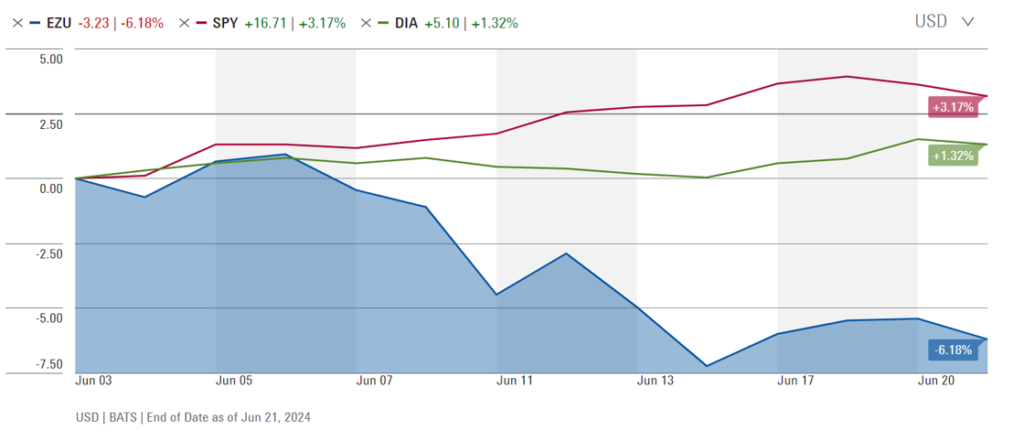

What has been happening with European stocks (ticker EZU below) since the beginning of the month? Why have they lost more than 6%, while the S&P 500 (ticker SPY) and the Dow Jones (ticker DIA) have gained more than 3% and 1% respectively? Someone might say that the S&P 500 includes the superchargers of the likes of Nvidia and Microsoft, but the question remains: What is happening with the Eurozone stocks?

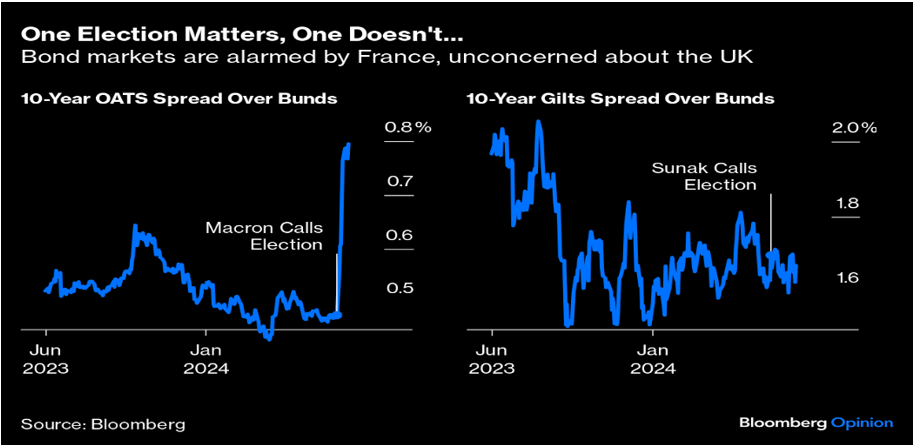

Let’s take a different look through the bond market lens: As it is shown below and reported by John Authers in his Bloomberg column yesterday, the spread of French bonds over German bonds has accelerated since the European parliamentary elections on June 9th and the subsequent snap elections called for by President Macron. The fear is that the far-right party led by Le Pen will win the snap election of June 30th and tremors (debt, euro, political/geopolitical) will return to Eurozone markets. On the other hand, the British snap elections, which will be held on July 4th, have a predetermined (Labor party will probably have a landslide) and not an earthshaking outcome, and thus have not had any material impact on British spreads.

The European parliamentary elections introduced again an element of uncertainty into the Eurozone. While the center-right kept the majority, in the two most vital markets (the German and the French) the far-right achieved substantial gains. Moreover, in France, the left-leaning parties united under an umbrella coalition that threatens the political standing of Macron’s party. The primary concerns emanate from the precarious French deficit and debt positions. Consequently, investors’ sentiment is shaky (including equity exposure as yields rise) given that the most optimistic scenario calls for gridlock with a caretaker government that on any day can lose a confidence vote, especially on matters related to budgetary issues and structural reforms.

In a different scenario of co-habitation where Macron serves as president and Le Pen’s party runs the government, the Le Pen party is not expected to be EU-friendly in the same manner that Meloni’s party has been in Italy (despite the paring back of some stated positions), implying the acceleration of risks and uncertainties. We need to recall that the target for Le Pen’s party is not the running of the government in the next two years, but rather the French presidency in 2027, therefore Le Pen’s party (the National Rally) will be coming to power in order to shake things up with Brussels.

However, a clash with Brussels may not be avoided if the coalition of the left (New Popular Front) wins enough votes and parliamentary seats to either run the government or form/support a temporary coalition government with Macron’s party to keep Le Pen’s party out of government control. Their proposals and stands are predicted to be in direct conflict with Brussels in economic/fiscal affairs which could undermine stability and calm markets.

Plotinus’ philosophical treatises reflect his mature thoughts after studying and teaching philosophy for a few decades. His writings took place between 254 and 270 AD. The beauty of Plotinus’ writings is found in the fact that he always centers his didactic style around the great central questions about life, existence, the transcendent, the intellect and its connection to the divine, the experiences in our life cycles, and the need to understand the Good of uniting our inner-beings with the higher purposes for which we were born, or what he calls the ascent and upward path. At the beginning of his chapter on Dialectic, he asks: “But what sort of person should the man be who is to be led to this upward path?”

Plotinus’ market dialectics is a dialectic of harmony and rhythmical moves. His dialectic is about ordering forces derived from rational and intelligent principles that lead to a unified understanding of a virtuous life. Let’s hear from Plotinus himself:

“What then is dialectic…? It is the science which can speak about everything in a reasoned and orderly way…it discusses good and not good, … and what is eternal and what not eternal, with certain knowledge about everything and not mere opinion. It stops wandering about the world of sense and settles down in the world of the intellect, and there it occupies itself, casting off falsehood and feeding the soul in what Plato calls ‘the plan of truth’.”

Our fear is that the market might be approaching a point of losing that dialectic ethos which could be the equivalent of Adam Smith’s invisible hand or Keynes’ animal spirit. What are the signs of such concern?

- High credit growth, which is usually associated with crisis and slower growth.

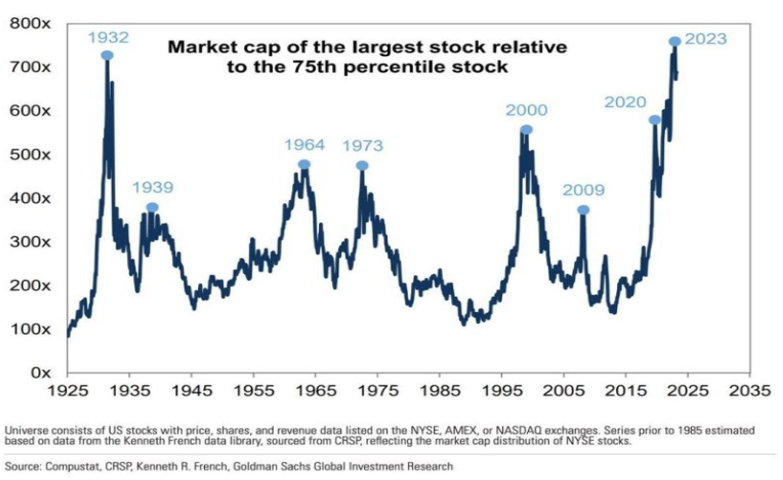

- Market concentration (e.g. close to one-third of the S&P 500 profits are generated by a few stocks).

- Political polarization at a time of rising public debts and profligate budgetary policies.

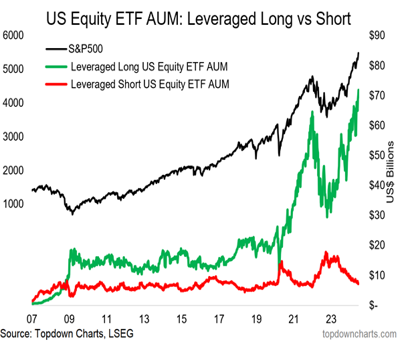

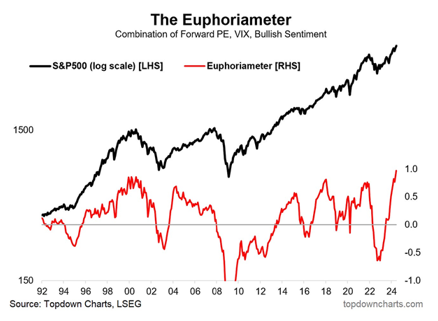

- Complacency as shown by measures of euphoria, bullish bets, and record-low bearish positions.

- Rising geopolitical risks at a time of high euphoria, market complacency, and potentially declining profit margins.

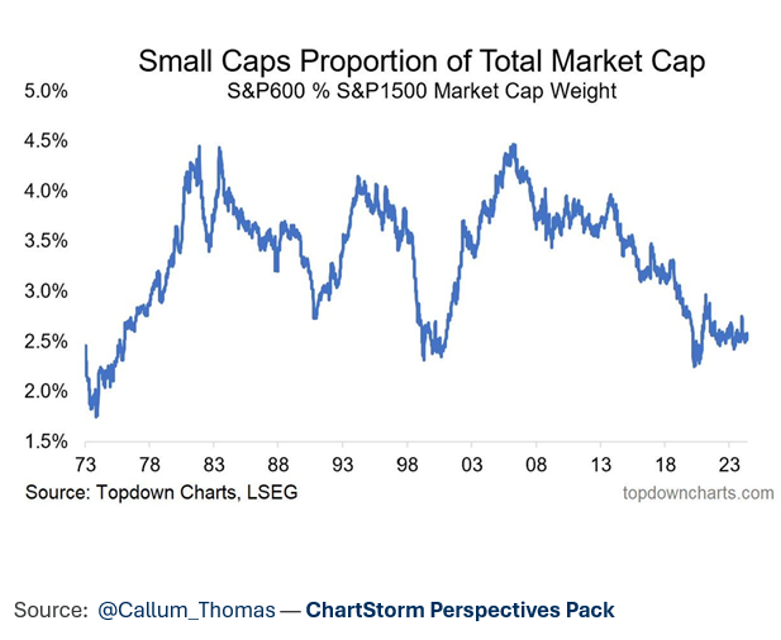

- Small caps become even smaller in terms of market capture and importance, which is usually associated with a crisis.

A significant and growing diversion between the price-to-sales ratio of the market and the price-to-sales ratio of just a few stocks.

The combination of the above signals and metrics makes us watchful participants in a market whose outcome could be a rising political beta that undermines portfolios’ alpha, or as Plotinus puts it:

“Dialectic is not just bare theories and rules; … it knows falsehood and sophism incidentally, as another’s product, and judges falsehood as something alien to the truths in itself, recognizing when anyone brings it forward, something contrary to the rule of truth.”