Weekly Market Update

Weekly Market Update

-

Author : The BlackSummit Team

Date : December 16, 2023

Global Market News

Global equities make gains

Global equities made gains this week with several indices rising and the 10-year Treasury note falling as the Fed signaled rate cuts in 2024. The Dow Jones and S&P 500 increased 2.92% and 2.49% on the week, respectively, while the Nasdaq rose 2.85%. The US 10-year Treasury note plummeted to 3.91%, while the price of a barrel of West Texas Intermediate crude closed Friday slightly higher at $72.10. Volatility, as measured by the CBOE Volatility Index, inched lower to end the week at 12.28.

Fed holds rates steady, signaling three cuts for 2024

The Federal Reserve held interest rates steady for the third time in a row and set the stage for three rate cuts in 2024. The committee voted to keep the benchmark rate between 5.25%-5.5%. With inflation slowing, the economy holding up, and the Fed’s potential cuts next year, markets jumped, with the Dow Jones Industrial Average going over 37,000 for the first time.

International Developments

COP28 produces landmark climate deal

The 28th UN Climate Summit, hosted in Dubai, has come to a close with a historic deal saying that countries would transition away from fossil fuels. This is the first time a COP28 document has mentioned moving away from fossil fuels to slow climate change, and the deal was approved by the 198 parties attending. The president of the talks, Emirate Sultan Al-Jaber, negotiated through the last night of talks to hammer together a deal that was agreed on Wednesday, one day after the summit was supposed to end. While critics of the deal say it doesn’t go far enough, governments around the world have hailed it as a huge step in the fight against climate change.

Further developments on Middle East instability

The US National Security Advisor Jake Sullivan met with top Israeli officials over the timeline of Israel’s war against Hamas. The Biden administration is pressing Israel to protect Gazan civilians during their campaign against Hamas and, during his visit, Sullivan also pushed for Israel to move into a lower-intensity phase of the conflict in the near future. At the same time, Israeli officials are warning that they will soon use force against Hezbollah, an Iran-backed terrorist group, to push the group back from Israel’s northern border with Lebanon. The White House has also called for diplomacy to wind down the conflict with Hezbollah instead of launching another war.

US Social & Political Developments

White House and Zelenskyy stress stakes of aid to Ukraine

This week, US President Joe Biden warned Republican members of Congress that they were aiding Moscow’s ambitions in Ukraine by blocking aid. In his visit to Washington, Ukrainian President Volodymyr Zelenskyy failed to convince key Republicans to support a $61 billion military aid package. Republicans have said they wanted provisions against illegal immigration on the southern border in return for additional aid to Ukraine. President Biden later announced a $200 million aid package that does not need Congress’s approval.

Biden becomes target of impeachment probe by House of Representatives

The House of Representatives has authorized an impeachment inquiry into President Biden. The Republican majority won the vote along party lines at 221-212 despite concerns from some that the investigation has little evidence to support this action. As of yet, no evidence has been brought forward that Biden acted in a corrupt manner or accepted bribes during his role as Vice President or in his current position. House Democrats called the inquiry a political stunt and a move of payback for Donald Trump’s two impeachments during his presidency.

Corporate/Sector News

South Korea announces $29 Billion for battery manufacturers

South Korea has announced the creation of a 38 trillion won ($29 billion) financial package that aims to fund Korean electric vehicle (EV) battery makers to diversify their supply chains away from China. The aid will be distributed over five years and will be in the form of loans, credit guarantees, and other financial instruments. South Korea’s three top battery makers – LG Energy Solution, Samsung SDI, and SK On Co. – control almost half the global market for EV batteries outside of China.

Tech sector developments: Intel, Microsoft, Nvidia

A flurry of tech news has come out in the past week. First, Intel has revealed a new computer chip for generative Artificial Intelligence (AI) software called Gaudi3, which will launch next year and compete with other AI rivals Nvidia and AMD. Second, Microsoft said it has been training a large-language AI model with US nuclear regulatory and licensing documents in order to speed up regulatory approvals for nuclear power, which otherwise can take years and cost millions of dollars. Finally, Nvidia has announced its intentions to establish operations in Vietnam to build up the country’s semiconductor industry and support AI advancement as trade tensions between the US and China open up opportunities elsewhere.

New policies crack down on rising Medicare drug costs

The White House has announced new measures to lower out-of-pocket expenses for Medicare members, targeting drugmakers that raise prices faster than inflation. The prices of at least 64 drugs have risen faster than inflation over the past four quarters. 48 Medicare Part B drugs could be subject to inflation penalties for Q1 2024 – this includes products made by major firms like AbbVie, Amgen, and Pfizer.

Recommended Reads

Three economic risks facing America in 2024

How Gilded Age Lawmakers Saved America From Plutocracy

In a first, COP28 targets the root cause of climate change

Is the World Really Ready to Abandon Fossil Fuels?

This week from BlackSummit

Assessing the Outlook for 2024

John E. Charalambakis

The BlackSummit Team

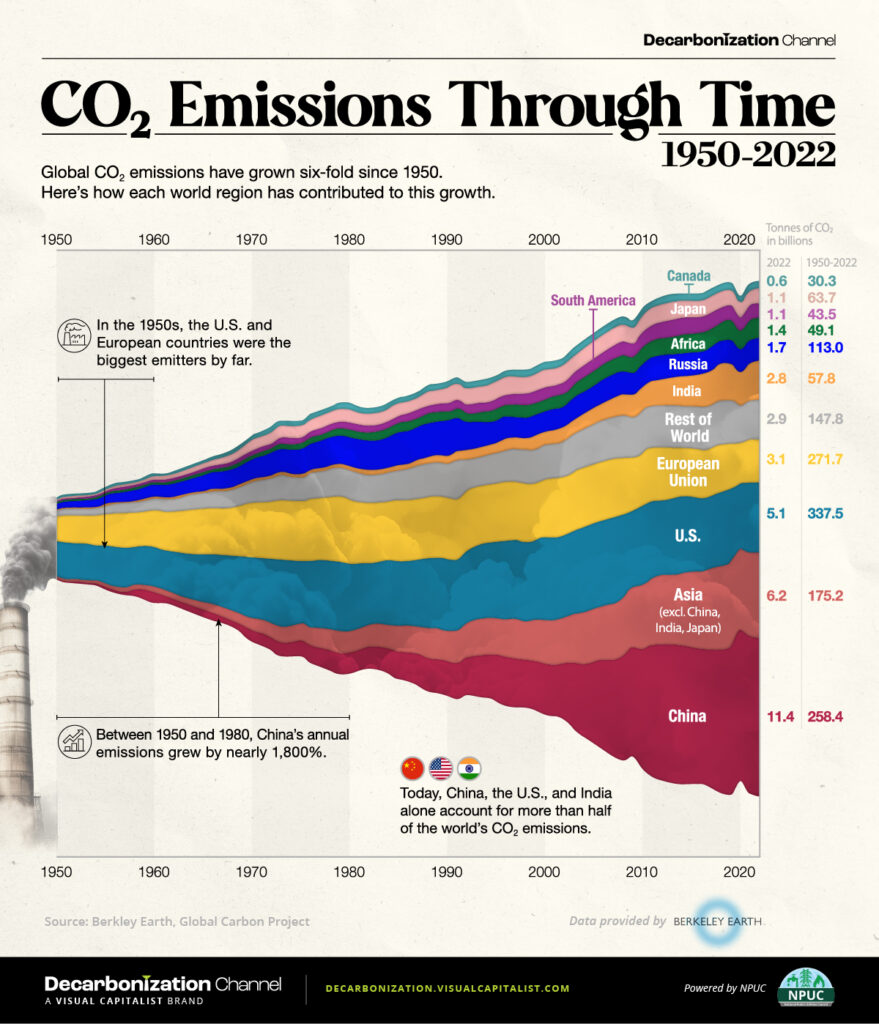

Image of the Week

Video of the Week

Source: Bloomberg