Weekly Market Update

Weekly Market Update

-

Author : Rachel Poole

Date : December 10, 2022

Global Market News

Global equities decline

Global equities were slightly down on the week. The S&P 500 and Dow Jones declined 2.25% and 2.77% respectively, while the Nasdaq dropped 3.44%. The yield on the US 10-year Treasury ended the week at 3.58%. The price of a barrel of West Texas Intermediate crude oil dropped several dollars to end the week at $71.59. Volatility, as measured by the CBOE Volatility Index, closed the week slightly higher at 22.83.

Oil hits lowest level of 2022

West Texas Intermediate crude oil futures fell to $71.10 a barrel on Thursday, hitting their lowest level of the year. The drop comes amid rising US inventories, weak global economic growth, and China’s continued Covid-19 restrictions. The oil market has erased its gains made after Russia’s invasion of Ukraine. In other oil news this week, OPEC+ decided to keep its output at current levels.

International Developments

Peru’s president impeached and arrested

In a matter of a day, Peru’s president attempted to dissolve Congress and was subsequently impeached and arrested. On Wednesday, Peruvian President Pedro Castillo tried to dissolve parliament and rule by decree in order to retain power and prevent himself from being impeached by Congress. In response to his actions, which some are calling an “attempted coup”, lawmakers immediately voted to impeach him and then had him arrested for breaking constitutional order. Castillo has struggled to create a successful government over the last year as he has faced corruption accusations and has failed to keep cabinet members. This week was the third impeachment attempt against him. Vice President Dina Boluarte had been sworn in. She is Peru’s sixth president in 6 years.

China and Saudi Arabia strengthen ties

Chinese President Xi Jinping traveled to Riyadh this week to meet with Saudi King Salman bin Abdulaziz Al Saud. During their meeting, the two leaders signed a strategic partnership agreement to strengthen diplomatic ties and pledge to cooperate in the global oil market. In a separate deal, Chinese tech giant Huawei – which is sanctioned by several Western nations – will begin providing cloud computing and other services in Saudi Arabia. China described the summit as its “largest-scale diplomatic activity between China and the Arab world” in modern Chinese history. Following the meeting between the two leaders, Xi attended a summit with other Arab leaders. News of the partnership comes at a time when US-Saudi relations have come under strain.

US Social & Political Developments

Brittany Griner freed in prisoner swap with Russia

US basketball star Brittney Griner, who has been detained since February for the possession of marijuana, was released from a Russian prison this week in a prisoner swap between Washington and Moscow. Griner was exchanged for Russian arms dealer Viktor Bout who is nicknamed the “dealer of death”. Talks of a prisoner swap have been ongoing for the last few months. Originally, the US was aiming to secure the release of both Griner and former US marine Paul Whelan. However, US President Joe Biden said Russia was “treating Paul’s case differently.”

Georgia runoff gives Democrats 51-Senate majority

Incumbent Democratic Senator Raphael Warnock defeated Republican candidate Herschel Walker this week in Georgia’s runoff election for Senate. Warnock’s victory gives the Democrats a 51-seat majority in the Senate. Georgia’s Senate race was one of the most expensive congressional races of all time, with both parties paying about $250 million for political ads in the general election alone.

Corporate/Sector News

TSM triples investment in US

Taiwan Semiconductor Manufacturing Company (TSMC) has announced plans to triple its investment in the US, making history as one of the largest foreign investments in the country ever. The chipmaking giant has announced plans to build its second chip plant in Arizona. The newly announced plan will amount to a $40 billion investment, bringing TSMC’s total investment in the US to $52 billion. The previously disclosed $12 billion chip factory is expected to begin mass manufacturing 4-nanometer chips in 2024 and the second factory is slated to begin production of 3-nanometer chips in 2026. When both plants are fully operational, they are expected to meet US annual demand. The passage of the CHIPS Act in August helped pave the way for TSMC and other semiconductor companies to expand their footprint in the US. This allows the country to lessen its reliance on microchips made in Taiwan in an effort to avoid geopolitical risks.

Price cap on Russian oil

A $60 cap on the price of Russian oil came into effect on Monday. Group of Seven (G7) nations and Australia agreed to the price cap, as well as a mechanism that keeps the cap at least 5% below market rate, to curb the revenue flows to Putin’s war machine. Under the deal, Russian oil can be shipped to third-party countries using G7 and European Union tankers only if the cargo is purchased at or below the $60 per barrel cap. Ukraine’s President Volodymyr Zelenskyy criticized the agreement, calling it “quite comfortable for the budget of a terrorist state.” In response to the price cap, Russia has said it will redirect its oil supply to “market-oriented partners” and will work on mechanisms to prohibit the use of the price cap. While some analysts believe Russia will be able to avoid the sanctions which would keep oil prices at current levels, others are fearful that a drop in Russian sales or output could send oil prices sky-high once again.

FTC votes against Microsoft’s Activision deal

The Federal Trade Commission (FTC) has voted 3-1 to block Microsoft’s $69 billion deal to acquire game developer Activision Blizzard. The FTC found the purchase could harm competition and feared it would give the Xbox maker an unfair advantage in the market for game subscriptions and cloud gaming. The decision demonstrates the FTC’s commitment under new leader, Lina Khan, to enforce antitrust laws and crack down on US tech giants. Microsoft is also facing scrutiny in Europe and the United Kingdom.

Recommended Reads

EU reaches deal to impose $60 cap on Russian oil exports

Sanctions on Russia are Working. Here’s Why.

Wall Street Chorus Grows Louder Warning That 2023 Will Be Ugly

The Dangerous Wisdom of Chinese Crowds

We looked at 1,200 possibilities for the planet’s future. These are our best hope.

Defaults Loom as Poor Countries Face an Economic Storm

This week from BlackSummit

Canceling the Noise; Not by Bread Alone: Part XVII

John E. Charalambakis

The BlackSummit Team

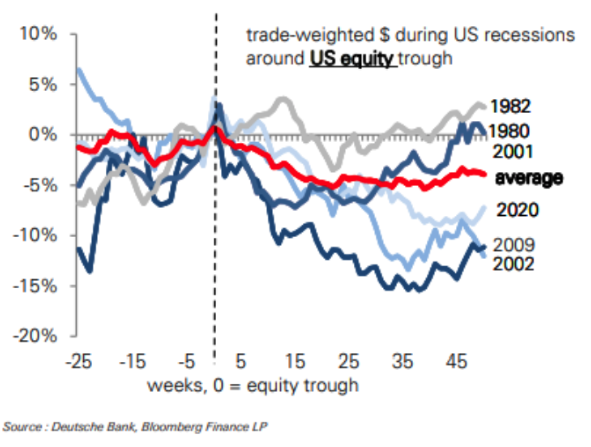

Image of the Week

Video of the Week

This underground farm used to be an air raid shelter

Source: World Economic Forum