Global equities mixed

Global equities were a mixed bag this week. The Dow Jones closed 0.12% down while the S&P 500 and Nasdaq ended the week up 0.06% and 0.65% respectively. The yield on the US 10-year Treasury note dropped several basis points to 2.37%, and the spread between the US 2-year and 10-year rate inverted for the first time since 2019, potentially indicating a recession is on the horizon. The price of a barrel of West Texas Intermediate crude oil came down below $100, closing at $99.43 on Friday afternoon. Volatility, as measured by the CBOE Volatility Index, ended the week at 20.6.

Energy Crisis: Rubles, rationing, and reserves

G7 nations rejected Russian President Vladimir Putin’s demand that “unfriendly countries” pay for Russian gas exports with rubles, saying it would violate contract terms. Instead, the Kremlin has come up with a payment mechanism that will allow foreign buyers to convert their dollars and euros via Gazprombank, a non-sanctioned entity. The developments signal that gas will continue to flow as long as Russia is being paid and regardless of what currency is being used. However, it is relatively easy for Russia to turn off its gas flows to Europe. To prepare for a worst-case scenario such as this, Germany and Austria have already begun plans for rationing while the European Union (EU) has indicated it is preparing for all contingencies. Across the Atlantic, the White House announced it would release a million barrels of oil a day from strategic reserves for the next six months in an effort to bring down oil prices. Despite the war in Ukraine wreaking havoc on energy prices, OPEC+ refuses to be drawn into the crisis and has not changed production plans. Russia is a member of the OPEC+ group, and on Wednesday the UAE’s energy minister said “Always, Russia is going to be part of that group and we need to respect them.”

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 490,190,000 Global Covid-19 deaths: 6,172,000

US Confirmed Covid-19 cases: 81,800,000US Covid-19 deaths: 1,007,000

*As of Friday evening

Pfizer and Moderna get approval for second booster, Shanghai locks down

Pfizer and Moderna have received approval from the FDA for a second Covid-19 booster shot. So far, the booster has been approved for people aged 50 and older as well as for people aged 12 and older who are immunocompromised. Booster uptake in the US has been slower than expected but it is unsurprising given the rollback of pandemic restrictions and the decline in hospitalizations and case numbers. On the other hand, Shanghai, China’s largest city, declared a two-phase lockdown on Monday as China continues its zero-Covid strategy. The city will be shut down for nine days so that officials can carry out staggered checks on its millions of residents as the number of Covid-19 cases rises.

International Developments

Ukraine Updates: Peace talks continue, Russia shifts strategy

Peace talks between Ukraine and Russia continued this week with several face-to-face meetings in Istanbul, Turkey. Moscow has agreed to draw back its military activity near Kyiv and the northern city of Chernihiv, as well as open a humanitarian corridor in the southern port city of Mariupol. However, yesterday, the Red Cross attempted to carry out a large-scale evacuation of Mariupol, but its convoy could not reach the city after “conditions made it impossible to proceed”. Russian forces continue to block aid from reaching the city. Russia says the first phase of its “special military operation” in Ukraine is complete and that it would refocus on the breakaway eastern Donbas region. While US intelligence officials say it is difficult to determine if the change in strategy is genuine, Russian troops have begun to move from around Kyiv to other parts of Ukraine. Russian troops have also transferred control of the Chornobyl nuclear power plants back to Ukraine.

China-EU leaders hold summit

On Friday, leaders from China and the EU held their first summit in two years. The war in Ukraine weighed heavily on discussions. Prior to the meeting, EU officials warned China that its support of Russia in the conflict would jeopardize its relations with the bloc. During the summit, Chinese President Xi Jinping voiced his support for dialogue between Europe, Russia, the US, and NATO but he did not commit to adding pressure on Russia to stop Putin’s invasion of Ukraine. European Commission President Ursula von der Leyen said they held “clearly opposing views” on the Ukraine conflict and told the press that EU leaders “made it very clear that China should, if not support, at least not interfere with our sanctions.” China-EU relations were on the rocks before the war in Ukraine emerged. A draft China-EU investment deal reached in 2020 has been paused due to China’s repression of Uyghurs and other minority groups.

US Social & Political Developments

Biden lays out $5.79 trillion budget proposal

On Monday, President Biden announced a $5.79 trillion budget for the fiscal year starting on October 1st. Among the many programs and measures included in the proposal, are new taxes on the wealthy, increases to military spending, and new investments for domestic programs that address affordable housing and supply chain issues. The budget plan includes a 20% minimum tax rate for households worth more than $100 million (the top 0.01% of Americans) and a raise in the corporate tax rate from 21% to 28%. Climate and debt reduction are also two major themes of Biden’s proposal.

House passes legislation to cap insulin prices and legalize marijuana

12 House Republicans joined their Democratic colleagues to pass a bill that caps the price of insulin at either $35 a month or at 25% of an insurance plan’s negotiated price, whichever is lower. While the measure faces an uncertain future in the Senate, it is a major steppingstone in the Democrats’ fight to lower drug prices. Also this week, the House of Representatives passed a bill to federally decriminalize marijuana. Despite the announcement, cannabis stocks were in the red on Friday, erasing earlier gains. A similar piece of legislation was passed in 2020 but stalled in the Senate.

Corporate/Sector News

Tesla and GameStop seek stock splits

Just two years after dividing its stock in a 5-for-1 split, Tesla is seeking another stock split. While the company has not disclosed the ratio or timing, it is seeking board and shareholder approval for the action. Tesla’s share price ticked up 8% on Monday following the news. GameStop is also hopping on the stock split trend (Apple, Amazon, and Alphabet have made similar announcements recently). According to GameStop, the split would help “provide flexibility for future corporate needs”. Shares of the stock have soared recently amidst a new wave of meme trading.

White House invokes Defense Act to boost EV battery production

On Thursday, President Biden announced that the White House will invoke the Defense Production Act to boost the domestic production of electric vehicle batteries. The decision adds cobalt, nickel, lithium, graphite, and manganese to a list of commodities covered by the act. As a result, mining companies now have the ability to access $750 million in government funding for feasibility studies on projects that extract these precious materials.

Ford and GM to stop production at two Michigan plants

Due to parts shortages, Ford and General Motors (GM) will halt production at two plants in Michigan next week. Both companies have faced a myriad of supply chain issues over the last year, forcing them to pause production several times at various plants across the nation. The global semiconductor shortage continues to be one of the primary disruptors of production in the automobile industry, but other supply chain challenges also persist. While Ford’s decision was based on chip shortages, GM’s was not, but it provided no other details as to the reason for the production halt. Just last month, Ford warned that the ongoing chip shortage would lead to a significant decrease in vehicle volumes in the first quarter.

Recommended Reads

Winners and Losers in Putin’s War

The LNG Export Boom Is Draining U.S. Natural-Gas Supplies and Lifting Prices

War in Ukraine: what explains the calm in global stock markets?

How Bill Clinton Sealed Ukraine’s Fate

Germany and Austria plan for gas rationing over payment stand-off with Russia

Ethiopia Truce an Uncertain Prospect

Graphic: The Hard Truth About Latin America’s Education Crisis

This week from BlackSummit

Geopolitical Challenges and Statecraft

The BlackSummit Team

Deconstructing Declining Dividend Yields

Tyler Thompson

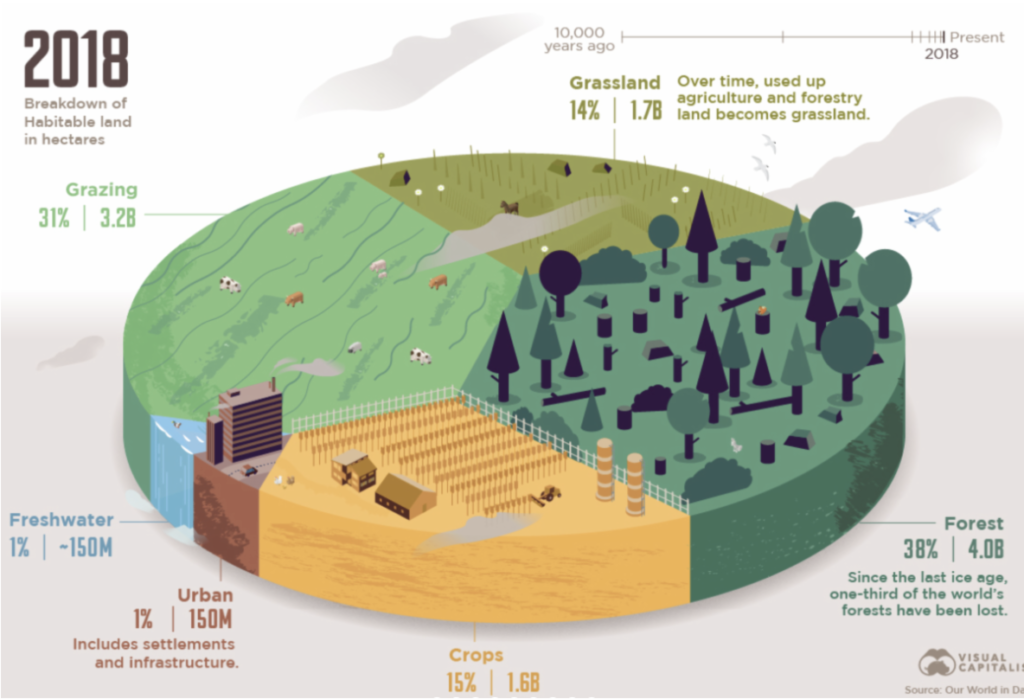

Image of the Week

Visualizing the World’s Loss of Forests Since the Ice-Age

Video of the Week

China’s Moon Dust Paves the Way for Future Mining Missions | WSJ

Source: Wall Street Journal