Global Market News

Global Equities Down

Global equities were down on the week amidst continued uncertainty surrounding economic policies and geopolitical tensions.. The S&P 500 and Nasdaq lost 2.27% and 2.43%, respectively, and the Dow Jones fell 3.07%. The US 10-year Treasury note rose slightly to 4.32%. The price of a barrel of West Texas Intermediate crude oil only slightly rose, closing Friday at $67.14. Volatility, as measured by the CBOE Volatility Index, fell 17.54%, closing at 21.77.

US Consumer Sentiment Plunges to Lowest Level Since 2022

The latest consumer sentiment data for the United States shows a significant decline in March 2025. According to the University of Michigan’s Consumer Surveys, the Consumer Sentiment Index plummeted to 57.9, a sharp drop from February’s 64.7 and the lowest level since November 2022. This decline was more severe than economists had anticipated, with concerns about inflation and President Donald Trump’s tariff policies playing a major role. Inflation expectations for the coming year surged to 4.9%, up from 4.3% in February, while the five-year inflation outlook rose to 3.9%, marking the largest month-over-month increase since 1993.

International Developments

EU Drafts ‘Massive’ Defense-Investment Plan, Putin Ambiguous Position on Ceasefire Proposal

On March 14, 2025, the European Commission unveiled a draft plan to bolster Europe’s defense capabilities amid reduced U.S. military support. The proposal emphasizes strengthening the EU’s defense industry, prioritizing investments in air defense, drones, and joint procurement. Meanwhile, Russian President Vladimir Putin expressed conditional support for a 30-day ceasefire with Ukraine on March 13, 2025, signaling extended negotiations as he raised concerns over military conditions and U.S. arms shipments to Ukraine. Putin’s comments highlight Russia’s determination to continue its military operations, particularly in the Kursk region, as peace talks remain complex and contentious.

Mark Carney Sworn in as Canada’s 24th Prime Minister

Mark Carney, a former central banker and financier, was sworn in as Canada’s 24th prime minister on March 14, 2025, after securing the Liberal Party leadership with 86% of the vote. His tenure begins amid significant economic instability, exacerbated by President Donald Trump’s ongoing threats and tariffs on Canadian goods, which have placed severe strain on trade relations. With a federal election scheduled for May 2025, Carney faces the dual challenge of navigating complex international trade negotiations and addressing domestic issues such as high living costs and immigration. Carney’s first international visits will be to London and Paris, signaling an attempt to diversify Canada’s foreign relations amidst the growing tensions with the U.S.

Kurdish-Led SDF Agrees to Integration with Syrian Government

On March 10, 2025, a landmark agreement was signed between the Syrian government and the Syrian Democratic Forces (SDF), a Kurdish-led militia group, to integrate into the state’s military and civilian institutions. Under the deal, the SDF, which controls over 46,000 square kilometers in northeast Syria, will hand over key assets including border posts, an airport, and oil fields. The agreement also recognizes Kurds as an “integral part” of Syria and ensures their political representation. This pact aims to unify the country following the civil war and could reduce tensions with Turkey, which opposes Kurdish groups like the YPG, a key part of the SDF.

US Social & Political Developments

Schumer Breaks with Democrats to Support G.O.P. Spending Bill

On March 13, 2025, Senate Minority Leader Chuck Schumer of New York announced his decision to support a Republican-written spending bill, despite opposition from many within his party, to avoid a government shutdown. The bill, which would keep federal funding in place through September 30, 2025, has sparked a fierce debate among Democrats, with some fearing it would empower President Trump and Elon Musk by granting them wide control over government programs. Schumer argued that a shutdown would be more harmful than passing the bill, which many Democrats criticized for being heavily partisan and unresponsive to the country’s needs. The deadline to pass the bill was set for midnight Friday, March 15, 2025.

Judge Orders Musk’s Team to Provide Documents

On March 13, 2025, U.S. District Judge Tanya S. Chutkan ordered Elon Musk and his Department of Government Efficiency (DOGE) team to hand over documents and answer questions regarding their involvement in mass federal layoffs and program changes. This decision marks the first time Musk’s division has been subjected to discovery, following a lawsuit from 14 Democratic state attorneys general who seek to investigate the group’s actions. The judge’s ruling requires Musk’s team to provide detailed records about its engagement with federal agencies and employee programs within three weeks. This legal push follows growing concerns over the lack of transparency surrounding Musk’s team’s operations, which have sparked multiple legal challenges.

Corporate/Sector News

OPEC Maintains Optimistic Oil-Demand Outlook Ahead of Output Hike

As of March 12, 2025, OPEC reaffirmed its forecast for oil demand growth, expecting an increase of 1.45 million barrels per day (bpd) this year, despite broader concerns about the global economic outlook. The Vienna-based group, which plans to raise output starting in April 2025, remains more optimistic than other industry forecasts, with the International Energy Agency predicting a growth of only 1.1 million bpd. OPEC also upheld its global economic growth forecast at 3.1% for 2025, citing resilient consumer demand and emerging-market growth. This comes as oil prices hover around $70 per barrel, with concerns about U.S. tariffs and the potential global supply surplus impacting future price stability.

Tesla Warns of Exposure to Retaliatory Tariffs Amid U.S. Trade Actions

On March 14, 2025, Tesla issued a warning to U.S. Trade Representative Jamieson Greer, stating that the company, along with other American exporters, is vulnerable to retaliatory tariffs in response to recent trade actions by the Trump administration. Tesla’s letter highlighted the potential negative impact of tariffs on U.S. manufacturers, noting challenges in sourcing vehicle parts domestically and urging the USTR to consider the broader supply chain constraints. This follows President Trump’s imposition of a 20% tariff on China and 25% tariffs on Canada and Mexico, set to take effect after April 2, 2025. The trade tensions have contributed to a 33% drop in Tesla’s stock price over the past month, amid broader market instability.

Gold Surpasses $3,000 Amid Economic Turmoil and Trump Trade Policies

On March 14, 2025, gold prices surged past $3,000 per ounce for the first time, fueled by central bank buying, economic instability, and President Trump’s aggressive trade policies. The rally, driven by fears of inflation and geopolitical uncertainty, saw more than 23 million ounces of gold flow into U.S. depositories from Election Day to March 12, helping push the U.S. trade deficit to a record high. Despite typical headwinds like high interest rates and a strong dollar, demand for gold has soared, with some analysts predicting a rise to $3,500 per ounce. Central bank gold purchases have doubled since Russia’s 2022 invasion of Ukraine, highlighting the growing reliance on gold as a store of value in uncertain times.

Corporate Profile

Rheinmetall Sees Record Growth Amid European Rearmament

Rheinmetall, Europe’s largest munitions producer, has reported a record 30% growth in defense sales in 2024, reaching €9.8 billion ($10.6 billion), as European countries ramp up military spending in response to the ongoing war in Ukraine. The Düsseldorf-based company, led by CEO Armin Papperger, has capitalized on increased demand for arms, including munitions, armored vehicles, and drones, supplying both NATO allies and Ukraine. As part of its expansion, Rheinmetall is building new factories in Ukraine, Lithuania, Hungary, and Romania, with plans for continued growth driven by European defense pledges. The company is exploring further domestic expansion, including taking over former auto factories in Germany.

Recommended Reads

Consumer Sentiment Tanks as Americans Expect More Pain Ahead

30 Charts That Show How Covid Changed Everything

Stock Turmoil Spreads as Fear Hits the World of Corporate Bonds

A Market Indicator From Early 1900s Is Blaring an Alarm for Stocks

Trump Tariffs Hurt US Stocks More Than Other Markets

This Week from BlackSummit

BlackSummit Team

Geopolitics and the Day After

BlackSummit Team

Market Icons and Uncertainty in a Changing World Order

John E. Charalambakis

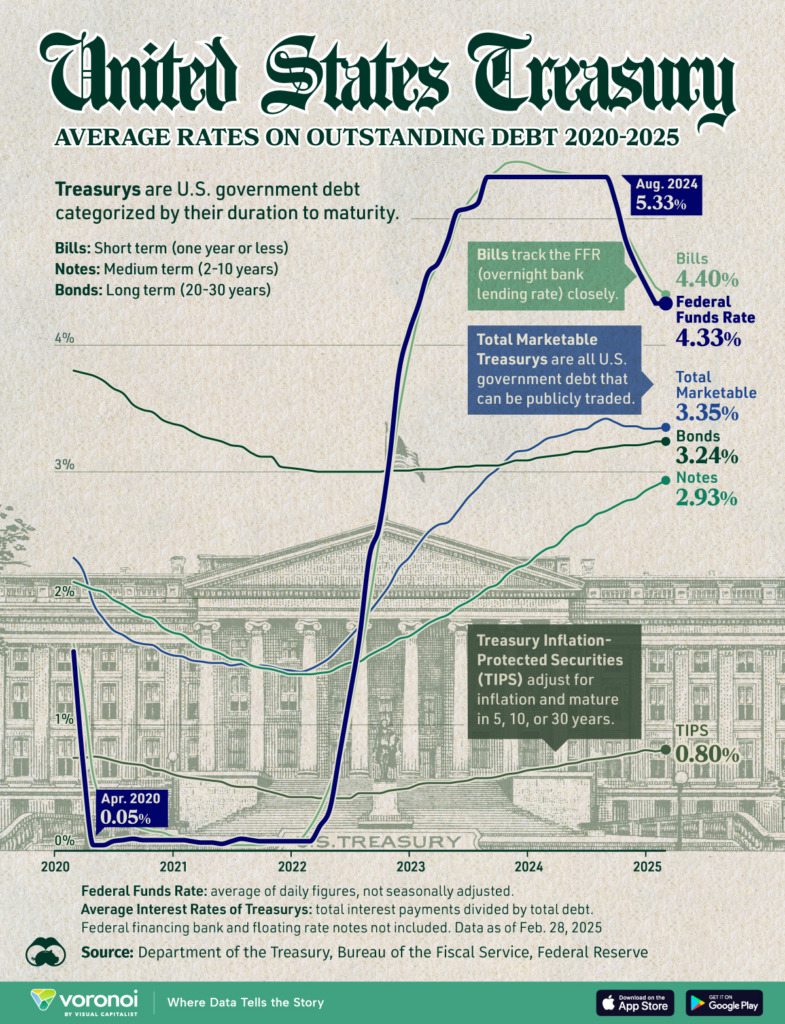

Image of the Week