Market Action

Global equities rebounded this week, spurred by calmer emerging markets and modest hopes that US-China talks will defuse growing trade tensions. The yield on the US 10-year Treasury note extended its rise to 3%, up 18 basis points from two weeks ago. The price of a barrel of WTI crude oil rose 1.83% to $68.99 while volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX) fell to 12.1 from 14.9 last week. Click here for this week’s update on market returns.

Sweden faces a political impasse after its mainstream center-left and center-right blocs virtually tied in an election on Sunday, while the far-right – which neither wants to deal with – made gains on a hardline anti-immigration platform. Full preliminary election results give the center-left bloc (grouping the minority governing Social Democrat and Green parties with the Left Party) 144 seats versus 143 seats for the center-right Alliance bloc. The Sweden Democrats, who want to leave the European Union, won 62 seats, up from 49 in the 349-seat Riksdag where 175 seats are needed to form a majority.

Turkey’s central bank sharply raised interest rates on Thursday – defying President Recep Tayyip Erdogan’s demand to cut them – in an attempt to counter the country’s economic problems and reverse growing investor aversion to emerging-market economies. Russia’s central bank raised interest rates Friday, surprising most economists and easing investor concerns over the bank’s freedom of action in maintaining Russia’s macroeconomic stability.

Mark Carney, the governor of the Bank of England, warned the British government that a “no-deal” Brexit will result in a 35% drop in UK home prices over the following three years and a more than doubling of the unemployment rate, while soaring inflation would spur the BOE to hike rates. Carney agreed to extend his term at the BOE’s helm through January 2020 (after initially wanting to leave the post in June 2019) to support a smooth transition culminating in the UK’s exit from the EU which is set for the end of March 2019.

US officials reached out to their Chinese counterparts ahead of the imposition of additional tariffs on $200 billion of imports from China on top of tariffs on $50 billion in goods already in place. High-level talks are expected to take place by the end of September, and the US is expected to refrain from imposing the latest round of duties in advance of the talks. The fact that the two sides are talking is seen as a mild market positive, although there are few hopes for a breakthrough.

This Week from BlackSummit

Is Amazon Causing a Retail Apocalypse?

Ken Rietz

Recommended Reads

The Policymakers Saved the Financial System. And America Never Forgave Them.

Neil Irwin

No Lehman Repeat, but a Great Opportunity to Lose Money Is Coming Anyway

James Mackintosh

From Trump to Trade, the Financial Crisis Still Resonates 10 Years Later

Andrew Ross Sorkin

Can Ethiopia’s Reforms Succeed?

Michael Woldemariam

The World’s Forgotten Asset Class

Matthew C. Klein

The Cost of American Retreat

Robert Kagan

Video of the Week

Hurricane Florence makes landfall in North Carolina

Image of the Week

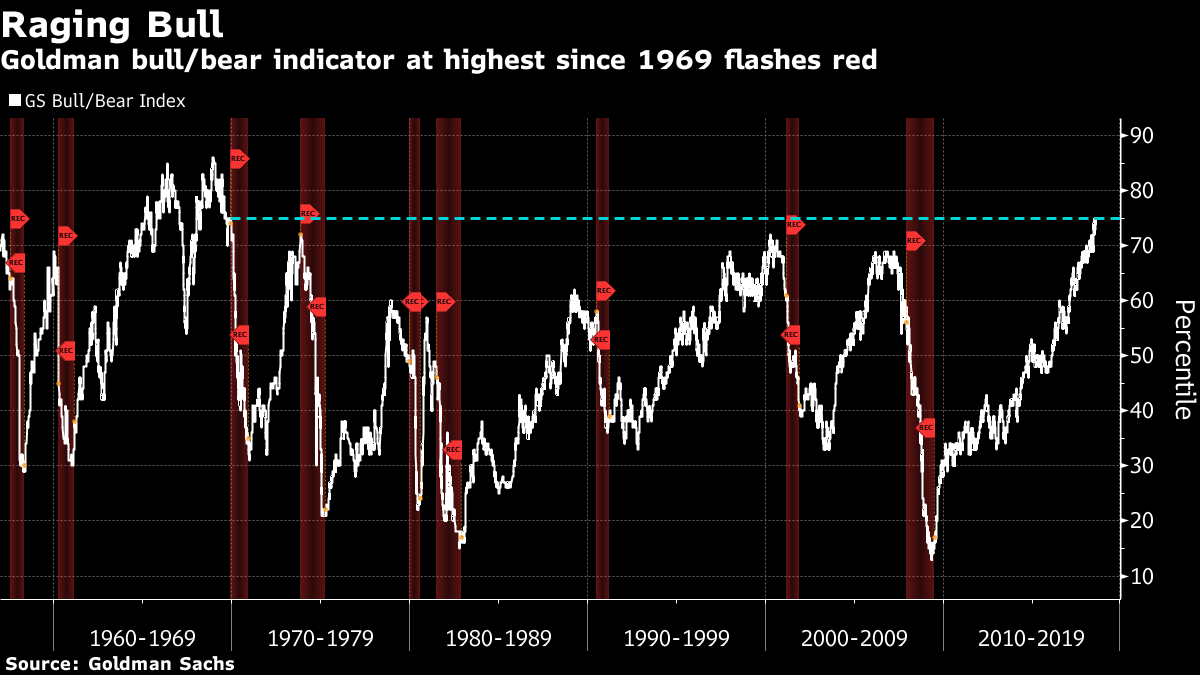

A Goldman Sachs indicator designed to provide a “reasonable signal for future bear-market risk” has risen to the highest in almost 50 years. While the gauge is at levels that have historically preceded a bear market, Goldman strategists including Peter Oppenheimer wrote that a long period of relatively low returns from stocks is a more likely alternative.

What could affect markets in the week ahead?

Major storms hitting the southeastern United States and parts of East Asia have prompted mass evacuations and other emergency preparations ahead of landfalls Friday and Saturday. Some five million people are expected to be affected by Typhoon Mangkhut. The storm, forecast to hit the Philippines’ northeast early on Saturday, is likely to be one of the strongest in the country’s history. Mangkhut is then projected to head toward Hong Kong and southern China. In the United States, Hurricane Florence made landfall in North Carolina early on Friday morning, leaving hundreds of thousands without power. Sectors on watch include insurers, agriculture, healthcare, electricity providers and building supplies.

Brent crude oil hit $80 a barrel this week – good news for exporters like Saudi Arabia and Russia but less so for importers such as India and especially those with big current account deficits, like Turkey. The loss of Iranian supply into an already tight market may help keep prices elevated. But $80 has proved a formidable psychological and technical barrier since 2014, so staying above that is going to be tricky.

The Bank of Japan is expected to keep monetary policy steady next week and debate how escalating global trade frictions could undermine its confidence that the export-reliant economy will sustain a moderate expansion thanks to robust world demand.

United States existing home sales have hit a wall, falling for four straight months, and next week could bring news that they slipped again last month. The number of homes for sale is stuck near a record low and inventory growth has been negative on a year-over-year basis every month for more than three years, which is driving prices to a record high with annual sales price increases of nearly 5%.