Market Action

Global equities were higher on the week; so too were yields on the 10-year US Treasury note, which rose to 2.49% from 2.42% a week ago on signs of economic stabilization in China and continued hopes for a resolution of the US-China trade standoff. Oil prices continued to firm, with the price of a barrel of West Texas Intermediate crude rising to $62.60 from $60 a week ago. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), fell to 13 from 14 last Friday.

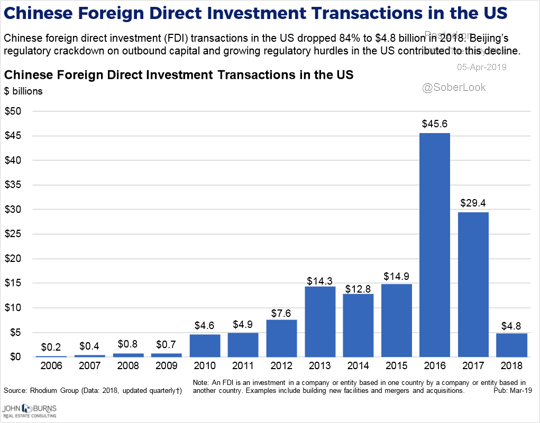

US President Trump said the US and China are very close to a deal on trade but still need to iron out sticking points like the status of existing tariffs and differences over the enforcement mechanism. Trump estimated an additional six weeks of negotiations is needed to finalize an agreement.

The eurozone composite PMI fell to 51.6 from 51.9 the prior month, weighed down by a slump in Germany where the composite PMI fell to its lowest level in nearly six years. Germany’s leading economic think tanks collectively slashed their 2019 economic growth forecasts by more than half. The institutes now project that German economy will grow 0.8% this year, down from their 1.9% forecast last fall. They say that the fallout from the US-China trade dispute and the uncertainty surrounding Brexit are holding back Germany’s export-reliant economy. Elsewhere, the Italian treasury cut its 2019 growth forecast to just 0.1% from an earlier 1% forecast. Slower growth is projected to push Italy’s budget deficit up to 2.3% or 2.4%, higher than the 2% deficit targeted in consultation with the EU.

Chinese PMI data released this week indicated that both the manufacturing and services sectors of the Chinese economy showed signs of improvement in March. China’s composite PMI, which combines both manufacturing and service sector PMIS, rose to 54.0 last month, a jump of 1.6 points from February. Global markets breathed a sigh of relief, hopeful that past targeted stimulus efforts by Chinese authorities are beginning to bear fruit. The US manufacturing sector also showed signs of life in March, with the ISM reporting its manufacturing gauge rose to 55.3 from 54.2 in February while the services sector reported a downtick, falling to 56.1 in March from 59.7 in February.

Backing off from a threat to close the US border with Mexico, US president Donald Trump instead threatened to impose tariffs on US-bound vehicles assembled in Mexico if Mexico does not do more to mitigate the flow of migrants and illicit drugs into the United States. Trump said that if the flow of drugs does not stop after a one-year warning period, he would institute auto tariffs and close the border.

In Ukrainian presidential elections last weekend, comedian Volodymyr Zelensky won the first round with 30.24% of the vote. As no candidate received an absolute majority of the vote, a second round will be held on 21 April. Incumbent President Petro Poroshenko and Zelensky have agreed to a rare public debate in Ukraine’s largest sports arena ahead of the runoff elections.

Local elections in Turkey last weekend saw President Erdogan’s alliance hold on to rural strongholds but suffer defeat in five of Turkey’s six biggest cities, including Istanbul, the country’s economic engine, and the capital, Ankara. Election night was overshadowed by a more than 10-hour blackout in updates from vote counts, with the state broadcaster Anadolu Agency halting the reporting of results just as the opposition candidate appeared on course to overtake the government’s candidate for the Mayor of Istanbul. The timing raised concerns of manipulation and gave rise to a number of conspiracy theories regarding electoral fraud.

Click here for this week’s updated market returns table.

What could affect markets in the days ahead?

Having already extended the Article 50 negotiating period by two weeks, the British Parliament is no closer to a Brexit resolution than it was prior to the delay. Scheduled for Wednesday is a European Council emergency summit to deal with Prime Minister Theresa May’s latest request for an extension, through 30 June. The European Union is reluctant to grant a short extension, however, because of European Parliamentary elections next month. The EU would rather the United Kingdom seek a long extension, with an option for the country to leave early once the two sides agree on a way forward, which would force the UK to take part in the vote.

Early legislative elections will be held in Israel on Tuesday to elect the members of the twenty-first Knesset. The elections had been due in November 2019, but were brought forward following a dispute between members of the ruling coalition government over a bill on national service for the ultra-Orthodox population.

General elections will be held in Indonesia on April 17. For the first time in Indonesian history, the president, the vice president, and members of the People’s Consultative Assembly (MPR), will be elected on the same day. It will be world’s biggest direct presidential elections (because the US uses an electoral college) and one of the most complicated single-day elections in global history.

Fed officials have started alluding to a new economic reality of slowish growth and little upward price pressure. Even as wages creep higher, improved productivity curbs firms’ costs. Minutes of the March Fed policy meeting, to be released on Wednesday, will be cross checked for references to a new “patient” approach and “muted” inflation. The March producer price index, a glimpse of pipeline price pressures, is scheduled for Thursday.

No policy changes are expected at Wednesday’s ECB meeting, especially since some board members are traveling to Washington for the International Monetary Fund’s spring meetings. But talk of tiered rates to ease pressure on banks, global recession fears, Brexit, and a sense of panic that has pushed 10-year German bond yields back below zero percent, all suggest ECB chief Mario Draghi’s news conference may prove lively. Investors will also keep an eye out for further details on cheap loans known as the targeted long-term refinancing operations (TLTROs) – one of the few policy tools left in the kit after the end of QE – and what the ECB will do to incentivize banks to take it up.

This Week from BlackSummit

The Bond Market and Investors’ Assertiveness

John E. Charalambakis

Listen on the go! Subscribe to the podcast Market Commentary with BlackSummit on iTunes, Android, Google Play, Stitcher, Spotify or TuneIn.

Recommended Reads

The cost of Brexit to December 2018: Towards relative decline? | Centre for European Reform

Trump Turns U.S. Policy in Central America on Its Head – The New York Times

The Asian century is set to begin | Financial Times

Wall Street braced for ‘earnings recession’ as margins fall | Financial Times

The Troubling Rise of Economic Nationalism in the European Union | PIIE

Video of the Week

Rwanda marks 25 years since the genocide