Global Market News

Global equities continue falling

Global equities declined this week, with the S&P 500 marking its worst January to April performance since 1939 and the Nasdaq posting its worst four-month start to the year ever. The S&P 500 and Dow Jones closed the week down 3.27% and 2.47% respectively, while the Nasdaq dropped 3.93%. The yield on the US 10-year Treasury note increased slightly to 2.93%, while the price of a barrel of West Texas Intermediate crude oil began rising again, closing Friday at $104.69. Volatility, as measured by the CBOE Volatility Index, rose several points this week, ending the week at 32.9.

US economy contracts

The US economy unexpectedly contracted in the first quarter of 2022 as government spending slowed and private inventory investment declined. A widening trade deficit, which has highlighted supply chain issues, also contributed to the contraction. While economists expected significantly slower growth than the 6.9% annualized rate posted for the fourth quarter of 2021, the contraction of 1.4% was a surprise. On the other hand, personal consumption and business investment rose compared to the previous quarter. The Fed is still likely to raise interest rates by 50 basis points next week.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 512,987,000 Global Covid-19 deaths: 6,259,600

US Confirmed Covid-19 cases: 83,037,000 US Covid-19 deaths: 1,020,000

*As of Friday evening

China intensifies lockdowns

Authorities are closing more and more businesses and residential compounds in Beijing to try and contain a Covid-19 outbreak in China’s capital. Meanwhile, resentment in Shanghai is growing as people have been unable to leave their homes for nearly a month due to a lockdown that was only supposed to last for a week. Fears are growing that Beijing could enter a complete lockdown like Shanghai in the coming days, further disrupting China’s economy and increasing pressure on global supply chains. The Chinese government has committed to speeding up tax cuts in an effort to cushion the economic blow of Covid-19 restrictions.

International Developments

Ukraine Updates: Russia cuts off gas to Poland and Bulgaria, Germany ready for Russian oil embargo

Russia escalated tensions with the West earlier this week when it completely cut off Poland and Bulgaria from its natural gas deliveries. Moscow took the action in response to what it said was the two countries’ refusal to pay for the gas supplies in rubles. The US is stepping in to help fill the energy import needs of Poland and Bulgaria. There are plans to divert US natural gas from Japan and other destinations to Bulgaria if needed, and Poland says it has significant gas reserves that should sustain it for the time being. The US and its European allies are also working with Korea, Japan, Qatar, and others to supply natural gas to Poland and Bulgaria. On Friday, Germany said it was ready to pursue a Russian oil embargo if Germany was given enough time to secure alternative energy supplies. The shift in Germany’s stance significantly increases the likelihood that the European Union will agree on a phased-in ban on Russian oil, with a decision coming as soon as next week. Russia continues its attack on Ukraine, ramping up military efforts particularly in the eastern and southern regions, with no end in sight.

Macron defeats Le Pen

Emmanuel Macron defeated his far-right opponent Marine Le Pen last weekend, securing a second term as France’s president. The 44-year-old centrist was re-elected with 58.5% percent of the vote. While France’s far-right has risen in the last few years since Macron and Le Pen’s last runoff in 2017, it has not grown enough to upend France’s leadership. The election has been seen as a victory for liberal, pro-European politics over a wave of nationalism that has been spreading. Legislative elections will be held in June, and Macron’s party is expected to retain its majority.

US Social & Political Developments

Biden requests $33 billion to support Ukraine

US President Joe Biden has asked Congress for $33 billion in aid for Ukraine. The amount is more than double the assistance pledged to Ukraine to far, and it would last through September. Roughly $20 billion would be military assistance and the remaining $13 billion would cover economic and humanitarian aid. On Thursday, Congress approved the revival of the WWII era lend-lease bill which will facilitate military exports to Ukraine.

Washington announces $670 million in global food aid

On Wednesday, the White House announced that the US Department of Agriculture (USDA) and US Agency for International Development (USAID) would provide $670 million in food assistance to countries that are facing food insecurity due to the war in Ukraine. Ethiopia, Kenya, Somalia, South Sudan, Sudan, and Yemen are among the countries receiving the aid. USAID will draw down the full balance of the Bill Emerson Humanitarian Trust to procure US food commodities for the emergency food operations in the six countries, while the USDA will provide $388 million in funding to cover food transportation and other associated costs.

Corporate/Sector News

Ping An calls for HSBC breakup

The largest insurer of UK-based bank HSBC, Chinese company Ping An, is pressuring the bank to split its Asian and Western operations. Ping An has told executives it was becoming increasingly difficult for the bank to balance between its Chinese and western interests as geopolitical tensions have grown. Additionally, it has argued that an independent institution listed in Hong Kong would be more profitable. According to sources familiar with the matter, Ping An has outlined a plan for the break-up of HSBC to the board.

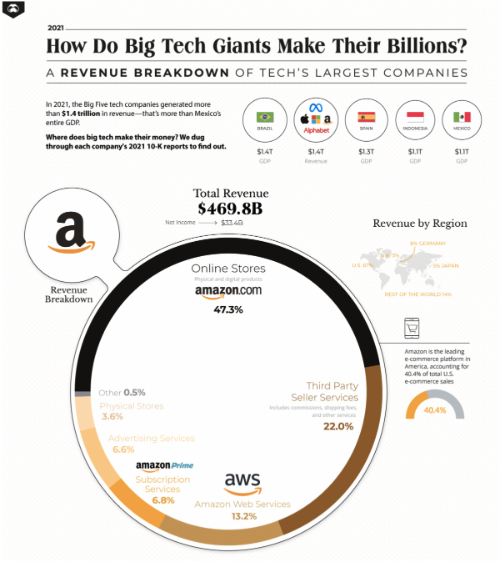

Amazon, Apple, and Alphabet report earnings misses

Traders were not impressed with earnings results from Amazon, Apple, and Alphabet this week. Amazon plummeted more than 14% on Friday, while Apple and Alphabet were down just over 3.5% at market close. Amazon reported its slowest revenue growth on record along with a $7.6 billion write-down of its stake in EV-company Rivian for Q1. Apple’s CFO announced supply chain issues could cost the company $4-8 billion, while CEO Tim Cook indicated that the company may not be able to completely recapture the demand lost by the pandemic lockdowns. Alphabet’s YouTube ad revenue fell short of expectations and the company reported a major slowdown in revenue growth as compared with revenue numbers in 2021.

Ford to scale up production of its electric pickup

Ford has plans to scale the production of its electric pickup truck, the F-150 Lightning, even faster than its competitors. In the next year, Ford aims to boost manufacturing of the vehicle to 150,000 units, which is more than triple its initial target of 40,000. The F-150 Lightning is also much cheaper than the competition, starting at $40,000 for the work version and $53,000 for the consumer pickup. The company has secured the lithium-ion batteries it needs to meet production levels for its EV and is prioritizing its supplies of semiconductor chips. The first deliveries of the pickup could happen in a matter of weeks.

Recommended Reads

Will the renminbi depreciation actually boost Chinese growth?

War in Ukraine is compounding Africa’s food crisis

This Eminent Scientist Says Climate Activists Need to Get Real

The Former Chancellor Who Became Putin’s Man in Germany

These Stocks Got Hot During the Pandemic. Now They’re Cooling.

Stocks Crumbled to Finish April. It’s the Worst Start to a Year in Decades.

This week from BlackSummit

Canceling the Noise; Not by Bread Alone Part VIII – John E. Charalambakis

Baffling Landscapes: Declining Markets, Ockham Razor’s, Putin, and Verdi’s Spy – John E. Charalambakis

The Day After & the Era of Transformation – The BlackSummit Team

Image of the Week