Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : June 29, 2024

Global Make Slight Gains

Global equities were mixed this week. The S&P 500 and the Dow Jones fell -0.08%. On the other hand, the Nasdaq rose slightly by 0.24%. The US 10-year Treasury note ticked up to 4.38% and the price of a barrel of West Texas Intermediate crude oil rose 0.97%, closing Friday at $81.51. Volatility, as measured by the CBOE Volatility Index, fell -10.31% over the week to 12.44.

Inflation Cooling

The Personal Consumption Expenditures (PCE) price index indicated a downward trend last month, lending support to the idea that the Fed’s fight against inflation is working. This cooling of inflation has raised hopes for a potential cut in interest rates. This trend, if sustained, could lead the Fed closer to reducing its benchmark interest rate. However, sectors such as housing are showing signs of slowing down amid a high rate environment. Financial markets estimate a 68% chance that the Fed’s easing would begin in September.

International Developments

Presidential Elections in Iran Amid Crisis

On Friday, Iran held a snap presidential election to replace Ebrahim Raisi, who died in a helicopter crash last month. The election is took place in the backdrop of various domestic and external crises, including a struggling economy and tensions with Israel. High voter turnout is crucial for the regime’s legitimacy, but reports showed mixed participation, with some Iranians opting to boycott. The leading candidates are conservatives Mohammad Bagher Ghalibaf and Saeed Jalili, with reformist Masoud Pezeshkian also in the race. On the eve of the election two other candidates dropped out to help consolidate the conservative vote, putting Pezeshkian at a further disadvantage.

Ukraine Conflict Update: the EU, Military Shuffles, and Dagestan

On Thursday, Ukraine’s President Volodymyr Zelenskyy urged EU leaders during an EU Summit to deliver on their promises of military aid, emphasizing the urgency of air defense needs on the battlefield. He signed a 12-page security pact with the EU, outlining long-term commitments to military, financial, and infrastructural support. This week also marked the beginning of EU membership talks with Ukraine, a significant step following the ongoing conflict with Russia that began in 2022. Additionally, on Monday, Zelenskyy dismissed Lieutenant General Yuriy Sodol as commander of the joint forces of the country’s military, replacing him with Brigadier General Andriy Hnatov, likely due to increasing claims of incompetent leadership by the former. Meanwhile, in Russia, two synagogues and Russian Orthodox churches resulted in the deaths of 16 law enforcement officers, a priest, and several civilians, largely thought to be carried by Islamic extremists, although the Russian officials have sought to downplay that prospect instead claiming that Ukraine or the West might have been behind the attacks.

Bolivia: Failed Coup Raises Questions

Bolivia’s army chief, Juan José Zúñiga, was arrested after attempting to seize power by occupying the presidential palace on June 26. The coup attempt lasted only three hours, ending after President Luis Arce demanded Zúñiga’s withdrawal, which the mutinied units eventually complied with. This dramatic event came a day after Arce dismissed Zúñiga for controversial remarks about former President Evo Morales, despite the two’s ongoing political feud for leadership of the MAS party. As of mid-day Friday, 21 individuals have been arrested in connection with the attempted coup d’etat. Experts are divided on whether the coup was staged by the government to boost its image or a genuine power grab. Regardless, the incident highlights Bolivia’s deep political and economic instability, further eroding public trust and damaging the country’s international reputation.

US Social & Political Developments

Biden-Trump Debate Increases Concerns for Democrats

In the first, and likely last, presidential debate of the year President Biden and former President Donald Trump clashed over many topics including the economy, immigration, and the future of democracy. Biden’s stumbling performance did little to quell fears over his age and ability to serve another four years while Trump’s relatively steady delivery increased Democrats’ anxieties over the November elections. The debate was dominated by personal attacks, with discussions of policy largely taking a backseat. Strategists from both parties expressed concerns about Biden’s ability to continue in the race, leaving Democrats less than optimistic about his performance and some suggesting that he should drop out of the race in favor of a younger candidate.

Surgeon General Declares Gun Violence a Public Health Crisis, Highlights Dangers of Social Media

This week, U.S. Surgeon General Dr. Vivek Murthy declared gun violence a public health crisis, emphasizing the urgent need to address the escalating number of firearm-related injuries and deaths. He has proposed measures such as banning assault weapons, implementing universal background checks, regulating the gun industry, and enforcing safe storage laws, although these require legislative approval. Murthy’s advisory comes amid heightened concerns about gun violence and follows a summer weekend marked by mass shootings. Additionally, he has highlighted social media’s role in the youth mental health crisis, advocating for warning labels similar to those on cigarette packs.

Corporate/Sector News

SpaceX Awarded NASA Contract to Destroy the ISS

NASA has awarded SpaceX the contract— that could pay up to $843 million—to safely destroy the International Space Station (ISS) by deorbiting it through Earth’s atmosphere in a controlled manner around 2031. The process involves developing a special vehicle to guide the ISS to its fiery end, minimizing the risk of debris falling on populated areas. The ISS, which has been operational since 1998, is aging and needs to be decommissioned to avoid potential safety hazards. SpaceX’s task is challenging due to the ISS’s size and complexity, requiring significant adaptations or a new design for the deorbit vehicle.

Boeing’s Offer for Spirit AeroSystems

Boeing has proposed acquiring Spirit AeroSystems Holdings Inc. for approximately $35 per share, shifting from an all-cash offer to a mostly stock-funded deal. This offer represents a 6% premium over Spirit’s recent stock price, valuing the company at around $4.1 billion. The change to a stock deal aims to ease financial pressures on Boeing, which faces significant cash constraints. The complex transaction, expected to be finalized soon, will also involve Spirit spinning off some of its manufacturing plants to Airbus SE.

Joint Venture Announced between Rivian and Volkswagen for Electronic Vehicle Production

On Tuesday, Volkswagen Group (VW) announced that it will invest up to $5 billion in Rivian Automotive as part of a new joint venture to share electronic vehicle (EV) architecture and software. This partnership aims to provide Rivian with the necessary funding to develop its upcoming R2 SUVs and R3 crossovers, set to launch in 2026, while also helping Rivian cut operating costs and turn cash flow positive. Volkswagen’s investment, which includes immediate and milestone-based funding, will also support the integration of Rivian’s software into VW’s brands like Audi and Porsche. The move addresses Volkswagen’s software challenges, particularly with its Cariad division, and aims to strengthen its position in the EV market. After the announcement, shares of Rivian grew by roughly 50% in extended trade.

Recommended Reads

Europe Has a New Economic Engine: American Tourists

Nvidia’s Success Is the Stock Market’s Problem

See how this green hydrogen plant converts water into clean fuel

This week from BlackSummit

The BlackSummit Team

Wonderful Highs and Miserable Lows: Plotinus on European Tremors and Market Dialectic

John E. Charalambakis

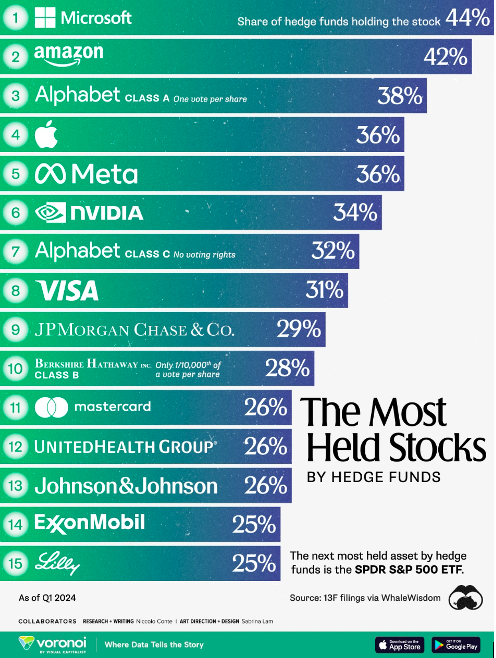

Image of the Week

Video of the Week