Weekly Market Update

Weekly Market Update

-

Author : Andy Quirk

Date : August 18, 2018

Market Action

It was a good week for US stocks as the Dow and the S&P 500 saw major gains on Thursday. US government debt yields fell this week amidst fears surrounding emerging markets. European markets edged slightly lower on the week, with Asian markets closing higher with the exception of the Shanghai Composite, down 1.34% at the end of the day. The price of WTI Crude Oil finished at $65.89 per barrel, up 0.43 cents for today but down by more than a dollar on the week.

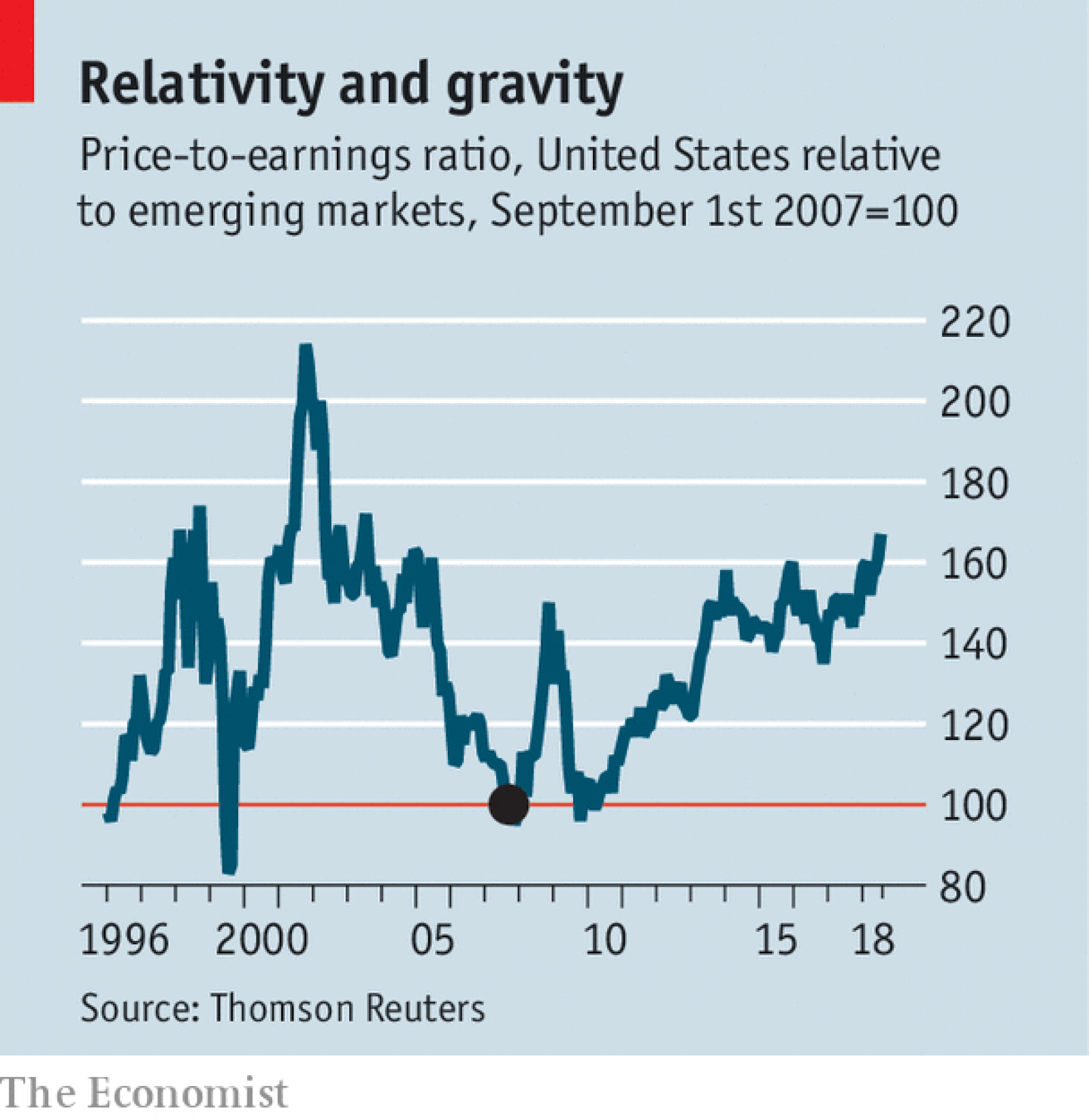

The Turkish lira weakened a further 4% on Friday as a Turkish court rejected the appeal of the American pastor Andrew Brunson. US Treasury Secretary Steven Mnuchin told Trump that more sanctions could be put in place if Brunson was not freed. Turkish sovereign dollar bonds have also fallen, while the cost of insuring exposure to Turkish debt has risen. Analysts suggest the Turkish lira may see a downtrend well into 2019. The collapse of the lira has spilled over into other emerging market currencies, including the Indian rupee, which on Monday fell to an all-time low of 69.92 per dollar.

Tesla shares dropped as much as 8.9% on Friday after a New York Times interview highlighted some serious personal and business challenges for Elon Musk. Tesla shares have fallen more than 15% since Elon Musk tweeted that he was considering taking Tesla private, which sparked an SEC investigation.

Mexico’s economy minister, Ildefonso Guajardo, said on Friday that he hopes to conclude any outstanding bilateral issues regarding the renegotiation of the North American Free Trade Agreement (NAFTA) with the US by next week. Guajardo said that although most issues are “advancing well” some areas, including auto rules of origin remain unresolved. Despite these advances, President Trump said on Thursday that he was in “no rush” to conclude talks on NAFTA.

The US special representative for Iran said on Thursday that the Trump administration is ready to impose sanctions on all countries buying oil from Iran after the November deadline. This list includes China, the number one importer of Iranian crude oil. Brian Hook, the special representative for Iran, has said that the US will issue waivers from sanctions to countries that make an effort to reduce imports of Iranian oil. China has said that it does not intend to comply with the new wave of US sanctions; in fact, some oil analysts expect China to increase its imports from Iran.

Malaysia’s central bank has announced a liberalization of the country’s foreign exchange system. The new governor of the central bank has said she intends to modify the policy that mandates insurance companies cap their level of foreign ownership at 70%. Exporters will no longer be obligated to convert most of their earnings into ringgit. The new rules will also allow non-resident corporations to trade in ringgit-denominated interest rate derivatives. This could come in response to the recent volatility, particularly in emerging market currencies.

Please click here for this week’s update on market returns.

This Week From Blacksummit

Dollar Shortage, Contagion Fears, and Currencies’ Tremors

John E. Charalambakis

Recommended Reads

Iran Sanctions Redux

Jeffrey J. Scott

China’s Growth Engine Sputters as It Battles U.S. Over Trade

Liyan Qi, Grace Zhu and Dominique Fong

Turkey Faces Its Crisis with Shaky Leadership and Few Friends

Jacob Funk Kirkegaard

Opinion: Brexit has reached a dead end

Bernd Riegert

High suspense in Brazil’s general election

The Economist