Last Friday’s trade war escalation may not be substantial in terms of GDP impact but could indicate a turn in the ongoing trade disputes and may inflict significant damage in business, investment, and consumer confidence. Such particular development in the midst of an economic slowdown could turn out to be a determinant negative factor for the financial markets’ momentum and direction.

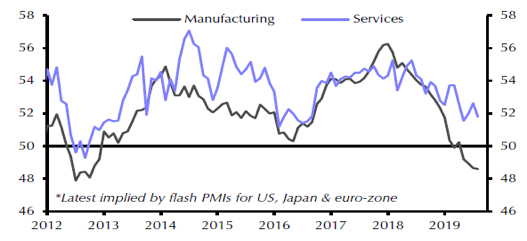

But let us start with the facts regarding the economic slowdown. As the first graph below shows the industrial activity in the US has declined to a point that implies GDP growth barely above 1%.

Source: Markit, Capital Economics

So, while the August PMI for EU-wide and Japan ticked up a little bit, the overall industrial production for developed countries was lower than anticipated which in turn implies an even further reduction to the expected GDP growth (see graph below).

Source: Markit, Capital Economics

The signals are such that the weak industrial growth would also find its twin in the services sector, and if that turns out to materialize (i.e. the service weakness to continue deteriorating as it has been happening lately, see figure below), then the chances for stagnation (not necessarily recession) become significant.

Source: Markit, Capital Economics

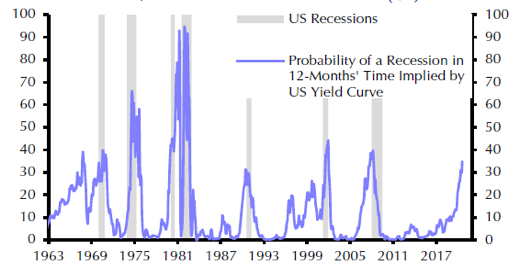

The yield curve inversion (where the 3-month Treasury Bill pays more than the 10-year Treasury Note) is not just a US phenomenon. The same inversion is happening in other developed countries too, and from a historical standpoint we could say that the probability of a US recession at this point is around 40%, as shown below (shaded areas signify recession).

Source: Refinitiv, NBER, Capital Economics

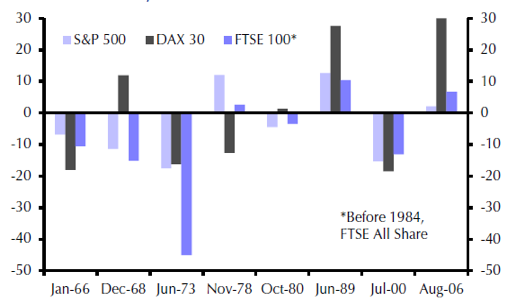

The ramification of a recession and/or stagnation (which may be more probable under the current circumstances) is that the deterioration in confidence and earnings could lead to a market decline not just in the US but also in other developed markets too (especially the ones like the UK and Germany which are already under economic pressure), as shown below.

Source: Refinitiv, NBER, Capital Economics

As noted in last week’s commentary, we would not be surprised if the pressures that are accumulating lead the markets to a 7-10% drop between now and the end of the year.