Global Market News

Global Equities Down

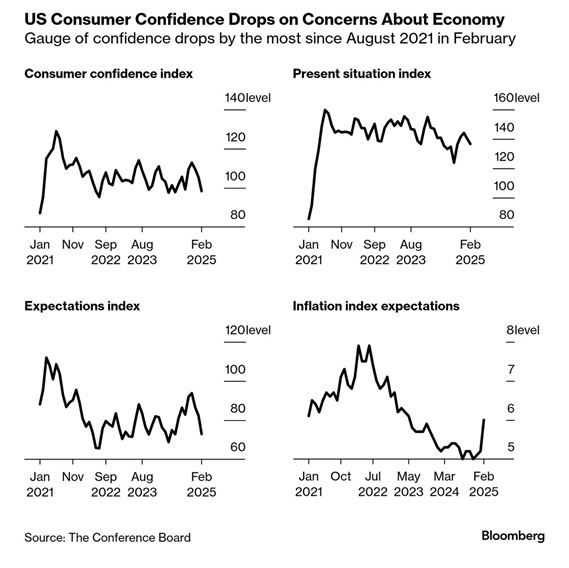

Global equities were down on the week amidst uncertainty surrounding economic policies and geopolitical tensions, with tech stocks being hampered by the concern that a slowdown in AI infrastructure could harm profits. The S&P 500 and Nasdaq lost 0.98% and 3.47%, respectively, while the Dow Jones made a minor gain of 0.95%. The US 10-year Treasury note tumbled several basis points to 4.21%. The price of a barrel of West Texas Intermediate crude oil declined slightly, closing Friday at $70.08. Volatility, as measured by the CBOE Volatility Index, rose more than 10% over the week, closing at 19.63.

US Threatens Tariffs on EU as Tariffs on Canada, Mexico, and China Come Into Effect

US President Donald Trump announced plans to impose 25% tariffs on imports from the European Union, accusing the bloc of exploiting the US and vowing to address trade imbalances. The move follows his decision to enact tariffs on Canada and Mexico and an additional 10% tariff on Chinese imports, all of which will go into effect on Tuesday. The EU, which had a €155.8 billion ($159.6 billion) goods trade surplus with the US in 2023, warned of proportional countermeasures, while the European Commission defended the EU’s role in fostering free trade. Trump’s tariffs, particularly targeting automobiles and industrial goods, could raise consumer prices and heighten inflationary pressures in the US.

International Developments

Jailed PKK Leader Calls for Group to Lay Down Arms in Historic Peace Initiative

On February 27th, Abdullah Ocalan, the jailed leader of the Kurdistan Workers’ Party (PKK), made a historic call for the group to lay down its arms, dissolve itself, and end its decades-long conflict with the Turkish state. A delegation from Turkiye’s pro-Kurdish DEM Party visited Ocalan in his prison on Imrali Island before delivering his statement in Istanbul, marking a potential turning point in the long-standing conflict. President Recep Tayyip Erdogan’s ruling AK Party welcomed the move, with Deputy Chairman Efkan Ala stating that Turkiye would be “free of its shackles” if the PKK disbands. The call follows a renewed peace initiative led by Erdogan’s coalition partner, Devlet Bahceli, who suggested that Ocalan’s parole could be considered if the PKK renounced violence, with the move carrying major implications for Turkiye’s relations with Kurds in Iraq and Syria.

Germany’s CDU Party Secures Election Win, Plans to Expedite Defense Spending

Unsurprisingly, the Christian Democratic Union (CDU) secured the largest share of Germany’s parliamentary vote with 28.6%, while the right-wing Alternative for Deutschland (AfD) received 20.8%, and the ruling Social Democrats (SPD) fell to third place with 16.4%. The historically dominant centrist parties, CDU and SPD, are anticipated to form a grand coalition, although this process may take several months. Amid uncertainties regarding the US commitment to NATO, Chancellor-in-waiting Friedrich Merz has initiated discussions with the SPD to expedite up to €200 billion in defense spending through the current parliament, which will remain in power until late March.

Mexico Extradites 29 Cartel Figures to U.S. Amid Trump’s Tariff Threats

On Thursday, Mexico extradited 29 alleged drug traffickers, including cartel leaders Rafael Caro Quintero and the Treviño-Morales brothers, in a bid to avoid US tariffs linked to fentanyl smuggling. The move follows President Donald Trump’s threat to impose 25% duties on Mexican imports unless stronger action was taken against drug cartels and illegal migration. Mexican President Claudia Sheinbaum sent a high-level delegation to Washington, where officials agreed on coordinated actions, including deploying 10,000 troops to the border. The extraditions, hailed as “historic” by DEA officials, come amid growing concerns over cartel violence, particularly in Nuevo Laredo, following the arrests.

US Social & Political Developments

Trump Calls Off Peace Talks with Zelensky After Heated Meeting

Yesterday, Ukrainian President Volodymyr Zelensky met with President Donald Trump and Vice President JD Vance in the White House, where the exchange became heated and deeply unsettling for both European and Ukrainian observers. The meeting, marked by confrontational rhetoric, revealed a significant rift between Ukraine’s war goals and Trump’s stance, with Trump accusing Zelensky of being “not ready for peace” and disrespecting the US, while European leaders expressed shock and dismay over the treatment of the Ukrainian president. The fallout from the meeting has sparked outrage, with both European officials and British lawmakers condemning Trump and Vance’s conduct, with some warning of a potential betrayal of Ukraine’s sovereignty. This meeting came just days after visits from French President Macron and British Prime Minister Starmer to the White House. The proposed deal between the US and Ukraine on Ukrainian mineral resources remains uncertain, and the fate of US support for Ukraine’s defense is increasingly unclear.

House GOP Passes Budget Resolution with $4.5 Trillion in Tax Cuts, Sets Stage for Reconciliation

February 25 House Republicans narrowly passed a budget resolution in a 217-215 vote, advancing President Trump’s legislative agenda despite internal party divisions. The plan includes $4.5 trillion in tax cuts over the next decade, offset by at least $2 trillion in spending reductions, with significant cuts mandated for Medicaid-related programs overseen by the Energy and Commerce Committee. It also raises the debt ceiling by $4 trillion and increases funding for border security, defense, and the judiciary while relying on optimistic economic growth projections to maintain deficit neutrality. As the resolution moves to the Senate, lawmakers must reconcile differences before proceeding with budget reconciliation, a process allowing passage with a simple majority.

Corporate/Sector News

Trump Administration Proposes $1 Million Port Fees on Chinese Cargo Ships Amid Trade Dispute

The US Trade Representative (USTR) proposed a new policy imposing steep fees on Chinese-owned cargo ships and third-country vessels built in Chinese shipyards, charging at least $1 million per US port-of-call. The proposal follows a Section 301 investigation into China’s dominance in global shipbuilding, which found that Chinese government subsidies distort competition and threaten US maritime industries. Critics, including the Chinese government, trade groups, and economic experts, warn that the policy could increase supply chain costs, redirect trade to Canadian and Mexican ports, and fail to revitalize US shipbuilding. Public comments on the proposal are open until March 24th, after which the administration will determine whether to implement the fees.

Tesla Sales Plummet in Europe Amid Market Shifts and Musk Controversies

New data from the European Automobile Manufacturers’ Association (ACEA) shows that Tesla registrations in Europe fell by 45% in January 2025 compared to the same month in 2024, with declines reaching nearly 60% in Germany. The drop comes as overall electric vehicle (EV) sales in the region rose by 37%, while Chinese automaker SAIC Motor more than doubled its European sales. Analysts cite multiple factors, including delays in Tesla’s affordable model, the upcoming Model Y refresh, and growing competition from Chinese manufacturers. Additionally, Tesla CEO Elon Musk’s political controversies, including his support for Germany’s far-right AfD party, have fueled public backlash and calls for boycotts, particularly in Germany and Poland.

Trump Ends Chevron’s Venezuelan Oil Export Permit, Cutting Key Revenue Source

President Donald Trump announced on Wednesday that his administration will terminate the US permit allowing Chevron to export Venezuelan oil, a decision set to take effect this week. The move reverses the Biden administration’s 2022 concession, which had generated an estimated $4 billion for Nicolás Maduro’s government despite US claims it aimed to support democratic reforms. The decision follows Maduro’s disputed reelection in July 2024 and slow efforts to repatriate Venezuelan migrants, sparking criticism from both Venezuela’s opposition and officials. Venezuela’s Vice President Delcy Rodríguez condemned the decision, while opposition leader María Corina Machado praised it, stating Maduro used oil revenues for repression and corruption.

Corporate Profile

SAAB AB: Positioned for Growth Amid Rising European Defense Spending

SAAB AB, a Swedish defense and aerospace company, has seen a strong 28% surge in its stock price over the last month, reflecting growing investor confidence as European defense budgets are projected to surpass 3% of GDP by 2029. Specializing in military aircraft, radar systems, and defense technology, SAAB has experienced record sales, with a 24% jump in orders to 96.8 billion SEK in 2024, driven by rising defense demands from NATO members. With international business now constituting 72% of its backlog, SAAB is poised to benefit from a sustained rise in defense spending, especially as Europe seeks to strengthen its military capabilities. Future growth prospects remain robust, with key contracts in the pipeline and ongoing innovation in fighter jets and unmanned systems.

Recommended Reads

Why the AI data-center boom is a job-creation bust

Strong yen shows up on global money managers’ radar amid FX volatility

Samkelo depended on USAID-backed drugs to stay alive. Then came Trump’s order

Donald Trump’s assault on aid sparks chaos in east Africa’s relief hub

Rich People Are Firing a Cash Cannon at the US Economy—But at What Cost?

How Elon Musk Executed His Takeover of the Federal Bureaucracy

Image of the Week

Video of the Week

Trump Tells Zelensky He’s ‘Gambling With World War III’ in Heated Exchange