Global Market News

Global equities continue to fall

Global equities continued to fall this week as the Russian invasion of Ukraine intensified. The S&P 500 and Dow Jones closed the week down 1.27% and 1.30% respectively, while the Nasdaq dropped 1.76%. The yield on the US 10-year Treasury note closed the week unchanged at 2.78%. The price of a barrel of West Texas Intermediate crude oil rose a staggering 25.56% on the week, closing at $115 on Friday afternoon. Volatility, as measured by the CBOE Volatility Index, ended the week at 31.9.

Powell signals rate hike

During his Capitol Hill testimony this week, US Federal Reserve Chairman Jerome Powell signaled that he would most likely propose and support a 0.25% interest rate increase at the FOMC meeting on March 15th and 16th. However, he also indicated that the Fed would be prepared to raise rates more than 0.25% if inflation remains hot. Canada began tightening its policy on Wednesday as it raised its policy rate from 0.25% to 0.50%. Across the pond, rate hike expectations from the European Central Bank have changed given the crisis in Ukraine. As fears of slower economic growth due to high energy prices and Russian sanctions mount, markets have lowered expectations for multiple rate hikes this year.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 440,807,000 Global Covid-19 deaths: 5,978,000

US Confirmed Covid-19 cases: 78,428,000 US Covid-19 deaths: 947,625

*As of Friday evening

NYC lifts school mask mandate and indoor vaccination rule, Omicron surges in Hong Kong

While the Covid-19 pandemic has been largely overshadowed by news coverage of the war in Ukraine, there are a couple of notable developments. On Friday, the mayor of New York City lifted the school mask mandate as well as removed indoor vaccination rules after seeing a sharp decline in Covid-19 cases. Beginning on Monday, students older than the age of 5 will not have to wear masks in class and people in the city will no longer have to show proof of vaccination to visit the city’s restaurants, gyms, and other venues, however, masks are still required on public transit and in some Broadway venues. On the other hand, Hong Kong is experiencing a new wave of the virus, recording tens of thousands of cases a day. The outbreak is an ideal pretext for China to tighten its grip on the territory and eventually absorb it. This time mainland China is further blurring the lines of the “one country, two systems” framework through its health and civil services.

International Developments

West continues rolling out Russian sanctions as fighting in Ukraine escalates

Fighting between Russia and Ukraine has escalated over the week as Putin pushes his military farther into Ukraine. Yesterday, Russian forces took control of the Zaporizhzhia nuclear power station, the largest power plant in Europe. At the United Nations Security Council meeting following the seizure, Western diplomats condemned the attack as “reckless” and “dangerous”. However, Ukrainian forces are not backing down. Ukrainian President Volodymyr Zelensky has called Russian President Vladimir to the negotiating table for direct talks. Western sanctions have completely isolated Russia from the global financial system. This week, additional sanctions have frozen the foreign currency reserves held by Russia’s Central Bank and cut off seven Russian banks from SWIFT, the global communications system that facilitates global money transfer. Stock exchanges across the world have suspended trading and/or removed Russian securities from indices as markets remain volatile. The US, EU, and United Kingdom are also ramping up sanctions on Putin and his oligarchs.

Iran, U.S. days away from nuclear agreement

Senior diplomats from the US and Iran indicated on Thursday that they were closing in on an agreement to restore the 2015 nuclear deal. Weeks of intense negotiations involving the US, Iran, Britain, France, Germany, Russia, and China in Vienna are finally coming to an end. However, US and Iranian delegations caution that there is still at least one big issue that needs to be solved: sanctions. For months, Iran has demanded the US for more sanctions relief to restore the agreement. Most specifically, it wants the Islamic Revolutionary Guard Corps to be taken off Washington’s Foreign Terrorist Organization list. The US has pushed back against Iran’s demands but a restored nuclear deal would almost certainly include the lifting of sanctions on dozens of terrorist-listed people and entities. US and European diplomats have said that if an agreement is not finalized in the next few days, they will exit negotiations.

US Social & Political Developments

Jan. 6 committee finds enough evidence to criminally charge Trump

The House committee investigating the January 6th, 2021 Capitol riots says there is enough evidence for a criminal case against former President Donald Trump and some of his allies. The evidence collected demonstrates that Trump, conservative lawyer John Eastman, and others conspired to commit fraud and obstruction by misleading Americans about the 2020 election outcome and attempting to overturn the result. Given the evidence, Trump could potentially be charged with obstructing an official proceeding of Congress and conspiring to defraud the American people.

Biden announces new rules for Buy American Initiative

The Biden administration finalized a new rule as part of the Buy American Initiative to boost US manufacturing. On Friday, President Joe Biden announced that by 2029, any goods that the federal government purchases with taxpayer money must contain 75% US-made content. When the rule was first announced in July 2021, the requirement was only 55%. During his announcement, President Biden also praised Siemens USA for its $54 million investment in the expansion of its domestic manufacturing of electrical equipment which is expected to create more than 300 jobs.

Corporate/Sector News

Sony to enter EV industry

The latest company to enter the EV industry is Sony. The company announced it is partnering with Honda Motor to develop and sell battery electric vehicles. The joint venture is expected to be established later this year and aims to begin selling its first vehicle in 2025. Honda will be responsible for manufacturing the vehicle while Sony will develop the mobility service platform for the new company. In other EV industry news, Ford is restructuring to create a distinct electric vehicle business, Chinese tech giants Baidu and Xiaomi have recently formed electric vehicle divisions, and rumors continue swirling about self-driving cars from Apple.

Companies across the globe cut ties with Russia

The list of companies cutting ties with Russia is growing longer and longer by the day. Most notably, major oil companies Shell, ExxonMobil, Equinor, and BP, among others, are walking away from Russia as its invasion of Ukraine ramps up. Major companies in other industries are also joining the mass exodus from Russia, including Boeing, Disney, Apple, and Ford. Media giants Facebook and YouTube have blocked access to Russian news outlets, while Twitter announced that any link shared by a user to a Russian state media organization’s website will automatically receive a label warning. Operating in Russia has become increasingly problematic and costly as the West doubles down on economic sanctions.

OPEC+ doesn’t raise output despite soaring oil prices

At a meeting on Wednesday, OPEC+ decided to stick to its original output plan for April despite the crisis in Ukraine causing major oil price increases. Oil prices soared above $110 a barrel this week, with WTI crude touching $116 per barrel on Thursday, as Western sanctions tightened on Moscow and disrupted oil sales from Russia, the world’s second-largest oil exporter. OPEC+ snubbed calls from the US and other major consumers to increase oil production to bring down the skyrocketing prices. On the other hand, the US and other members of the International Energy Agency agreed to release 60 million barrels from the Strategic Petroleum Reserve and other emergency stocks.

Recommended Reads

Four ways the war in Ukraine might end

Russian Stocks Are Nearly Worthless as Ukraine Sanctions Bite

Ivan Ilyin, Putin’s Philosopher of Russian Fascism

BP and Shell Are Leaving Russia. These Other Oil Companies Could Face Pressure Next.

Why Vladimir Putin has already lost this war

Russia’s Invasion of Ukraine Is Driving Up Grain Prices

Jan. 6 Committee Lays Out Potential Criminal Charges Against Trump

The best bet for the 2020s is short tech, long commodities

This week from BlackSummit

The Wooden Nickel – The BlackSummit Team

A Discussion about Crimea and Russia in St. Petersburg: The Eagles’ Echoes – John E. Charalambakis

Geopolitical Challenges and Statecraft – The BlackSummit Team

Canceling the Noise; Not by Bread Alone – Part III – John E. Charalambakis

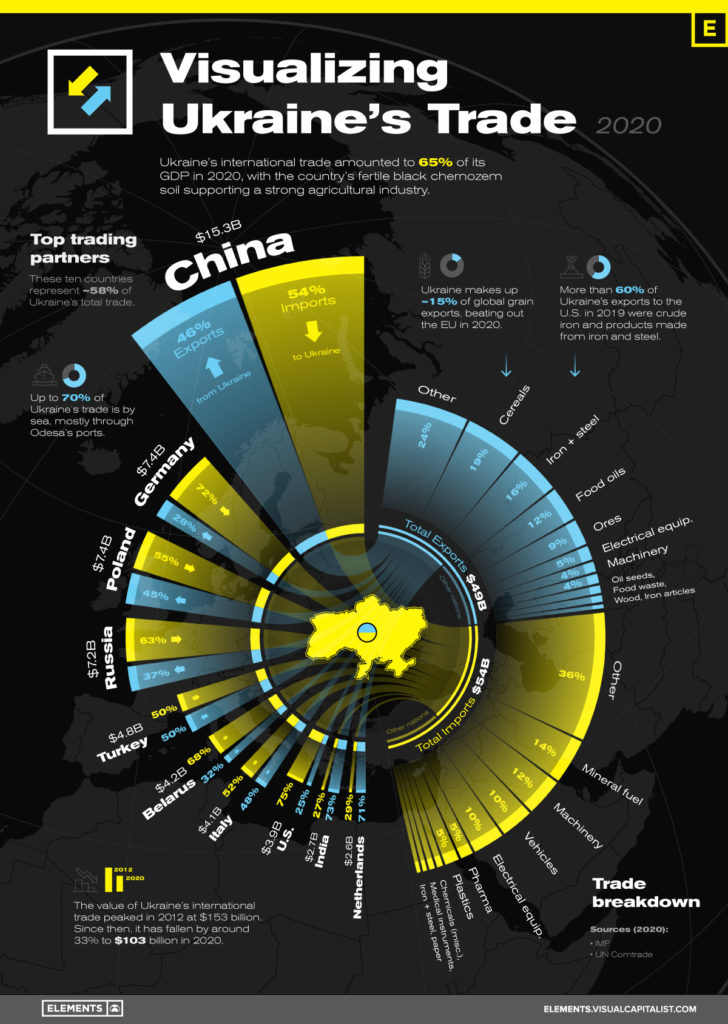

Image of the Week

Video of the Week

Ukraine Nuclear Power Plant Fire Extinguished as Russia Continues Attacks | WSJ

Source: The Wall Street Journal