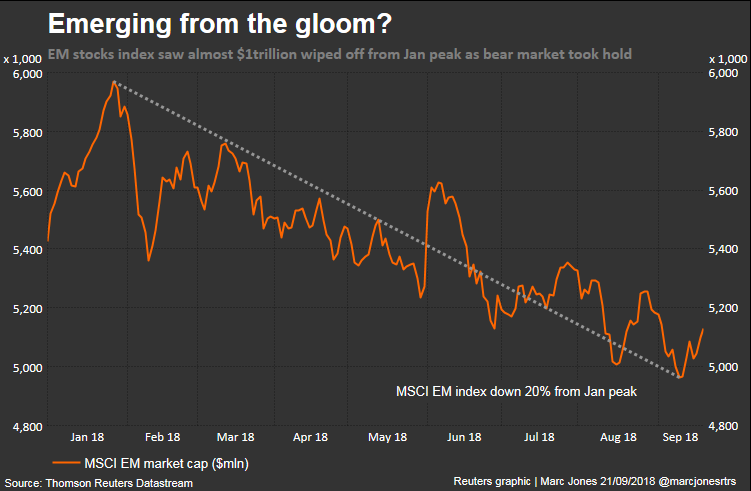

On the back of growing concern that escalating trade conflicts could inhibit confidence and investment, the Organization for Economic Co-operation and Development (OECD) trimmed its 2018 outlook to 3.7% from 3.9% previously while cutting its 2019 view to 3.7% from 3.8%. The organization also cited tightening financial conditions in emerging markets, a slowdown in global trade and political risks as causes for concern.

No closer to a Brexit divorce deal with Europe, British prime minister Theresa May returned to London after an informal summit with European Union leaders in Salzburg, Austria. On Friday, May acknowledged that the talks are at an impasse and that the United Kingdom will continue to make preparations for an outcome that does not include an agreement.

This Week from BlackSummit

Monetary Policy, Currency Misalignments, and Markets’ Memory: Pausing the Hiking of Rates

John Charalambakis

Recommended Reads

A manifesto for renewing liberalism

The Economist

Zambia slumps towards another debt crisis

The Economist

The Dangers of a No Deal Brexit

Peter Müller and Jörg Schindler

Giant Debt Offer Shows Appetite for Low-Rated Companies

Sam Goldfarb and Soma Biswas

China Inc.’s $17 Billion Global Asset Selloff Is Far From Done

Bloomberg News

Why the Euro Won’t Replace the Dollar

Matthew C. Klein

Video of the Week

Gulper Eel Balloons Its Massive Jaws

Image of the Week

What could affect markets in the week ahead?

The Fed is widely expected to lift interest rates by another 25 basis points to a range of 2% to 2.25% when it concludes its two-day meeting on Wednesday. Investors will also closely be watching updates to the Fed’s language on inflation, updates to the summary of economic projections and updates to the dot plot of interest rate projections.

The US economic calendar picks up next week with updates on consumer confidence, home prices, trade, durable goods orders, personal income and spending and a revision to second-quarter growth figures. Revised GDP figures on Thursday are expected to show no change since the previous estimate with economists forecasting 4.2%. Data on Friday are expected to show personal income jumped 0.4% month-on-month in August, while personal spending rose 0.3%. Moreover, with the looming trade talks with China trade will come under scrutiny as well.

China’s ability to stabilize the yuan in recent weeks despite weak economic data and a further escalation in its trade war with the United States is reinforcing expectations that the central bank will cut banks’ reserve ratios again within weeks. Such a move would underscore shifting policy priorities in Beijing, with growth promotion competing with the stated goal to reduce leverage and risks in the financial system.

World leaders are gathering at the United Nations for the 73rd annual U.N. General Assembly in New York City. US President Trump is scheduled to speak at the event on Tuesday, but reports already suggest a number of hot topics will be discussed from the podium. Those include the Iran deal, foreign aid, the Skripal poisoning case in England, chemical weapons and North Korea.