There are two distinct but inseparable parts in today’s commentary: First, we discuss epochs of transition and relate those transitions to the developments we are witnessing nowadays. Second, we ask the question of if growth and value could interchange weights as the new era unfolds. We will address the intermediate and long-term effects of Artificial Intelligence (AI) on portfolios in a future commentary.

From the time of the railroads and automobiles to the time of weapons manufacturing and the atomic bomb, and now to the emerging era of AI, there is an underlying ideology that wraps each epoch’s development. Is it a coincidence that each one of these epochs is marked by an energy transition? We can see three main eras since the time of the Industrial Revolution: First the period between the mid-nineteenth century (1850) to the end of World War I (WWI). The second era marks the period from the 1920s to the Great Financial Crisis (GFC) of 2008. We are undergoing the third period today.

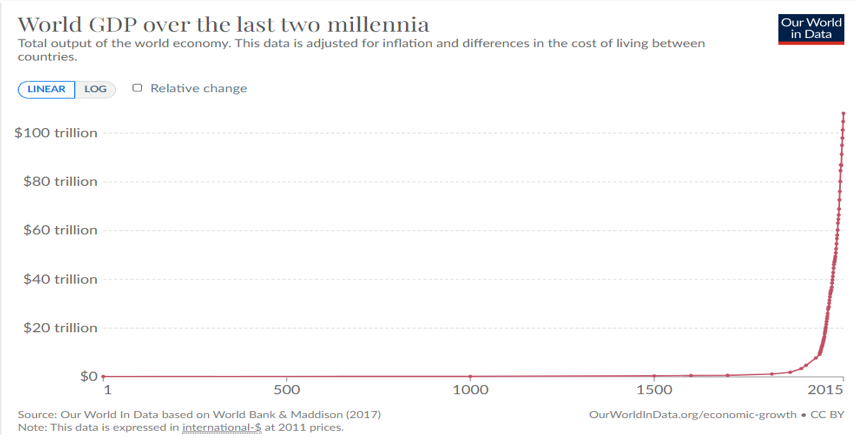

The figure below might be telling of the story that has been unfolding since the 1850s. There are three facts in the graph below:

- First, from the beginning of the intelligent/commercialized life to the 1850s, the GDP per capita was flat, experiencing zero growth.

- Second, in the 19th century, GDP/capita starts increasing exponentially. Two facts coincided: Energy transition from firewood to coal and scientific advancements. The latter is marked by historic advancements in the internal combustion engine, steam power and industrialization, electric lighting, telecommunications, chemical innovations, and electromagnetic theory, to name some of the most important ones.

- Third, GDP/capita explodes again in the 20th century. Two of the most critical and important factors are again energy transition (from coal to petroleum) and scientific advancements. Again, some of the most important advancements in science were weaponry, computers and information technology, space exploration, the internet, medicine and biotechnology, telecoms and transportation, and, of course, consumer electronics.

Where are we headed now? It is our opinion that since the GFC, the world is experiencing a new epoch also marked by the advancement of the applications of scientific knowledge, and by energy transition. The former will be exemplified by the applications of AI in research, production, and employment, as advancements in machine learning, nanotechnology, quantum computing, augmented reality, genomics, and space exploration shape the field of science and, consequently, our lives. In energy transition, we expect a peak in hydrocarbon use within the next 10-15 years, where in the interim period, we will experience a move from petroleum to natural gas/LNG (with a possible increase in nuclear power as well), while simultaneously advancing in energy storage technology, and eventually moving to renewable energy which is anticipated to provide most of our energy needs after 10-15 years.

It should also be added that those periods are marked philosophically and socially by distinct periods where there is transition from the search of truth (19th/beginning of the 20th century) to the era where -in the period following the end of WWI – the search for material happiness replaces the inquiries to find the transcendent truth in our human affairs. Hence, as we move from the 19th to the 20th century, determinism is replaced by scientific inquiries, but happiness is linked to material advancements. Consumption choices imply greater freedom, and mobility enhances our pleasure and comfort.

This is the era when ample choices plant the seeds that will allow us to make up our own facts in the era that has now been unfolding since the GFC. Economic analysis no longer suffices to explain political developments. The manufacturing of “truth” and “identity” are advanced by scientific discoveries. The latter tend to take a soteriological dimension which, when combined with an identity crisis (the war in Ukraine is a form of identity crisis, while President’s Xi’s economic insecurities also reflect an identity crisis for the Chinese leader), forms an ideology of salvation. Such ideology is mirrored in scientific advancements and/or in belligerent policies and practices. The excuse of the absolute power of science empowers our endeavors with confidence and fear, which is a paradox added to the underlying identity crisis that individuals, families, institutions, and nations are undergoing.

Moving now to the second part, we believe that one of the fundamental questions that investors should be asking (besides the decision of allocating portfolios among fixed income, equities, cash, and alternatives) is whether they should re-evaluate their equity allocations between growth and value-oriented stocks.

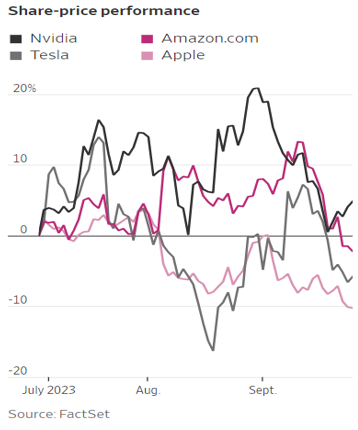

Very early in August, we questioned portfolios’ high exposure in equities, and we argued for increased exposure to Treasury Bills (TBs). The graph below shows the performance of some well-known “anchor” names since we wrote that commentary. The expectation of sustained high rates makes growth stocks less attractive, as their future earnings are discounted much more, and investors weigh the fact that a TB pays them over 5%.

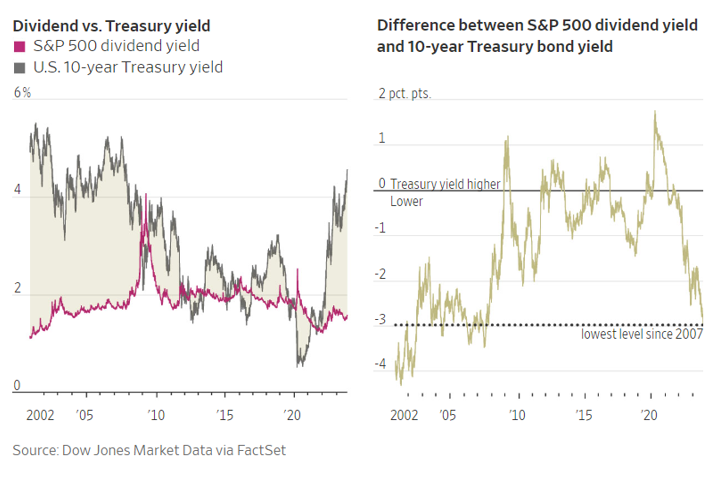

Moreover, even dividend-paying stocks when compared to the yield of TBs look unattractive, as shown below.

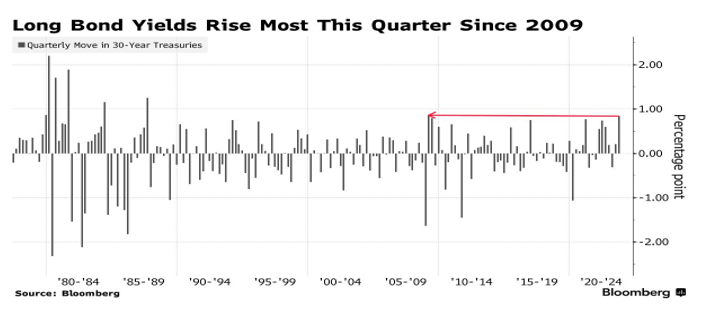

More recently, we argued that it may be time to start buying 10-year Treasuries. The rising yield and the corresponding low price make them attractive.

In addition to the points made above, it is our argument that at times when the equity premium (the earnings yield on the S&P 500 minus the 10-yeat Treasury yield) reaches current low levels, the investment climate reflects excessive optimism and exuberance not justified by fundamentals. Usually, such complacency reverses when market turmoil shakes investors’ confidence. At such times, market conditions justify dollar-cost averaging investment in value-oriented stocks (undervalued and underappreciated stocks with strong fundamentals and potential for stable growth). The figure below tells this story.

In conclusion: It is our opinion that at the current stage of economic transition, a portfolio rebalancing may be needed as rising rates along with chances of sticky inflationary pressures, accompanied by economic slowdown, point to allocating more capital to value-oriented stocks.