The market moves of this week have certainly garnered a lot of attention and inspired much ink to be spilled speculating on causes, meaning, significance, and future ramifications. Indulge us as we add our own voice to the mix.

While stocks had their largest point drop in history on Monday and oil had its second largest drop ever, they haven’t been the primary focus of our attention. An equally, if not more surprising move, has been made in the bond/rates markets. The US 10 Year Yield collapsed from 1.56% on February 20th to 0.42% on Monday. The entire yield curve in fact stood below 1%, even out to 30 years, and sat below the Fed Funds rate. Credit spreads have concurrently widened to their largest level since 2015, when the market experienced an earnings and industrial recession. Moving out to a longer timeline, spreads aren’t near the highs (yet) of the post Financial Crisis era when market prognosticators feared a double dip recession.

Figures 1&2: Spreads Have Widened Significantly

A closer look however and we can see that the vast majority of the move in wider credit spreads is due to benchmark government bonds falling, not yields on corporate credits increasing. Yields on Moody’s BAA Investment Grade bonds have stayed quite steady. Why does this matter? Because in an environment of true fear and panic investors and the market would be repricing risk assets in addition to flocking to havens. Instead, investors have not reevaluated their tolerance of risk.

Figure 3: Corporate Bond Yields are Stable

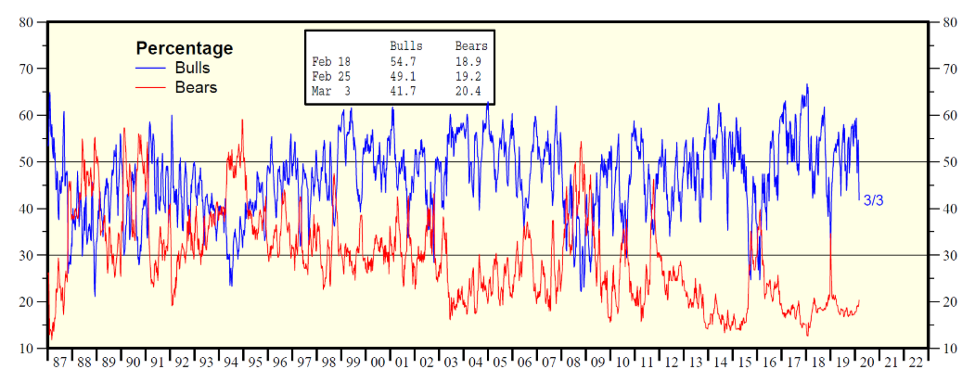

Further, the number of outright bears in the market has not appreciated by very much. Demonstrated below, the number doesn’t even approach 2019 levels. This further shows that while sentiment is incrementally negative it is not at a panic stage in our opinion. Why is this significant? Because even though major equity indices are more than 15% off of all-time highs set just a few weeks ago, investor appetite has not been washed out to the point of capitulation. The Bull/Bear Ratio, published by Investor’s Intelligence, shows that the decline in sentiment has been due to Bulls getting neutral on the market, not bears taking hold.

Figure 4: Sentiment Has Become Neutral…but not Bearish

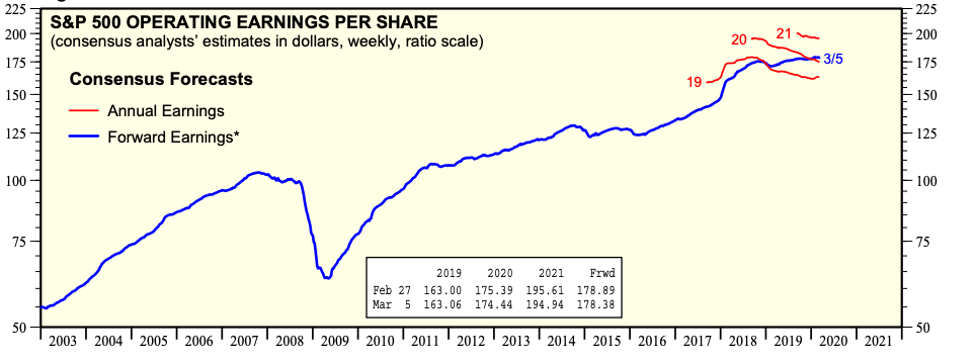

These indicators, along with others, tell us that it’s far too easy to imagine risk markets selling off even further, at least for now. Consider the fact that valuations still do not provide much cushion or margin of safety at the moment. The S&P 500 is trading at roughly 17x 2019 earnings, a slightly above average multiple. While not egregious by the extremes of history (1999 and 2007 in particular) remember that 2019 saw virtually zero earnings growth, the consensus for 2020 of between 7% and 10% EPS growth for 2020 will certainly come down and could very well go negative given China, Italy and other parts of the global economy shutting down, and that we traded at 14x in the meltdown of Q4 of 2018 where we didn’t have a fundamental economic fear like we do now. Add all those up and it’s not difficult to paint the scenario whereby markets drop further as additional indicators of macro demand get weaker; both multiples (often a proxy for sentiment) and earnings (the fundamentals) can deteriorate further.

Figure 5: 2020 Earnings Have Not Budged Despite Macro Fears

Energy will be one of the first places to look for the next dominos to fall after this weekend’s “price war” instigated by Russia and Saudi Arabia. Oil’s collapse of about 25% on Monday spells trouble for a number of players. Exploration and Production (E&P) firms will be the first to see their earning’s estimates cut for 2020 and many companies will have to restructure. The sector represents roughly 10% of the high-yield market and with the stresses of lower prices, may have trouble accessing capital markets. These lower quality firms have also rarely exhibited capital discipline to balance the market, continuing to spend more than they take in. The latest collapse in oil prices will be a new test of their supposed commitment to pay attention to cash flow.

Occidental Petroleum’s 86% cut to their dividend on Tuesday is just the start. More restructurings will come and have consequences on credit markets, both junk and investment-grade. This will take considerable time to work through, all while the macroeconomic backdrop tries to adjust to reshuffling global supply chains, as well as trying to figure out the level of demand in the economy (and the appropriate level of investment such demand calls for). Moreover, additional questions will be emerging regarding China’s real strength, and Europe’s structural endurance, all while relations across major global partners is still shaky.

It is likely to be a messy period, filled with volatility and eventually opportunity but our opinion is that the latter needs more time to present itself.