Market Action

The EU began enforcing the General Data Protection Regulation (GDPR), which applies to any company doing business in the bloc and includes new privacy rights as well as data collection responsibilities. The GDPR is backed up with high fines: up to 4% of a firm’s annual revenue or €20M, whichever is higher.

Oil prices on Monday reached their highest level since late 2014 on speculation that the US would impose new sanctions on Venezuela after Nicolas Maduro won a new six-year term in an election deemed illegitimate by the opposition and foreign governments. Oil prices reversed course abruptly on Tuesday afternoon following reports that OPEC was planning to increase production to prevent further price increases from destroying demand. Ironically, the threat of US sanctions may have been partly at work in this case as well, if OPEC was seeking to compensate for the loss of Iranian and Venezuelan supply.

The US Congress passed a bill that exempts medium-sized banks from the most stringent rules introduced after the financial crisis. Only banks with at least $250bn in assets will now be subject to strict federal oversight, up from $50bn previously. It marks the biggest change of financial laws since the Dodd-Frank reform act passed after the financial crisis.

At an emergency meeting, Turkey’s central bank raised one of its key interest rates from 13.5% to 16.5% as it tried to halt another run on the Turkish lira, which had plunged by 5% against the dollar in a day. The lira’s decline was suspended only for a day after the rate increase.

A sudden shift in tone from North Korean officials in recent weeks prompted US president Donald Trump to cancel a summit with North Korean Leader Kim Jong Un, Trump said in a letter to Kim. The meeting had been scheduled for June 12th in Singapore.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Unelected Power: The Quest for Legitimacy in Central Banking and the Regulatory State (Interview)

Paul Tucker

Recommended Reads

AI Technology Revolution Is Just Getting Started

Tiernan Ray

How Worried Should We Be about an Italian Debt Crisis?

Olivier Blanchard, Silvia Merler, and Jeromin Zettelmeyer

Eritrea: 25 years of independence but still not free

Daniel Pelz

The constitutional crisis is here

Eugene Robinson

Global Debt Is Heading Toward Dangerous Levels, Again

Michael Heise

Video of the Week

Eritrea: Delving into a Sealed-Off Country

Image of the Week

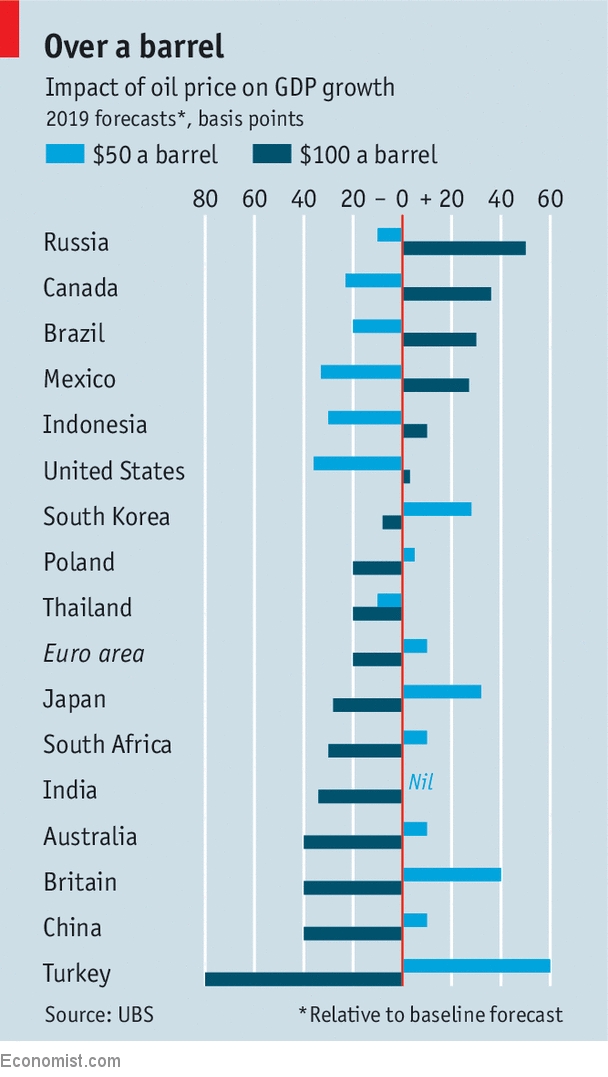

As a rule, higher oil prices hurt countries that import oil and lower prices hurt countries that export oil. But it can be more complicated than that. Oil prices between $50 and $75 a barrel seem to help global prospects; either lower or higher is harmful. More info: https://www.economist.com/finance-and-economics/2018/05/26/dear-oil-helps-some-emerging-economies-and-harms-others