Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : September 28, 2024

Global Market News

Global Equities Increase

Global equities increased on the week, trading near record levels. The Dow Jones and S&P 500 rose 0.59% and 0.62%, respectively, while the Nasdaq gained 0.95%. The US 10-year Treasury note rose slightly to 3.75%, and the price of a barrel of West Texas Intermediate crude oil slumped to $68.63 amid rumors Saudi Arabia will increase its oil production to recoup market share. Volatility, as measured by the CBOE Volatility Index, remained fairly steady over the week but rose slightly on Friday, closing at 16.82.

China Ramps Up Stimulus Amidst Weak Growth

China took a series of policy steps this week in an attempt to tackle its weak economic growth. Its central bank cut interest rates, lowering several key policy rates and indicating the possibility for more cuts in the near future. Additionally, the central bank decreased the amount of cash banks must keep in reserve, freeing up money for banks to make more loans. Amid other measures, fiscal efforts have also been made to continue propping up China’s flailing property sector. The moves suggested a new sense of urgency and buoyed market sentiment, leading the Shanghai Composite Index to rise 13% on the week.

International Developments

Shigeru Ishiba To Become Next Japanese Prime Minister

On September 27th, Shigeru Ishiba was elected the new leader of Japan’s ruling Liberal Democratic Party (LDP), succeeding Prime Minister Fumio Kishida. His election followed a two-round process within the LDP, where he won by 21 votes in the final runoff against economic security minister, Sanae Takaichi. Ishiba, a former defense minister, has advocated for the creation of an “Asian NATO” to counter security threats from China and North Korea. Ishiba’s tenure will focus on addressing regional security concerns, a weakening economy, and restoring public trust in the LDP after a series of corruption scandals.

Netanyahu Reaffirms Israel’s Tough Stance Against Hezbollah Amongst World Leaders at UNGA

On Friday, Israeli Prime Minister Benjamin Netanyahu addressed the U.N. General Assembly, reaffirming Israel’s stance against Lebanon-based Hezbollah and sowing doubts about a US-backed 21-day ceasefire proposal. Netanyahu emphasized that Israel must continue its fight against Hezbollah, despite private signals that Israel shared the US and France’s goals for a temporary ceasefire. His defiant speech, in which he criticized the UN as a “contemptuous farce,” coincided with Israeli airstrikes on Hezbollah targets in Beirut. The conflict is part of the larger regional tensions, with concerns that Iran’s involvement could escalate the situation into a broader war.

Myanmar’s Junta Invites Rebels to Peace Talks after Significant Losses

This week Myanmar’s military junta, led by General Min Aung Hlaing, made a rare offer for peace talks with ethnic armed groups and promised to hold general elections in 2025 after a coup in 2021 triggered widespread conflict. The junta is facing significant losses, reportedly losing control of over 86% of the country, with the People’s Defense Force (PDF) and ethnic groups gaining ground. However, the opposition, including the National Unity Government (NUG), rejected the offer, accusing the military of starting the conflict and vowing to pursue the establishment of a federal democratic union. The junta also announced a nationwide census starting October 1st to update voter lists, though international skepticism remains about the possibility of free and fair elections under the current regime.

US Social & Political Developments

Hurricane Helene’s Deadly Impact on the Southeast

Hurricane Helene made landfall as a Category 4 storm on September 26th near Florida’s Big Bend area, causing widespread destruction and flooding across multiple states. As of this morning, at least 42 deaths have been reported across 4 states. Over 4 million homes and businesses lost power, and emergency crews conducted rescues in flood-stricken areas, including Tampa and Valdosta, Georgia. The storm weakened as it moved inland, with President Biden deploying over 1,500 FEMA workers for recovery efforts, while warnings continued for dangerous flooding across the Southeast.

Congress Passes a Stopgap Spending Bill

On Wednesday, Congress passed a stopgap spending bill to prevent a government shutdown ahead of the September 30th deadline, while also approving $231 million in additional funding for the Secret Service. The bill, which had bipartisan support in both chambers, extends government funding until December 20th, 2024. House Speaker Mike Johnson initially attached voter registration restrictions, but they were removed following pushback, including from former President Donald Trump who had advocated for the measure. The bill’s passage sets the stage for a new spending debate in December which could further test Johnson’s leadership.

Corporate/Sector News

Port Workers from the East Coast to the Gulf Coast Expected to Strike Next Week

Port workers from Maine to Texas, represented by the International Longshoremen’s Association (ILA), plan to strike on Tuesday, threatening to disrupt major East Coast and Gulf Coast ports. The strike would affect over 36 locations, including the Port of New York and New Jersey. A shutdown could disrupt about 36% of US imports, 40% of exports, and roughly 8% of global trade, leading to shortages of goods. Negotiations between the ILA and the United States Maritime Alliance (USMX) have stalled, with the union seeking significant wage increases, while USMX calls the demands unreasonable. The Biden administration is monitoring the situation but has not considered invoking the Taft-Hartley Act to stop the strike.

Intel Expected to Secure $8.5B in Chips Act Funding

Intel is expected to secure $8.5 billion in US government funding by the end of 2024 as part of the CHIPS and Science Act which is aimed at boosting domestic semiconductor manufacturing. The funding will support Intel’s projects in states such as Arizona, New Mexico, Ohio, and Oregon, where it plans to expand production capacity. The agreement is part of broader efforts under President Biden’s administration, which has already allocated nearly $20 billion to Intel earlier this year for chip production. Intel’s recent financial troubles have sparked potential takeover approaches from the company’s competitors, including Qualcomm who reportedly has explored buying a stake in Intel. A potential takeover could complicate efforts to secure the CHIPS funding.

AMLO Expropriates US-owned Port Increasing Tensions with the United States

In his final week as president, Andrés Manuel López Obrador (AMLO) expropriated a US-owned Vulcan Materials port and quarry on Mexico’s Caribbean coast, declaring it a natural protected area. The move has deepened tensions with the US and provoked warnings from Vulcan of long-term damage to US-Mexico trade relations, while shares of Vulcan fell by 1.2%. US lawmakers have sought to dissuade the expropriation, which Vulcan has added to its ongoing arbitration case against Mexico under the USMCA. AMLO’s successor, Claudia Sheinbaum, has not yet commented on the issue ahead of taking office on October 1st.

Recommended Reads

China’s central bank tries to save the economy—and the stockmarket

Escalation in Lebanon puts UN General Assembly to the test

US Consumer Confidence Falls Most in Three Years on Labor Views

OpenAI’s new fundraising is shaking up Silicon Valley

At the Musée des Arts Décoratifs: Death of the Department Store

This week from BlackSummit

The BlackSummit Team

The Black Summit Team

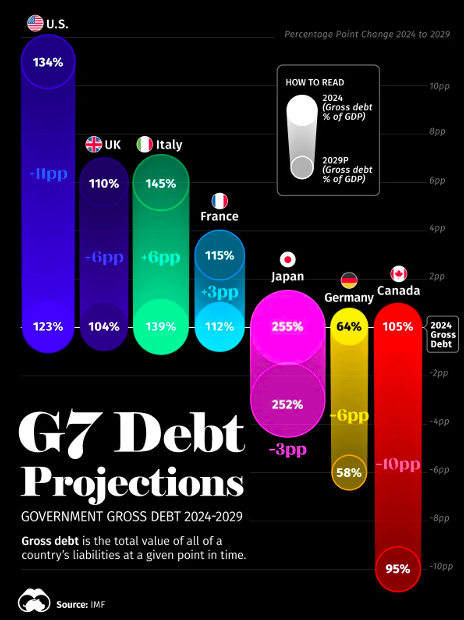

Image of the Week

Video of the Week

The Pipeline Changing America’s Access to Cheap Canadian Oil

Source: The Wall Street Journal