Data from around the world show that economic activity is slowing down. At the same time, the trade uncertainty exacerbates the concerns that a slowdown crowned with an intensifying trade war during geopolitical disputes could derail growth and expectations at a time when earnings are experiencing a slowdown.

As the following figures for the US and the EU show, manufacturing activity fell below the threshold level of 50 (implying contraction) for all size of firms. Moreover, the global manufacturing index fell to its lowest point since June 2012 signifying the falling output around the world.

The declining yields of long-term bonds around the world also point out to lower expectations regarding growth, while also portraying concerns for an oncoming recession. The impact of the trade war on expectations also trims investment and capital expenditure spending. Therefore, while consumption and the employment figures are holding up (and hence we have not slipped yet into recession), the drops in the trading activity of intermediate goods will haunt growth, and that’s when the rabbits get in hold of the guns.

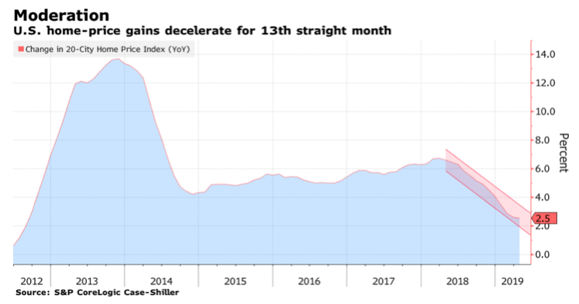

Additional signs for the slowdown can be seen in the deceleration observed in the home-price gains (13th straight month of deceleration), possibly reflecting the declining consumer confidence (see the following two graphs).

What do all the previous observations tell us about the record levels in the markets? I would rather answer that question by posing another question: If we are headed for higher highs why wouldn’t the small caps and the transportation stocks follow the rally? As can be seen below, the performance of both small caps and transportation stocks has been declining in a significant way.

Without excluding the possibility of higher highs in the market, we would recommend that the gun be kept pretty close to the chest. The rabbits are looking forward to the opportunity to grasp it.

When the Rabbits Get the Guns

Author : John E. Charalambakis

Date : July 9, 2019

Data from around the world show that economic activity is slowing down. At the same time, the trade uncertainty exacerbates the concerns that a slowdown crowned with an intensifying trade war during geopolitical disputes could derail growth and expectations at a time when earnings are experiencing a slowdown.

As the following figures for the US and the EU show, manufacturing activity fell below the threshold level of 50 (implying contraction) for all size of firms. Moreover, the global manufacturing index fell to its lowest point since June 2012 signifying the falling output around the world.

The declining yields of long-term bonds around the world also point out to lower expectations regarding growth, while also portraying concerns for an oncoming recession. The impact of the trade war on expectations also trims investment and capital expenditure spending. Therefore, while consumption and the employment figures are holding up (and hence we have not slipped yet into recession), the drops in the trading activity of intermediate goods will haunt growth, and that’s when the rabbits get in hold of the guns.

Additional signs for the slowdown can be seen in the deceleration observed in the home-price gains (13th straight month of deceleration), possibly reflecting the declining consumer confidence (see the following two graphs).

What do all the previous observations tell us about the record levels in the markets? I would rather answer that question by posing another question: If we are headed for higher highs why wouldn’t the small caps and the transportation stocks follow the rally? As can be seen below, the performance of both small caps and transportation stocks has been declining in a significant way.

Without excluding the possibility of higher highs in the market, we would recommend that the gun be kept pretty close to the chest. The rabbits are looking forward to the opportunity to grasp it.