Market Action

Global equities rose on the week despite elevated trade tensions, with US stocks ending the week less than 3% below all-time highs reached in January while Japanese stocks posted their best weekly gain in the past six months. Although the trade picture has not improved, hopes for renewed talks between the US and China supported sentiment in conjunction with optimism around the start of corporate earnings season. The yield on the US 10-year Treasury note rose 2.8 basis points from the previous week, while the price of a barrel of WTI crude oil declined 4% on the week as Libya resumed production.

British prime minister Theresa May released a white paper meant to serve as a blueprint for upcoming negotiations with the European Union, proposing to keep the United Kingdom closely aligned with EU rules on trade in goods while allowing the UK a freer hand on services. Two of May’s most senior ministers, Brexit minister David Davies and Foreign Secretary Boris Johnson, resigned in protest. May hopes the plan will avoid the need to impose a hard border on Northern Ireland. Critics say the plan amounts to a “half-Brexit” in which the UK will remained saddled with many EU rules while enjoying few benefits from breaking free from Brussels. US President Trump was among the critics, saying the proposal would kill any chance of a free trade deal between the US and Great Britain.

The Trump administration threatened to impose tariffs on a further $200bn-worth of goods from China. This came a few days after America began levying duties on $34bn-worth of Chinese industrial exports, to which China retaliated with tariffs on an equivalent value of American goods. The broad imposition of tariffs will likely drive up American consumer prices, leading many who support targeting China’s trade practices to question the wisdom of enacting broader trade restrictions.

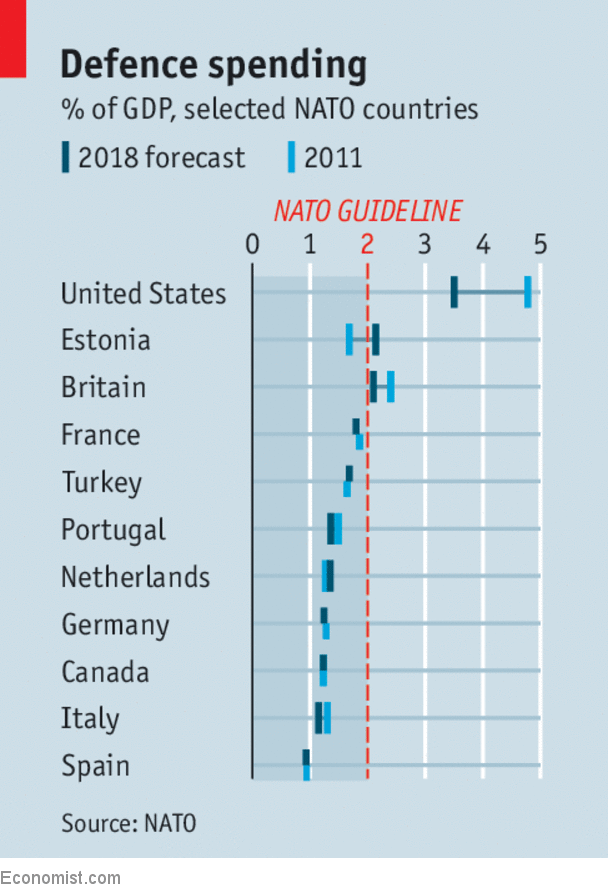

World leaders at the NATO summit agreed to substantially up their commitment to defense. An emergency session was convened after US President Trup warned allies that if they didn’t immediately meet the 2% goal, “I’ll do my own thing.”

The leaders of Ethiopia and Eritrea agreed Sunday to restore diplomatic relations and open the border between their neighboring Horn of Africa countries, ending a state of war that had lasted two decades. Ethiopia is Africa’s second most populous nation, one of the world’s fastest-growing economies, and a top Western and Chinese ally in the volatile Horn of Africa region. Tiny Eritrea has a population of about 5 million people, hosts a major United Arab Emirates military base, and is home to a 715-mile Red Sea coastline – but has remained for 20 years one of the world’s most closed-off nations. The restoration of diplomatic relations between the countries could lead to improved economic growth in the region, particularly as landlocked Ethiopia gains access to Eritrean ports.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Trade Disputes, Emerging Markets, and Supply Chains: Rising Tensions and Conflict Inflation

John E. Charalambakis

Recommended Reads

Image of the Week