Is Amazon Causing a Retail Apocalypse?

Is Amazon Causing a Retail Apocalypse?

-

Author : Ken Rietz

Date : September 12, 2018

Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) are the first US companies to cross the one trillion dollar market cap ribbon, with Apple winning by a nose. (They are not the first trillion dollar companies, however. Both PetroChina and Saudi Aramco have been larger than that for a while.) While Apple continues to open up new markets, Amazon is commonly viewed as gobbling up existing companies, not without some reason. Indeed, there is a Wikipedia page devoted to “Retail Apocalypse” where the major cause they cite is online shopping, with Amazon leading the way. In this commentary, we examine the idea that Amazon is generating a Retail Apocalypse.

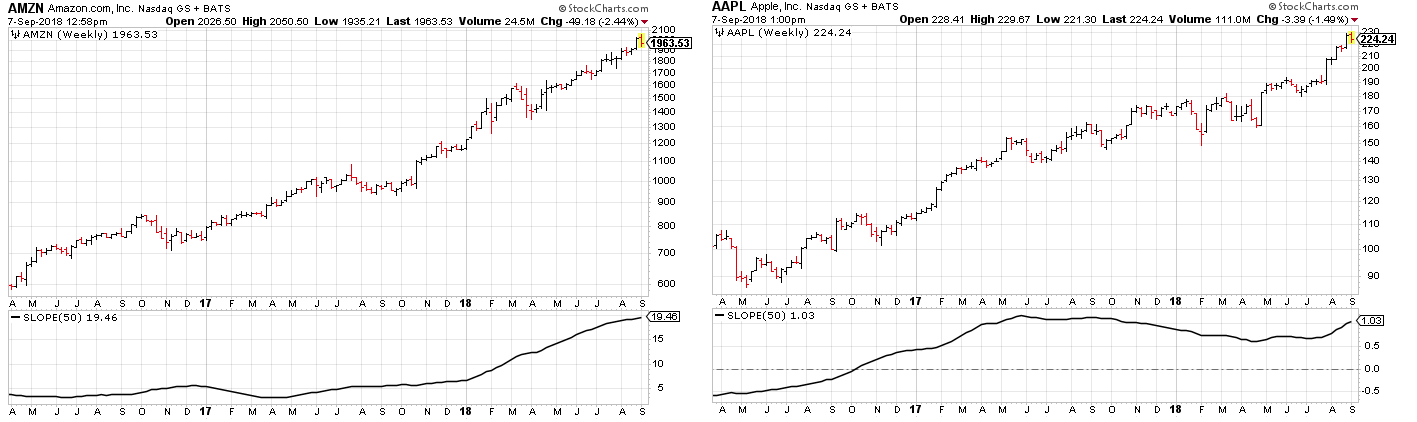

The growth of Amazon is often described as parabolic, which is certainly true in a non-technical sense. More accurately, AMZN is growing exponentially, as seen in the graph below, left. The price axis is logarithmic, so the amazingly linear graph indicates that Amazon is indeed growing exponentially. The lower section of the graph shows an average linear regression slope, which has in the past year been increasing, giving AMZN a slightly more-than-exponential growth. For comparison, the AAPL graph is given below, right, with the same plotting parameters. If you assume that the trends continue, Amazon is certain to grow larger than AAPL fairly soon, even if the new products Apple is planning on announcing Wednesday cause a significant increase in AAPL stock price.

When Amazon enters a sector, the rest of that sector’s stocks immediately drop, as seen with Amazon’s recent acquisitions of Whole Foods and PillPack. Some of the major financial media are grinding out wild-eyed predictions such as “the death of the retail market” at the hands of the juggernaut Amazon.

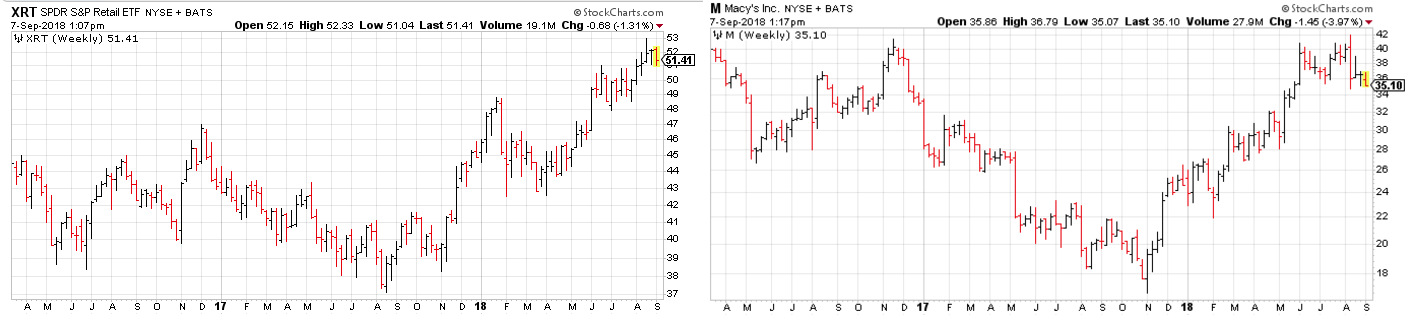

But, the reality is not as clear. The SPDR S&P retail market ETF, XRT (NYSEArca), does not contain AMZN, but has set all-time highs in the past month (chart below, left). This trend is certainly contrary to the narrative that Amazon is killing off all retail stores. Similarly, Macy’s (NYSE:M), which is also not in XRT, has recently set multi-year highs (chart below, right). The Wall Street Journal recently (9/7/18) recently published an article “Natural Grocers Shrug Off Amazon-Whole Foods Threat” with subtitle “Natural and organic markets worried Amazon’s Whole Foods acquisition would hurt sales but many are actually ringing up increases.” And even the Wikipedia article on “Retail Apocalypse” includes a list of companies which are planning on opening new stores. It turns out that companies like Home Depot are thriving, since the majority of their products are the sort that consumers want to be able to see before purchasing – such as paint, appliances, and building supplies. This has earned them the coveted name of Amazon-proof.

How can we understand all this? It is clear that Amazon crushes not just weak companies, but also companies that don’t respond well to its challenge. This is why Amazon is disruptive. But Amazon also forces strong companies that respond well to become stronger. The result is that a stronger retail environment will eventually balance out, with Amazon and numerous others in their own niches. That is, by all measures, a most positive development. A good parallel is to the effect of mass-produced trucks. They destroyed horse-based (local) transportation, but not train (distance) freight, and they carved out their place. And now, trains, planes and trucks each have their share of land transportation, each with its distinct strength. Similarly, the retail apocalypse is not on the horizon.