Market Action

The Dow Jones Industrial Average dropped 200 points on Friday morning after US President Trump announced $50 tarifs on $50 billion worth of Chinese imports. China’s Ministry of Commerce has said it will respond in “equal scale and equal strength.” Later in the day it recovered half of the losses.

US President Trump met with North Korean leader Kim Jung-Un this week in Singapore. The summit resulted in a relatively vague joint statement to work toward de-nuclearization, though the North Korean leader did not extend a moratorium on testing nuclear weapons.

Union countries unanimously voted to impose import duties on €2.8 billion of US products as a counter-measure against US tariffs on EU steel and aluminum. The European Commission has proposed 25% duties on US goods including orange juice, bourbon, jeans, and motorcycles.

Luis Caputo has taken over as chief of Argentina’s central bank after the peso continued to plunge despite Argentina receiving the biggest loan in the history of the IMF. Investors will look to Caputo to provide stability and decrease volatility of the peso, which has lost over a quarter of its value since April.

Leveraged Buyout (LBO) volume reached $156 billion this year and is on track to reach the highest volume of LBOs since 2007. The rise in LBO activity is causing merger and acquisition (M&A) activity to increase dramatically; $2.1 trillion of M&A deals have been announced so this year alone. The court ruling on Tuesday that AT&T can acquire Time Warner without violating anti-trust laws will likely encourage other major M&A activity.

The Japanese government announced it was pushing its target date for achieving a budget balance from 2020 to 2025. This delay illustrates Japan’s struggle to cut its deficit with inflation still close to zero. The central bank has not yet moved to tighten monetary policy.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Everything is a Political Theater, but a Political Theater is not Everything

John E. Charalambakis

Recommended Reads

Fixing the Euro: the Time to Act Is Now

Henrik Enderlein

Present at the destruction: Donald Trump is undermining the rules based international order

The Economist

Wall Street keeps waiting for infrastructure to fund

Jeffrey Ball

Trump’s Mostly Meaningless Summit with Kim

Bloomberg

Video of the Week

Who is not invited to Russia’s world cup

Image of the Week

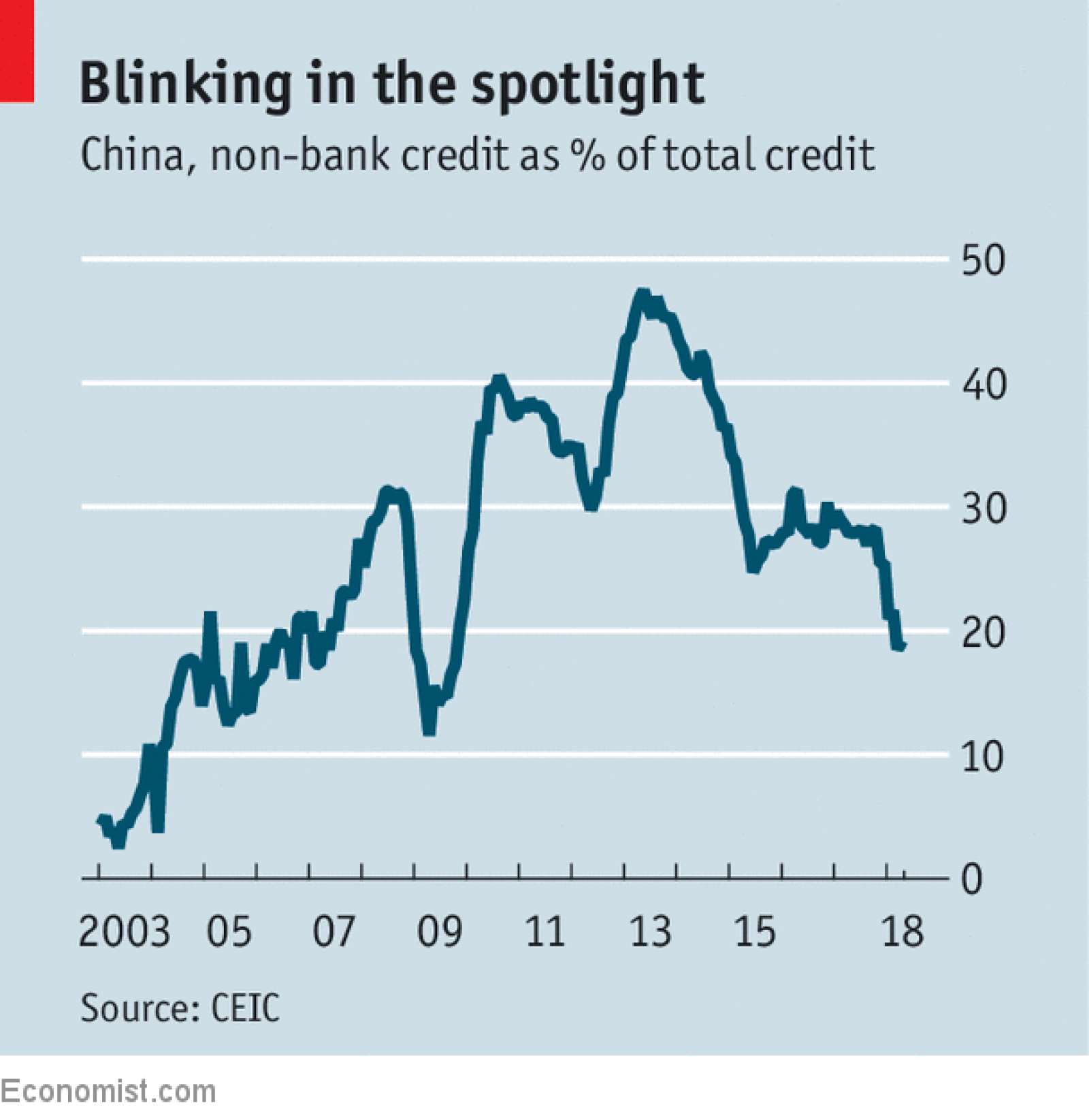

The share of new credit issued by shadow banks in China plunged in the first few months of 2018:

Source: The Economist, “China’s tighter regulation of shadow banks begins to bite,” June 14, 2018