A few days ago, it was reported that Social Security will be tapping into the Trust Fund in order to pay its obligations. As our total indebtedness reaches $200 trillion (federal, state, city debt) I am pondering when we will be returning to a state of soberness. According to the Congressional Budget Office, by 2035 all federal tax revenues will be used to pay entitlements, leaving nothing to pay the interest on the debt, let alone to pay for education, defense, infrastructure, and research. We should add that the 2035 year estimate assumes that there will be no recession between now and then and that the GDP growth rate will be 3%!

We created a crisis in the early part of this century due to credit overextension, over-collateralizing toxic assets, and through re-hypothecating paper (sometimes worthless) assets. We opted to kick the can down the road by never fixing the real causes of the crisis, but it seems that we also doubled down: we never thought that the road may be ending at some point. Prosperity bought on credit carries a price and when unfunded liabilities (pensions, health care, etc.) are included into the picture, then we may have no other alternative but to seek non-conventional alternatives, because when the music stops liquidity will be hard to find.

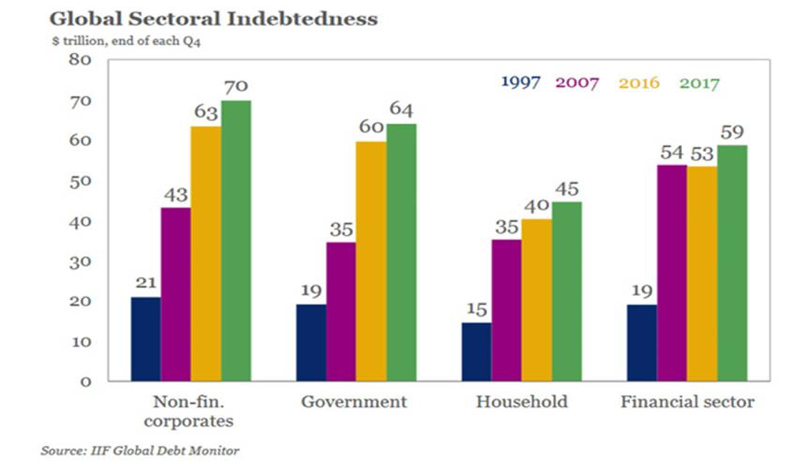

Globally the picture is probably worse. The graph below, originally published by the IIF (Institute for International Finance) tells that we are now approaching the debt levels of 1997. So much for deleveraging!

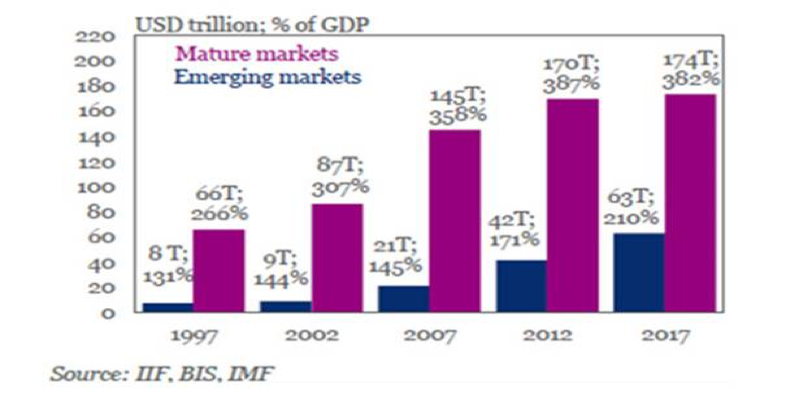

However, when we look at the same picture relative to our ability to pay it back i.e. relative to global GDP, then we discover that the situation is worse than 1997, as shown below.

In addition, emerging markets’ debt is in a much worse position, especially when we take into account the rising US rates and the tremors this rising will cause to their ability to pay back the dollar-denominated debt. Wherever we look south of our border (Brazil, Argentina, Mexico) we see trouble brewing. When we look east, we see oceans of debts in both Japan and China. The latter’s indebtedness exceeds 260% of its GDP. Someone may argue that China has foreign reserves, but so did Japan in the 1980s and the US in the 1920s. Actually, in both cases foreign reserves exceeded 5% of the GDP and both Japan and the US suffered tremendously during the subsequent decades. Excess foreign reserves are signs of capital misallocation and debt over-extension.

Are we supposed to seek shelter? My humble opinion is that it is time to start taking precautionary measures, having spare tires, anchoring our portfolios and hedging our positions.

Everything is a Political Theater, but a Political Theater is Not Everything

Author : John E. Charalambakis

Date : June 13, 2018

A few days ago, it was reported that Social Security will be tapping into the Trust Fund in order to pay its obligations. As our total indebtedness reaches $200 trillion (federal, state, city debt) I am pondering when we will be returning to a state of soberness. According to the Congressional Budget Office, by 2035 all federal tax revenues will be used to pay entitlements, leaving nothing to pay the interest on the debt, let alone to pay for education, defense, infrastructure, and research. We should add that the 2035 year estimate assumes that there will be no recession between now and then and that the GDP growth rate will be 3%!

We created a crisis in the early part of this century due to credit overextension, over-collateralizing toxic assets, and through re-hypothecating paper (sometimes worthless) assets. We opted to kick the can down the road by never fixing the real causes of the crisis, but it seems that we also doubled down: we never thought that the road may be ending at some point. Prosperity bought on credit carries a price and when unfunded liabilities (pensions, health care, etc.) are included into the picture, then we may have no other alternative but to seek non-conventional alternatives, because when the music stops liquidity will be hard to find.

Globally the picture is probably worse. The graph below, originally published by the IIF (Institute for International Finance) tells that we are now approaching the debt levels of 1997. So much for deleveraging!

However, when we look at the same picture relative to our ability to pay it back i.e. relative to global GDP, then we discover that the situation is worse than 1997, as shown below.

In addition, emerging markets’ debt is in a much worse position, especially when we take into account the rising US rates and the tremors this rising will cause to their ability to pay back the dollar-denominated debt. Wherever we look south of our border (Brazil, Argentina, Mexico) we see trouble brewing. When we look east, we see oceans of debts in both Japan and China. The latter’s indebtedness exceeds 260% of its GDP. Someone may argue that China has foreign reserves, but so did Japan in the 1980s and the US in the 1920s. Actually, in both cases foreign reserves exceeded 5% of the GDP and both Japan and the US suffered tremendously during the subsequent decades. Excess foreign reserves are signs of capital misallocation and debt over-extension.

Are we supposed to seek shelter? My humble opinion is that it is time to start taking precautionary measures, having spare tires, anchoring our portfolios and hedging our positions.