Global Market News

Global Equities Decline

Global equities continued to decline this week. The Dow Jones and S&P 500 declined 1.85% and 1.95%, respectively, while the Nasdaq lost 2.34% on the week. The US 10-year Treasury note rose sharply to 4.76% over the week amid inflation jitters. The price of a barrel of West Texas Intermediate crude oil climbed to $75.70 on Friday. Volatility, as measured by the CBOE Volatility Index, rose more than 10% to close the week at 19.54.

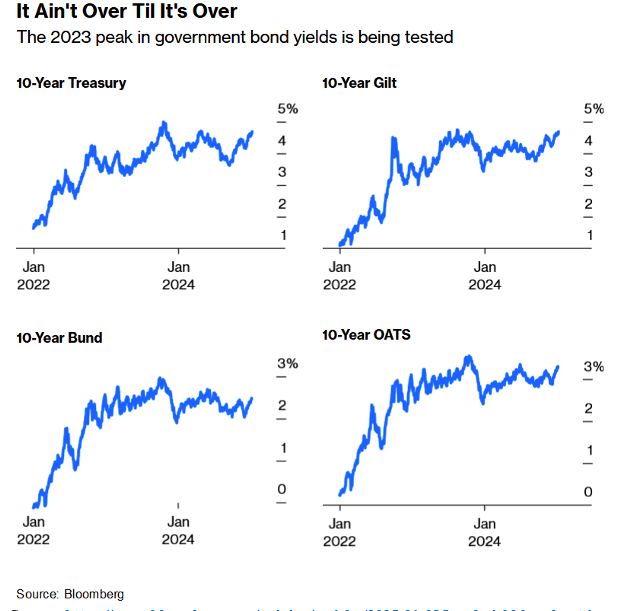

US Bond Yields Rise Amid Inflation Jitters

US bond yields rose after nonfarm payrolls increased by 256,000 in December, surpassing expectations. The labor market showed strength with job openings rising and unemployment claims falling, contributing to inflation concerns. Additionally, the Institute for Supply Management services index increased, indicating higher prices. Fears of inflation were further fueled by the projected Trump 2.0 policies, leading to a rise in year-ahead inflation expectations and the 10-year Treasury note yield reaching its highest level since October 2023.

International Developments

Earth’s Hottest Year on Record

In 2024, global temperatures exceeded 1.5°C above pre-industrial levels for the first full year, with an average rise of 1.6°C compared to 1850–1900, according to the EU’s Copernicus Climate Change Service. This alarming milestone reflects the accumulating greenhouse gases from burning fossil fuels, which also drive rising sea levels, melting glaciers, and intensifying natural disasters like wildfires, floods, and heatwaves worldwide. July 10th marked the hottest day ever recorded, averaging 17.16°C globally, and 2024’s temperature leap surpassed 2023’s record by an unprecedented margin. Scientists and experts warn that this trend underscores the urgency for nations to meet Paris Agreement goals, as political will remains inconsistent despite escalating climate impacts.

Justin Trudeau to Resign as Canadian PM Amid Political Turmoil

Canadian Prime Minister Justin Trudeau announced on January 6th that he will resign after nearly a decade in office, following mounting pressure from within his Liberal Party. Trudeau cited internal divisions, economic struggles, and declining popularity as key factors for his decision, pledging to remain in office until the party selects a new leader ahead of a likely spring election. His deputy, Chrystia Freeland, resigned in December 2024, delivering a blow to his leadership as she criticized his policies and governance style. With Governor-General Mary Simon agreeing to prorogue Parliament until March 24th, Trudeau’s departure sets the stage for a critical political reset amidst growing support for opposition leader Pierre Poilievre and Canada’s economic challenges.

US Announces Additional Sanctions on Russia

The Biden administration has announced new sanctions targeting Russia’s energy sector, specifically focusing on two major oil producers, liquefied natural gas production, and elements of Russia’s so-called dark fleet of tankers used to carry oil to non-Western buyers. This move aims to weaken Russia’s oil industry over time, costing Russia billions of dollars a month in revenues, without causing immediate disruptions to global energy. President Biden emphasized that these actions are part of a broader strategy to degrade Russia’s status as a leading energy supplier. As President-elect Trump prepares to take office in less than two weeks, the move is viewed as an attempt by Washington to prepare the way for negotiations to bring Moscow to end the war in Ukraine.

US Social & Political Developments

Supreme Court Weighs TikTok Ban Amid National Security Debate

The US Supreme Court is deliberating whether to block a law that would ban TikTok by January 19, 2025, unless its Chinese owner, ByteDance, divests the platform. The Biden administration defends the law on national security grounds, citing risks of data access and manipulation by the Chinese government, while TikTok and its users argue it violates First Amendment rights. With 170 million American users, TikTok faces a politically charged case supported by bipartisan legislation, national security officials, and several states. The court’s decision may provide a provisional ruling soon, as President-elect Donald Trump also seeks a resolution to this contentious issue.

Biden Commits Full Federal Support for California Wildfire Crisis

President Biden announced that the federal government will cover 100% of wildfire disaster response costs in Southern California for the next six months, up from the previous 75%. The catastrophic fires, including the Palisades Fire and one in Pasadena, have killed at least five people, destroyed over 1,300 structures, and forced 179,000 evacuations. Federal resources, including 400 firefighters, 30 planes, and additional aid from FEMA and the Pentagon, are being deployed to contain the blazes fueled by Santa Ana winds and dry conditions. Biden urged Congress for supplemental funding and emphasized a long-term commitment to recovery and rebuilding efforts.

Corporate/Sector News

Nippon Steel and US Steel Sue Over Blocked Acquisition

Nippon Steel and US Steel have filed lawsuits against President Biden and others after his administration barred Nippon’s $14.9 billion acquisition of US Steel on national security grounds. The companies allege constitutional violations and accuse Cleveland-Cliffs, its CEO Lourenco Goncalves, and United Steelworkers President David McCall of antitrust and racketeering to sabotage the deal. The Committee on Foreign Investment in the US (CFIUS) cited risks to critical industries like energy and transportation, but the companies claim the decision was politically motivated to secure union support for Biden’s reelection. As Nippon Steel seeks expedited judicial review and damages, President-elect Donald Trump has indicated continued opposition to foreign ownership of US Steel.

Biden Implements Offshore Drilling Ban Across U.S. Coasts

President Biden announced a sweeping ban on new offshore oil and gas drilling, protecting over 625 million acres of waters along the Atlantic, Pacific, and parts of the Gulf of Mexico, as well as the Bering Sea. The decision, made under the Outer Continental Shelf Lands Act, is designed to prevent irreversible environmental damage and is difficult for successors, including President-elect Donald Trump, to reverse without Congressional approval. Environmental groups celebrated the move, calling it a victory for coastal communities, while Trump and industry advocates criticized it as a threat to American energy security. Biden’s action aligns with prior court rulings that limit presidential authority to revoke existing protections, setting up potential legal battles under the Republican-controlled Congress.

Microsoft’s $80 Billion AI Investment for FY 2025

Microsoft announced plans to spend $80 billion in 2025 on building AI-enabled data centers, with over half of the investment occurring in the US, according to Vice Chair and President Brad Smith. This marks a significant push to strengthen AI infrastructure, following Microsoft’s $13 billion investment in OpenAI and integration of AI models into products like Windows and Teams. Analysts predict a 42% year-over-year growth in capital expenditures, driven by the global AI race and rising competition from countries like China, which is subsidizing AI technologies for developing nations. Smith urged US policymakers to maintain AI leadership through education and by promoting American AI innovations abroad.

Corporate Profile

Constellation Energy Acquires Calpine to Expand Energy Market Presence

Constellation Energy, the largest U.S. producer of nuclear power, has agreed to acquire Calpine for $16.4 billion, including debt, to strengthen its position in the energy market amid rising electricity demand, driven by AI and tech companies’ expansion. This deal will provide Constellation with a larger footprint in Texas and California, two states with rapidly growing electricity needs. Constellation plans to leverage Calpine’s natural gas and geothermal power plants while continuing its investment in nuclear power, including the revival of the Three Mile Island reactor. With a market value exceeding $70 billion, Constellation aims to meet increasing demand for reliable, low-carbon electricity while exploring carbon capture technologies for sustainable growth.

Recommended Reads

Jimmy Carter’s Values-Based Foreign Policy Wasn’t a Failure

US corporate bankruptcies hit 14-year high as interest rates take toll

What the Latest Bonds Selloff Could Mean for Your Money

Preventative Priorities Survey 2025

Comparisons to chaos of Weimar era are usually overblown. Not this time

This week from BlackSummit

Rising Uncertainties and Portfolios: How Do We Invest in an Environment of Linguistic Relativism?

John E. Charalambakis

The BlackSummit Team

Image of the Week

Video of the Week

Before-and-After Satellite Images Show Devastation From L.A. Wildfires