The world got almost everything wrong about Xi Jinping prior to 2012 and even a few years after Xi took over China’s leadership. By 2017, it was clear that the Chinese dream of subjugating the rest of the world to its illiberal image would turn ugly in its domestic and foreign policy dimensions.

Bellicose transitions (political, economic, financial, trade, social) become watershed moments in human history, and the current period may not be any different. The world is undergoing a bellicose transition in China, and very soon in Germany, as it’s recovering from a pandemic that is changing the way we conduct our business, while two vital pivots are taking place: energy transition in the midst of climate change, and currency transition as digital/central-bank sponsored currencies are underway. In the past, in similar bellicose transitions, the end result was that the engine of finance (war) was deployed to rid the world of clear and present dangers.

Otto von Bismarck, a.k.a. the “Iron Chancellor”, with his prudent diplomacy united Germany. The fears of the major powers of the 18th and 19th centuries (France, United Kingdom, Russia) of a united German-speaking nation gave in to Bismarck’s juggernaut who also adopted policies of industrialization and fired up the cylinders of production. Prussia’s king, Kaiser Wilhelm I, was an autocrat (despite the pretense of a parliament) and was ruling with the shrewd counsel and guidance of Bismarck. Bismarck even succeeded in his goal of preventing an alliance between France and Russia that would have left Germany surrounded and unable to exercise its authoritative rule.

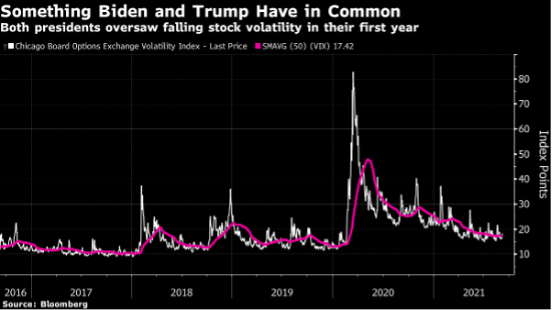

Commentators and market analysts, nowadays, point out the fact that it has been almost a year without a 5% correction, while volatility is very low, as shown below. We could call this a Bismarck moment.

Ample liquidity supports elevated valuations, and the fact is that the record-issuing amount of debt reinforces the concept of a permanently rising level of indebtedness which, in turn, would require debt-refinancing, and which will ultimately force the hands of central banks for a Japanese-style liquidity and monetization of debts. As this cycle progresses, the ample liquidity represses spreads and hence the spreads between junk bonds and Treasuries remains at very low levels, as shown below.

Credit spreads in Europe are also very low, signifying that refinancing can get the liquidity game going, given the pledge of the central bank not to raise rates. Tapering might take place, but as long as they do not raise rates, refinancing – which is the key to market calmness – is not only feasible but also almost “guaranteed”. Hence, the world’s $300 trillion debt with an average maturity of 5 years, can create a $60 trillion refinancing market every year. This is a pivot where equity calmness is dependent on debt issuance and refinancing.

The world in the 1880s (like in the 2010s) failed to comprehend Germany’s bellicose stance toward the world. Germany’s Scramble for Africa in the 1880s managed to assemble an empire-like of “trophies” that included Rwanda, Togo, Burundi, Cameroon, Namibia, parts of Nigeria, Tanzania, and Ghana. In 1888 Kaiser Wilhelm I died and his 29-year-old grandson, called Kaiser Wilhelm II, took over. The new Kaiser’s dream was to claim Germany’s rightful place in the sun, and the then wolf-like policy started. Bismarck was dismissed and Leo Caprivi was in. The world got everything wrong about the new Kaiser back then and got everything wrong about Xi Jinping now.

The rest is history: The new Kaiser rumbled up its defense spending (there cannot be an economic power without military power) which provoked a Triple Entente alliance (France, United Kingdom, and Russia) against Kaiser’s alliance made up of the Austro-Hungarian Empire, Germany, and Italy (with the Ottomans joining a bit later). The new Kaiser dreamed of dominance using his currency – similar to the Chinese dreams for the digital yuan – against the British pound and World War I erupted, a war which for years was fought in the trenches. In the midst of the war, the Russian revolution took place and Lenin gave the Kaiser a “get-out-of-jail” free ride. The sinking of the American Lusitania and the infamous German attempt to encourage a Mexican invasion of the US, brought the US into the picture and from that point on, the US ascended into the world balance-of-power game, as the fascist powers including the Ottomans surrendered on the eleventh hour of the eleventh day of the eleventh month in 1918.

The world thought that Xi Jinping would follow Wen Jiabao’s and Hu Jintao’s leadership of compromise and reform, honoring their mentor/reformist leader Hu Yaobang (whose demise brought the students to Tiananmen Square). However, they ignored the fact that Xi – like the infamous corrupt Chinese leader Bo Xilai – for the sake of ideology, forsook his own family. We misjudged the transition from Hu Jintao and Wen Jiabao, and now the question is whether the engine of finance will be deployed again in the years to come.