Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : January 13, 2024

Global Market News

Global equities rise

Global equities rose this week. The Dow Jones and S&P 500 grew 0.34% and 1.84% on the week, respectively, while the Nasdaq grew 3.09%. The US 10-year Treasury note fell under 4.00%, closing Friday at 3.94%. Meanwhile, the price of a barrel of West Texas Intermediate crude fell slightly to $72.68 amid continued turmoil in the Red Sea. Volatility, as measured by the CBOE Volatility Index, ended the week at 12.70.

Housing and Food Drive Slight Inflation Increase

In December, higher rents and food prices contributed to a rise in overall U.S. inflation, indicating that the Federal Reserve’s efforts to curb inflation to its 2% target may encounter challenges. The Consumer Price Index exhibited an annual growth rate of 3.4%, marking a 0.3% increase from the inflation recorded in November and surpassing economists’ expectations by 0.2%. While inflation is showing positive trends, the recent data suggests that any expectations of a March rate cut from the Fed may be reconsidered.

International Developments

Risk of Middle East Conflict Expanding Grows

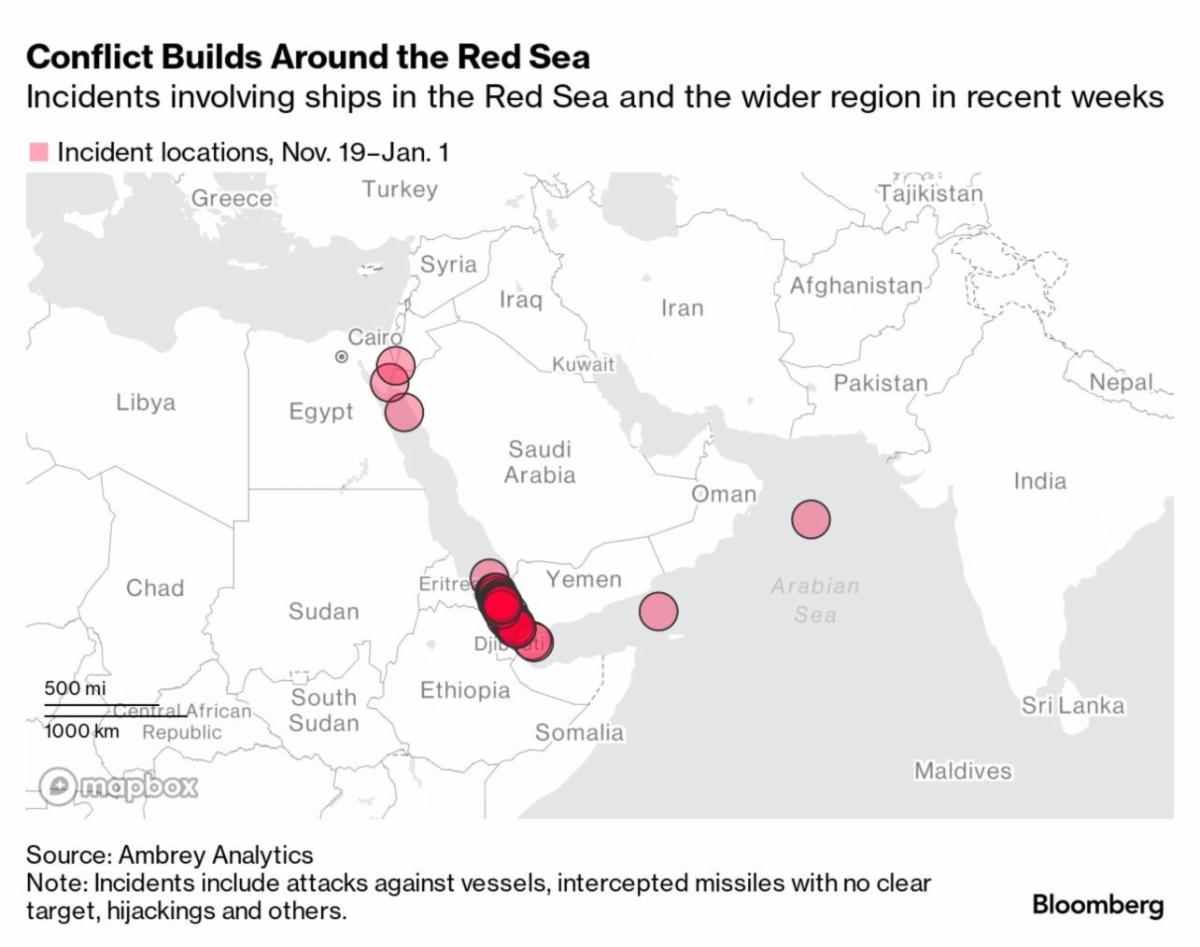

Thursday, Iran seized an oil tanker off the coast of Oman, calling the action retaliation for the United States seizing oil from the same vessel last year, and that it plans to hold the ship and the crew until repayment is received. This comes as Western countries try to prevent the Israel-Hamas war from expanding in scope. Also on Thursday, the U.S. and Britain carried out missile strikes on Houthi positions in Yemen. Since mid-November, the Houthis, a Yemeni rebel group backed by Iran, have shot missiles toward Israel and launched dozens of attacks on ships sailing through the Red Sea and Suez Canal in what they say is an attempt to stop Israel’s bombardment of Gaza. Houthi militants responded to the U.S. military strikes, saying that they would not go “unpunished or unanswered.”

Taiwan’s Ruling Party Wins Election

William Lai of the ruling Democratic Progressive Party has been announced the winner of Taiwan’s presidential election. Lai, the current vice president, framed the election as a choice between democracy or autocracy. Lai’s main rival, Hou Yu-ih of the nationalist Kuomintang, conceded defeat after polling results were revealed. In the run-up to the election, China was repeatedly accused of interference, with Beijing claiming that Lai would be a threat to regional stability if he won. The winning candidate says he remains committed to peace in cross-strait relations, but he is also committed to shoring up Taiwan’s defenses.

US Social and Political Developments

Report Says $1B of Ukraine Aid Not Properly Backed

A recent Pentagon report revealed that over $1 billion worth of military equipment sent by the United States to Ukraine was not properly tracked by officials. This raises concerns about the potential for theft or smuggling, especially as Congress debates whether to provide additional military aid to Kyiv. While the report does not present evidence of misuse of the weapons sent to Ukraine’s front lines, it highlights the failure of American defense officials and diplomats in Washington and Europe to promptly and comprehensively account for nearly 40,000 weapons sent to Ukraine.

House and Senate Leaders Agree on Potential Bill to Avoid Shutdown

Congressional leaders have successfully reached an agreement on potential deal to avoid a government shutdown and maintaining federal funding until the end of the fiscal year. The agreed-upon framework establishes topline spending levels, allocating $886 billion for defense spending in the current fiscal year and approximately $773 billion for non-defense spending. Congress must pass the bills before the looming government funding deadline on January 19. The deal is likely to face opposition from far-right House conservatives, who sought substantial spending cuts and border restrictions in exchange for their support on a spending bill. Lawmakers are now tasked with swiftly crafting legislation to secure congressional approval before funding expires for key programs on January 19, while the expiration for the rest of government funding is set for February 2.

Corporate/Sector News

Federal Regulators Announce Stricter Oversight of Boeing After Mid-Air Mishap

Following the investigation into an incident aboard an Alaskan Airlines flight where a door plug fell off the fuselage midair, the Federal Aviation Administration (FAA) has announced an increase in its oversight of Boeing production and manufacturing. The FAA, expressing that the incident should never have occurred, is set to scrutinize whether Boeing failed to ensure that completed products met the necessary conditions for safe operation in compliance with FAA regulations. In response to the incident, the FAA promptly ordered the temporary grounding of certain Boeing 737 Max 9 aircraft for inspections. The agency has indicated that the results of the initial audit will play a crucial role in determining whether additional audits are required to address safety concerns.

Hertz Offloading One-Third of EV Fleet

Rental firm Hertz is set to sell approximately 20,000 electric vehicles (EVs) from its U.S. fleet, constituting roughly one-third of its total EV inventory. Despite initially aiming to convert 25% of its fleet to electric by the end of 2024, Hertz has opted for gas-powered vehicles, citing higher expenses related to collision and damage for EVs. This decision highlights the challenges faced by the electric vehicle market, with slowing sales growth impacting carmakers such as General Motors and Ford, leading to a reduction in production plans. Concurrently, the wholesale prices of used EVs experienced a decline throughout much of 2023, influenced by decreasing prices for new EVs and a rise in unsold electric vehicle inventories.

Bitcoin ETFs Go Live

The first US exchange-traded funds (ETFs) directly holding Bitcoin witnessed a robust start, marking a historic first day of trading for these long-anticipated investment vehicles. On Thursday, over $4.6 billion worth of shares were traded among nearly a dozen US spot Bitcoin ETFs. The Grayscale Bitcoin Trust, now an ETF, accounted for approximately $2.3 billion in trading volume. Simultaneously, BlackRock’s iShares Bitcoin Trust (IBIT) experienced a significant turnover, with over $1 billion changing hands. Notably, the Grayscale Bitcoin Trust’s debut as an ETF set a record for the most heavily traded ETF launch to date.

Recommended Reads

SEC approves first spot bitcoin ETFs in boost to crypto advocates

What can investors expect from 2024?

Global economy headed for worst half-decade in 30 years, World Bank warns

The Medicis of the Middle East?

How France Fumbled Its Africa Ties and Fueled a Geopolitical Crisis

This Week from BlackSummit

The BlackSummit Team

The Black Summit Team

Image of the Week

Video of the Week

Why Ecuador is facing a deadly security crisis

Source: Le Monde