Market Action

Global equities improved on the week as fears of a coronavirus pandemic that would cripple economic growth began to subside. The yield on the US 10-year Treasury note rebounded to 1.59% from 1.53%. However, the price of a barrel of West Texas Intermediate crude oil continued to drop, falling $0.75 over the week to $50.65. Volatility, as measured by the Cboe Volatility Index (VIX) also declined, decreasing to 15.5 from 18.1.

US labor markets started the year strong as 225,000 new jobs were added in January. Economists had predicted 161,000 jobs to be added but warm weather caused a spike in hiring in the construction industry. Wages also fared well, rising 3.1% and beating Decembers 3.0% pace.

In coronavirus news this week, the Chinese government pumped record amounts of liquidity into local money markets and cut repo rates by five basis points in an effort to offset any economic drag caused by the outbreak. Many businesses have closed their doors and some companies have shut down production, causing ripple effects to be felt in global supply chains. For example, Hyundai shut down production in South Korea due to a lack of parts usually sourced from China. China has yet to release trade data that was due on Feb. 7th, citing the coronavirus crisis as the reason for the delay. As of Friday evening, just over 70 people in China had died from the virus and over 34,000 cases had been confirmed.

The US Senate voted to acquit President Donald Trump of abuse of power and obstruction of justice. Only one person crossed party lines, making for a straight-forward and unsurprising vote to acquit. Markets were little affected as the likelihood of Trump’s removal from office was slim to none given that a two-thirds majority in the Republican controlled Senate was required to convict.

Kenya and the US began trade talks this week, aiming to negotiate a bilateral trade agreement to replace the 20-year-old African Growth and Opportunity Act that expires in 2025. Many African governments have expressed a preference for multilateral trade deals, especially because the African Continental Free Trade Agreements comes into force in July. However, President Trump’s administration has decided to pursue bilateral deals with multiple African countries.

What Could Affect the Markets in the Days and Weeks Ahead

China announced it will slash tariffs on $75 billion of imports from the US beginning on February 14th, as pledged in phase one of the trade deal between the US and China. The US will also reduce tariffs on their imports from China.

The United Kingdom (UK) and European Union (EU) have seemed to stake out different trade positions leading up to negotiations toward a trade deal. British Prime Minister Boris Johnson said there would be no need for the UK to continue to follow EU regulations or accept EU product standards. The EU’s chief negotiator, Michel Barnier, said the UK could face tariffs for its noncompliance.

Ireland will hold general elections today. Irish Prime Minister Leo Varadkar called for snap elections in January after an arrangement with his party’s rivals fell through. Despite being applauded for his handling of Brexit, left-wing nationalist party Sinn Fein rose in polls to break even with the Prime Minister’s party, Fine Gael.

This Week From BlackSummit

Recommended Reads

Video of the Week

Image of the Week

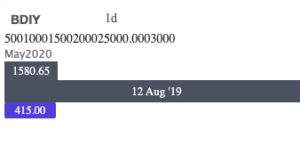

The Baltic index, which tracks freight rates for world’s largest cargo ships, sank to the lowest level since March 2016 in early February, with the capesize segment falling to an all-time low amid weak demand for ships and muted activity in China as the coronavirus outbreak deepened. The dry bulk index has plunged around 83 percent after touching a multi-year high of 2,518 points last September. Baltic Exchange Dry Index – data, forecasts, historical chart – was last updated on February of 2020.