Global Equities Increase

Global equities increased on the week, with the Dow Jones and S&P 500 rising 0.09% and 0.22%, respectively, while the Nasdaq gained 0.10%. The US 10-year Treasury note rose slightly to 3.97%, and the price of a barrel of West Texas Intermediate crude oil slumped to $74.55. Volatility, as measured by the CBOE Volatility Index closed at 19.21.

No Need to Rush Cuts, Says Powell

Federal Reserve Chair Jerome Powell stated that there is no rush to cut interest rates, emphasizing a cautious approach based on incoming economic data This comes after the release of strong job numbers, with the US economy adding 254,000 jobs in September, surpassing expectations and highlighting a robust labor market. Powell’s comments reflect confidence in the economy’s current trajectory, with a focus on maintaining stability.

International Developments

Tensions Rise as Wider War in the Middle East Appears Increasingly Likely

This week, Israel escalated its military operations on two fronts, launching a ground incursion into Lebanon against Hezbollah and while continuing strikes in Gaza. These actions resulted in eight Israeli combat deaths in southern Lebanon, marking a significant loss for Israel, especially on the eve of the Jewish New Year, Rosh Hashana. Iran, backing both Hezbollah and Hamas, had launched roughly 180 ballistic missiles into Israel the previous night, intensifying regional tensions. The conflict, which has left thousands of dead across Lebanon and Gaza, including civilians, has raised fears of a broader war potentially involving Iran and the United States.

Shigeru Ishiba’s Rise Increases Economic and Geopolitical Tensions

Shigeru Ishiba, Japan’s newly elected prime minister and leader of the Liberal Democratic Party (LDP), surprised many by winning the leadership election on September 27, 2024, after five attempts. His victory has raised concerns among economists and global investors due to his support for tighter monetary policy, a stronger yen, and fiscal tightening, which could potentially harm Japan’s economy. Ishiba’s hawkish stance on China and support for an “Asian NATO” further intensifies geopolitical risks, particularly with China and the U.S. In response to his unexpected win and policies, Tokyo stocks fell nearly 5%, highlighting the uncertainty surrounding his leadership.

Russian Forces Making Advances in Ukraine

This week, Russian forces captured the eastern Ukrainian town of Vuhledar after two years of fierce resistance by Ukrainian troops, marking Russia’s fastest advance in the conflict since 2022. Ukrainian forces withdrew from the hilltop coal-mining town to avoid encirclement, with Russian troops raising their flag over the devastated area. This victory strengthens Russia’s hold on the Donetsk region, part of its goal to seize the entire Donbas, which it currently controls about 80% of. The capture of Vuhledar also opens a strategic pathway for Russia to push deeper into Ukrainian defenses and connect Crimea to Donbas.

US Social & Political Developments

The Devastating Aftermath of Hurricane Helene

President Joe Biden visited hurricane-affected areas in Florida and Georgia, offering support to communities impacted by Hurricane Helene and committing long-term federal assistance. His tour included an aerial survey of Florida’s Big Bend region and a stop in Perry, where he met with local officials and residents affected by the Category 4 storm. Hurricane Helene caused significant destruction across several states, especially the Carolinas, resulting in over 200 deaths and extensive damage to homes, infrastructure, and agriculture. Federal agencies, including FEMA, are leading recovery efforts, deploying thousands of workers and providing resources such as emergency aid, meals, water, and generators to assist in the rebuilding process. Moody’s Analytics has estimated the cost of Hurricane Helene to be between $20 billion and $34 billion, with property damage accounting for $15 billion to $26 billion of that total.

Gavin Newsom Vetoes AI Safety Bill, Citing Innovation Concerns

California Governor Gavin Newsom vetoed a bill that aimed to establish safety regulations for large-scale artificial intelligence (AI) models, citing concerns that it could stifle innovation in the state. The bill, authored by Democratic state Sen. Scott Wiener, proposed stringent safety testing and public disclosures from AI developers, but Newsom argued it applied overly broad standards to all AI systems, even basic ones. The veto marks a win for tech companies and AI developers, many of whom, including Elon Musk and Anthropic, opposed the bill for potentially hindering industry growth. Despite the veto, the proposal has sparked discussions on AI safety nationwide, with other states considering similar regulations.

Corporate/Sector News

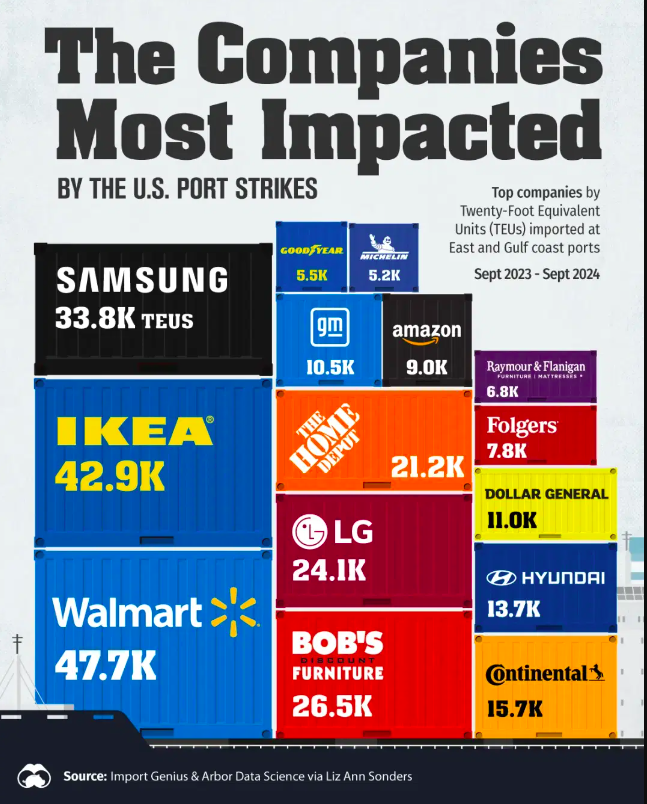

ILA Strike Ends on Thursday After Three Days of Protests

A strike by tens of thousands of dockworkers on the East and Gulf Coasts, which threatened to disrupt the U.S. economy, ended after a tentative agreement on wages was reached between the International Longshoremen’s Association and the United States Maritime Alliance. The agreement includes a 62% wage increase over six years, although the union originally sought a 77% increase. President Biden and senior administration officials worked behind the scenes to encourage a resolution, stressing the economic importance of the ports, especially in light of Hurricane Helene relief efforts. Ports from Boston to Houston, which handle over half of all U.S. cargo, are now resuming normal operations, though it will take time to clear the backlog of ships waiting offshore.

UK’s Last Coal Plant Retired

The UK’s last coal-fired power plant, the Ratcliffe-on-Soar station, closed on Monday, marking the end of 142 years of coal-generated electricity in Britain. The plant’s closure is hailed as a significant milestone in the UK’s transition to renewable energy, aiming for 100% renewable energy by 2030, with UK Energy Minister Michael Shanks praising coal workers’ contributions. The Ratcliffe station, which opened in 1967, was a notable landmark, but coal use in the UK has dropped from 80% of electricity in 1990 to just 1% in 2023. Additionally, Tata Steel’s Port Talbot steelworks in Wales is also closing its coal-powered blast furnace, eliminating nearly 2,000 jobs as part of the shift towards cleaner electric furnaces.

CVS Considering a Split Between its Retail Pharmacy and Insurance Units

CVS Health is considering options that may include splitting the company to separate its retail pharmacy and insurance units, following pressure from investors amid declining profits. The potential break-up would reverse its $70 billion acquisition of Aetna in 2017 and is being discussed by CVS leadership, though no decisions have been made yet. Investor Glenview Capital has been pushing for operational improvements after CVS lowered its 2024 profit outlook, while rising medical costs have impacted its Medicare business and led to the departure of Aetna head Brian Kane. CVS, led by CEO Karen Lynch, faces challenges from underperforming shares, rising costs, and growing competition from peers like UnitedHealth and Cigna.

Recommended Reads

Singapore dollar hits 10-year high on U.S. dollar weakness, sticky inflation

Has Israel-Hamas war displaced Palestinian refugees forever?

China’s Housing Glut Collides With Its Shrinking Population

The Coming Clash Between China and the Global South

U.S. Faces Economic Turbulence Just as Recession Fears Eased

This week from BlackSummit

The BlackSummit Team

The Peripatetic Journey Along and Across the Modern Rubicon: Alea Iacta Est & Market Empiricism

John E. Charalambakis

Image of the Week

Video of the Week

Biden and Harris Survey Hurricane Helene Damage in Carolinas and Georgia

Source: The Wall Street Journal