Global Market News

Global equities decline in volatile week

Amid large intraday swings, global equities declined on the week as rising interest rates and oil prices rocked the markets. The S&P 500 and Dow Jones closed the week down 0.21% and 0.24% respectively, while the Nasdaq dropped 1.54%. The yield on the US 10-year Treasury rose to its highest level since 2018, ending the week at 3.13%. The price of a barrel of West Texas Intermediate crude oil surged 5.54%, closing Friday at to $110.49. Volatility, as measured by the CBOE Volatility Index, closed Friday at 30.2.

Fed raises interest rates

As anticipated, the Federal Reserve raised interest rates by 50 basis points on Wednesday, bringing the federal funds target rate to between 0.75% and 1%. Markets reacted positively to the news on Wednesday afternoon but fell back down again on Thursday. The Fed also detailed its plan to begin reducing its balance sheet on June 1st, estimating that the reduction would roughly translate into a 0.25% tightening over the next year. At the meeting, Chairman Jerome Powell also suggested interest rates would be hiked an additional 50 basis points at the June and July meetings in an attempt to tame inflation.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 516,680,000 Global Covid-19 deaths: 6,275,000

US Confirmed Covid-19 cases: 83,530,000 US Covid-19 deaths: 1,024,000

*As of Friday evening

Beijing tightens Covid-19 restrictions

In a continuation of its zero-Covid policy, China is tightening restrictions in Beijing. This week, authorities banned indoor dining, and announced new rounds of mass testing, among other constraints. Meanwhile, Shanghai entered its fifth week of lockdown. Economic activity in China declined sharply in April as a result of the zero-Covid measures. The country’s manufacturing index dropped to its lowest level since February 2020, slumping to 47.4, and the service-sector purchasing managers index declined to 41.9, down from 48.4 in March. In a meeting on Thursday, Chinese President Xi Jinping underscored the government’s commitment to its zero-Covid policy and warned that it would fight any speech against it.

International Developments

Ukraine Updates: EU announces Russian oil embargo, US intelligence reportedly helped Ukraine target Russian warship and kill Russian generals

The European Union (EU) announced it is creating a plan to ban Russian oil imports, phasing them out in the next 6 months and banning refined petroleum products by the end of the year. The oil ban is part of a sixth round of sanctions the EU is preparing against Russia for its invasion of Ukraine. The sanctions are also expected to exclude several more Russian banks from the SWIFT global interbank messaging system. Also this week, unnamed US officials reported that intelligence-sharing assisted Ukraine in sinking Russia’s Moskva warship last month. In addition, US intelligence-sharing reportedly allowed Ukrainian forces to target and kill multiple Russian generals.

Irish pro-unity party nearing historic victory

In what the New York Times is calling a “seismic shift”, the pro-unity party Sinn Fein of Northern Ireland is likely to emerge the victor of legislative elections, according to polls Friday night. The win for Sinn Fein would push the Democratic Unionist Party, which favors North Ireland’s status as part of the United Kingdom, into second place in the Assembly for the first time since the 1998 Good Friday Agreement which created the current system under which unionists and nationalists share power. The political shift could raise hopes for Irish unity and sow political unrest at the same time.

US Social & Political Developments

US Supreme Court decision on Roe v. Wade leaked

A draft Supreme Court majority opinion on the landmark abortion decision Roe v. Wade was leaked in an unprecedented breach of security of the nation’s highest court. The document leaked suggests the court is in favor of overturning the ruling, but this is not a final decision, and Justices can change their votes as draft opinions circulate. The court’s holding will not be final until it is published in the next couple of months. If the decision to overturn Roe v Wade is confirmed as drafted, the federal constitutional protection of abortion rights would end, and states could decide whether to restrict or ban abortion. The leak evoked a massive public response given that abortion is such a politically controversial issue.

Pelosi visits Kyiv

Speaker of the House Nancy Pelosi traveled to Kyiv last weekend to meet with Ukrainian President Volodymyr Zelensky. She is the most senior US official to visit Ukraine since the start of Russia’s invasion. In a news conference in Poland following the meeting with Zelensky, Pelosi and some of her fellow Democratic lawmakers vowed to support Ukraine “until victory is won”, signaling a deepening US commitment to back Ukraine.

Corporate/Sector News

Oil news triggers market volatility

Lots of oil news hit the press this week, triggering market volatility. The news of the EU’s proposal of a Russian oil ban sent oil prices up earlier in the week, while a slew of announcements on Thursday shook up markets even more. OPEC+ detailed plans to slightly increase oil production by 432,000 barrels per day, which is up from the monthly 400,000-barrel supply increases it has been doing for almost a year in response to the Covid-19 pandemic. The plans indicate that the group is acknowledging calls for supply increases, but there are still signs that the group is unwilling to increase production by any serious degree. Also this week, the Biden administration announced plans to replenish the strategic petroleum reserve and the Senate Judiciary Committee passed a bill to bring antitrust lawsuits against OPEC+. The proposed legislation (previous versions of which have failed in the past), aims to protect US consumers from higher gas prices due to OPEC+ collusion.

Buffet and Munger speak against Bitcoin

At Berkshire Hathaway’s annual shareholder meeting, an event known as the “Woodstock of Capitalism”, Warren Buffett and Charlie Munger doubled down on their opinions of Bitcoin. Both men are famously against the popular cryptocurrency, arguing that is in no way a productive asset. Munger added that he believes Bitcoin undermines the Federal Reserve system and that it will eventually go to zero. Their comments come just a month after Peter Thiel called Buffett “enemy no. 1” of Bitcoin.

OMX Stockholm Index plunges in flash crash

On Monday morning, the OMX Stockholm 30 Index plummeted as much as 8% in just five minutes. The “flash crash” spilled over into European stock markets, taking out as much as €315 billion in market capitalization. Citigroup’s London trade desk has claimed responsibility for the sell-off, reporting that one of their traders “made an error when inputting a transaction.” The error was quickly identified and corrected, but not before causing some major market disruption. Citigroup is currently in talks with regulators about the incident.

Recommended Reads

The EU Goes After Russian Oil Sales to Europe—With an Eye on a Larger Target

Elena Kostioutchenko, a Russian journalist exposing the open wounds of Ukraine

Russia’s invasion of Ukraine in maps — latest updates

Citi Trader Made Error Behind Flash Crash in Europe Stocks

‘Not our fight’: Why the Middle East doesn’t fully support Ukraine

This week from BlackSummit

Canceling the Noise; Not by Bread Alone Part IX – John E. Charalambakis

Yes Market Timing is Still a Bad Idea – Tyler Thompson

Geopolitical Challenges and Statecraft – The BlackSummit Team

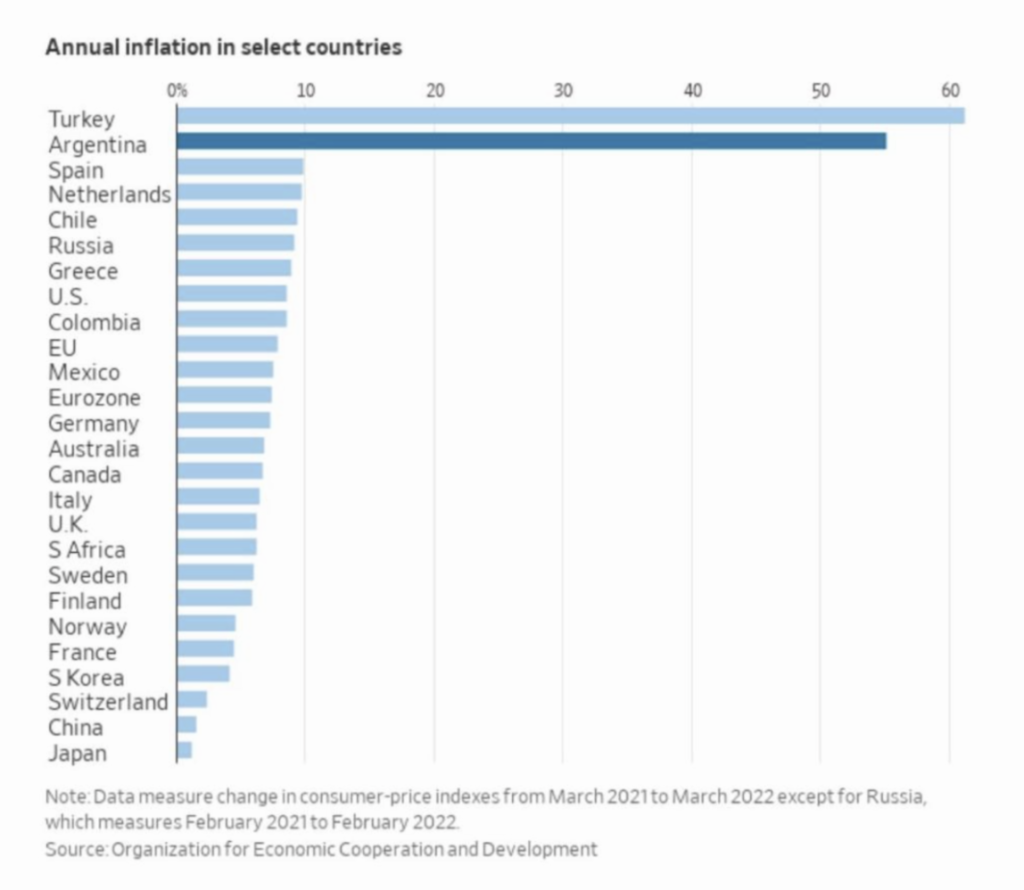

Image of the Week

Video of the Week

Interest Rate Investing Equities Activity

Source: James Eagle