Global Market News

Global equities tumble

Global equities were down on the week as banking concerns and fear over a US default mounted. The S&P 500 and Dow Jones closed down 0.80% and 1.24%, respectively, while the Nasdaq gained 0.10%. The US 10-year Treasury yield remained relatively unchanged, ending the week at 3.43%. The price of a barrel of West Texas Intermediate crude oil dropped several dollars, closing Friday at $71.32. Volatility, as measured by the CBOE Volatility Index, ticked up slightly to 17.19.

The Fed and ECB raise interest rates

The Federal Reserve raised rates by another 0.25% on Wednesday, signaling a slowdown in the central bank’s contractionary policy to get inflation under control. Fed Chairman Jerome Powell reasserted the central bank’s commitment to fighting inflation but hinted that the rate hikes could pause at the Fed’s next meeting, noting the slight slowdown in the US economy. The European Central Bank (ECB) announced an identical rate hike on Thursday, following a similar strategy as the Fed due to new data showing the eurozone economy’s slow growth and tightening financial conditions. Unlike what the Fed has hinted at, financial analysts believe that the ECB may continue to raise rates two or three more times.

International Developments

Russia strikes Kyiv after it alleges assassination attempt on Putin

Russia launched drone strikes on the Ukrainian cities of Kyiv and Odesa in apparent retaliation for Kyiv’s alleged role in a drone attack targeting the Kremlin. There are no reports of casualties from the attacks, but they do mark the fourth such attack in as many days. Russia has accused the US of ordering the drone attack on the Kremlin and is calling it an attempted assassination of President Vladimir Putin.

Iran’s Raisi visits Syria to bolster ties amid civil war

Iran and Syria’s presidents met on Wednesday to sign numerous long-term agreements between the two countries, marking the first time an Iranian president has visited Damascus since 2010. Tehran has been the main lifeline and ally of Damascus’ Assad regime since the eruption of civil war in 2011. As other Arab states begin to warm relationships with Syria, Iran is hoping to benefit from its long “investment” in the Assad regime through deals in oil, agricultural, railways, and free trade zone sectors. The meeting comes just a couple of weeks after the Saudi foreign minister’s visit which was the first visit by a Saudi top diplomat since the outbreak of the war.

US Social & Political Developments

Biden invites congressional leaders to White House to discuss debt ceiling

President Biden invited both House Speaker McCarthy and Senate Minority Leader McConnell to meet in the White House to discuss the debt ceiling. The two Republicans will be accompanied by Democratic Senate Majority Leader Schumer and House Minority Leader Jeffries. Biden plans to convince the leaders that Congress must act before the US reaches its debt limit, which has been projected to happen on June 1st. Democrats want a debt limit increase without policy conditions, while Republicans insist on attaching spending cuts to any bill. The timeline for action is narrowing, and analysts warn of financial disaster if the US fails to act.

US and China agree to climate talks

US Climate Envoy John Kerry has stated that China has invited him to visit the country for talks over climate change in the near future. The invitation comes amidst a backdrop of increasing diplomatic tension between the two countries and is set to address ways in which both sides can work together to manage issues pertaining to climate change. President Biden has already given Kerry the go-ahead to engage in the talks and the issue is considered an important “free-standing” topic for both countries to discuss since the US and China are the top two greenhouse emitters.

Corporate/Sector News

First Republic Bank is bought by JPMorgan

First Republic Bank is the latest in a string of bank failures that kicked off earlier this year with the failure of Silicon Valley Bank. The bank, which was initially bailed out by the private sector via $30 billion in deposits from big lenders, including JPMorgan, Morgan Stanley, and Wells Fargo, was bought by JPMorgan with assistance from the FDIC. The bank’s failure has rippled outwards as investors believe the worst is not over for troubled regional banks. PacWest and Western Alliance have both seen significant drops in their shares, while other regional banks such as Zions, Comerica, and Key have likewise been negatively impacted.

Chief AI executives visit White House

The White House has called chief executives of Google’s parent company Alphabet Inc., Microsoft, OpenAI, and Anthropic to discuss artificial intelligence. The administration seeks to understand the possible dangers associated with AI and to drive home the message of responsibility when releasing new technology. The White House also seeks comment on proposed accountability measures for AI systems as concerns mount over its impact on security and education.

Hollywood goes on strike

Talks between the Writers Guild of America and various media companies collapsed ahead of a Monday night deadline to reach a new contract. The dispute centers around concerns over writers’ compensation and changes in the business model. For instance, writers are seeking assurances that movies developed for streaming platforms, such as Netflix, will receive compensation at the same rate as movies slated for movie theaters. With both sides hardening their positions, fears are rising of a repeat of 2007-2008, where a Writers Guild’s strike lasted for 100 days and caused significant collateral damage.

Recommended Reads

Chinese cities begin to pay public employees in digital yuan

America’s Spies Are Losing Their Edge

ChatGPT Will Disrupt Many Jobs. These Are the Most at Risk.

Reactions to National Security Advisor Jake Sullivan’s Brookings speech

Recession Odds Are ‘Pretty Darn High’ Right Now, Gundlach Says

Quantum computing could break the internet. This is how.

America’s anything-goes Supreme Court

This Week from BlackSummit

Cheap, Clean, and Risk-Free: Europe’s Strategic Energy Decoupling

Tyler Thompson

Revisiting the Libation of Bearers: Aeschylus, the Serpent, and Hotel California

John E. Charalambakis

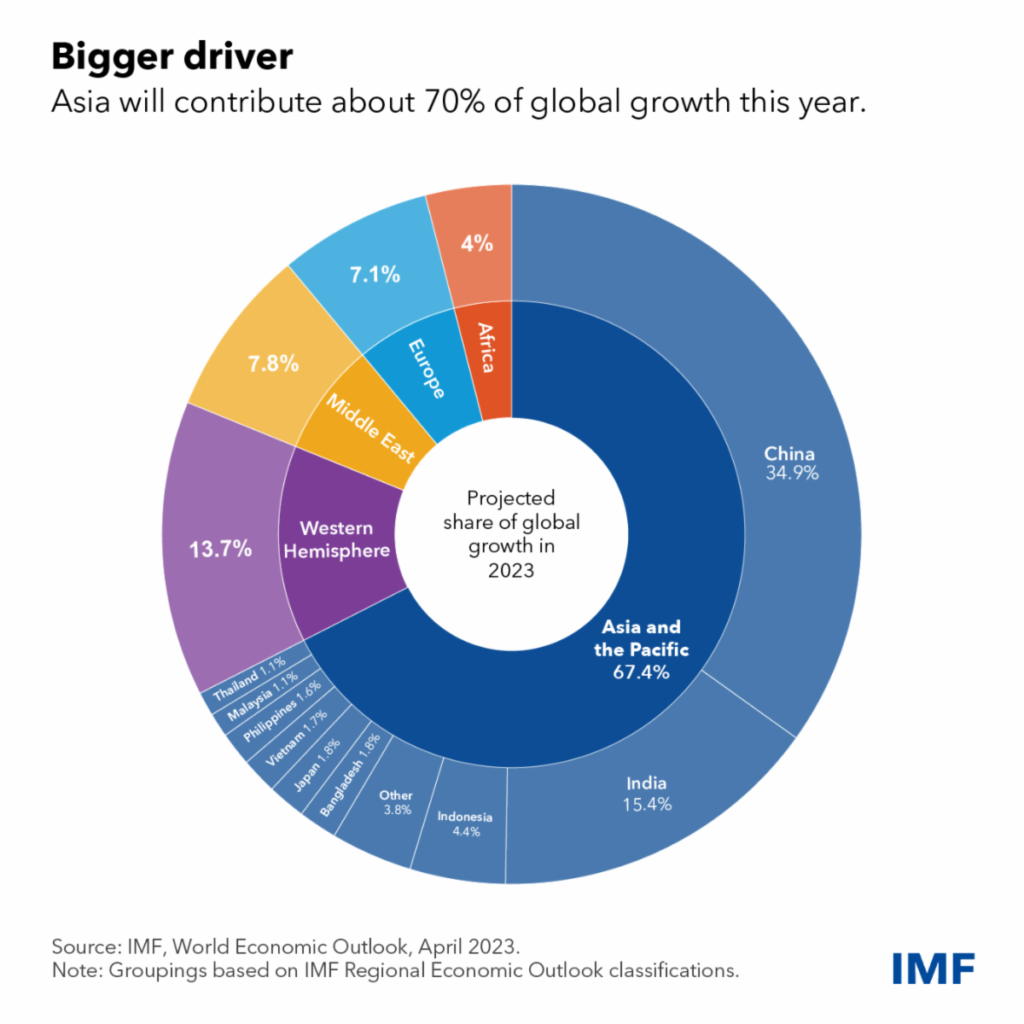

Image of the Week

Video of the Week

Sudan’s conflict explained in 5 minutes: ‘Lawlessness on the streets of Khartoum’

Source: The Telegraph