Global Market News

Global equities make gains

Global equities advanced this week, marking the first time that markets have seen a consecutive week of gains in 2022. The S&P 500 and Dow Jones closed the week up 1.79% and 0.31% respectively, while the Nasdaq rose 1.98%. The yield on the US 10-year Treasury note ticked up to 2.48%, its highest level since May 2019. Oil surged again this week; the price of a barrel of West Texas Intermediate crude oil increased 7.78%, closing at $112.85 on Friday afternoon. Volatility, as measured by the CBOE Volatility Index, decreased to 20.8.

The end of globalization as we know it?

The era of globalization characterized by free trade agreements and the interconnectedness of national economies is being upended by protectionist trade policies. The economic consequences and supply chain pressures the world has seen because of trade wars, pandemic restrictions, and now, the war in Ukraine, is turning nations away from complex multinational supply chains. Though this shift may insulate countries from international crises and decrease the influence other powers have on them, “with less economic interconnectedness, the world will see lower trend growth and less innovation”, Adam Posen, President of the Peterson Institute says.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 480,000,000 Global Covid-19 deaths: 6,143,000

US Confirmed Covid-19 cases: 79,700,000 US Covid-19 deaths: 973,000

*As of Friday evening

Airlines urge government to drop mask mandates, global Omicron BA.2 variant cases rise

Mask mandates have been dropped across all 50 US states and many testing sites are beginning to shut down as the country attempts to end the Covid-19 pandemic chapter. In a letter to President Biden, the CEOs of major airline companies including American Airlines, Delta, Southwest, and United, urged the government to drop the federal mask mandate on airplanes as well as the pre-departure testing requirements for international travelers, calling the regulations “now-outdated”. While the number of new Covid-19 infections in the US is at its lowest level since July of last year, Dr. Anthony Fauci, the government’s top infectious disease expert, is warning that the US could experience an uptick in cases, similar to that happening in Europe right now, due to the Omicron BA.2 subvariant. However, he did add that he does not think the subvariant will create another “surge”.

International Developments

Western leaders meet to coordinate action against Russia

Leaders of the European Union (EU), Group of Seven (G7), and North Atlantic Treaty Organization (NATO) met in Brussels on Thursday to discuss further responses to Russia’s invasion of Ukraine as the conflict enters its second month. US President Joe Biden traveled to Europe for the summits and to meet with US soldiers and Ukrainian refugees in Poland. While in Brussels, the US and EU announced a natural gas deal that aims to cut Europe’s reliance on Russian gas. Under the agreement, the US has committed to help guarantee at least 15 billion cubic meters of additional natural gas supplies for Europe by the end of this year. On the other side, Vladimir Putin has ordered Russia’s central bank to come up with a way to require “unfriendly” European countries to pay for Russian gas using rubles. This, if possible, would effectively prop up Russia’s currency. Also this week, President Biden has called for Russia to be expelled from the G20 and has warned Putin that NATO would respond “in kind” if Russia used nuclear weapons against Ukraine.

Saudi Aramco oil facility attacked by Houthis rebels

Saudi Aramco’s oil depot in the city of Jeddah went up in flames yesterday after Yemen’s Iran-backed Houthi rebels launched a series of attacks targeting the kingdom. The attack on Friday seemed to be focused on the same fuel depot the Houthis attacked in recent days. Houthi military spokesperson Yahya Sarea said the attacks targeted the Aramco facilities in Jeddah, Jizan, Najran, Ras Tanura, and Rabign, as well as vital facilities in Saudi Arabia’s capital city, Riyadh. Saudi Arabia has battled the Houthis in the Yemen war since 2015. The incident comes at a time when oil markets and global supplies are strained due to the loss of substantial Russian crude volumes. Repeated attacks on Saudi Arabia’s oil facilities risk a reduction in Saudi crude and refined products, which could exacerbate global oil supply issues when Western leaders are calling for the Saudis to ramp up production.

US Social & Political Developments

US to remove tariffs on UK aluminum and steel

The US has agreed to remove the Trump-era steel and aluminum tariffs on the United Kingdom (UK). In response, the UK will suspend the retaliatory tariffs on various US products which had affected nearly $500 million worth in annual trade. The tariff will be rolled back beginning on June 1st. The tariff removal is yet another step in the Biden administration’s efforts to repair relationships with allies.

Blinken begins MENA tour

US Secretary of State Antony Blinken begins his tour through the Middle East and North Africa (MENA) this weekend. Over the next week, Blinken will meet with leaders in Israel, the West Bank, Morocco, and Algeria. According to the State Department, he is expected to discuss the war in Ukraine, Israel-Palestinian relations, and Iran’s “destabilizing” activities in the region with regional allies.

Corporate/Sector News

Fertilizer stocks spike amid food concerns

The share prices of fertilizer companies are spiking as wheat and corn futures continue to surge. The top three US-listed fertilizer producers have grown by staggering amounts this year: Mosaic is up 80% in the last three months, CF Industries almost 50%, and Nutrien 44%. As farmers in the Northern Hemisphere are preparing for spring planting, fertilizer shortages are causing some major issues. Without adequate fertilizer, crop yields could be significantly reduced. Shortages of critical fertilizer ingredients, like nitrogen, phosphate, and potash, continue and prices of these ingredients are up 30% year-to-date. Exacerbating the problem is the Russia-Ukraine crisis. In 2021, Russia was the world’s top exporter of nitrogen fertilizers and the second-largest supplier of potassic and phosphorous fertilizers, according to the UN Food and Agriculture Organization.

Uber to list NYC taxis on its app

Uber will be partnering with NYC’s iconic yellow cabs to begin listing the 14,000-taxi fleet on its app. The announcement marks an “industry truce” between the most famous taxi group and the company that was formed to completely disrupt the ride-hailing industry. The yellow cabs will be integrating their technological system with Uber so that customers can hail taxi rides through the Uber app. It is Uber’s plan that passengers will be charged the same rates for taxi bookings as they charge for UberX options. Like Uber drivers, the yellow taxi drivers will be able to see how much they can expect to earn before accepting a ride request.

KoBold Metals to begin drilling for critical minerals in Greenland

KoBold Metals, a mineral exploration company backed by billionaires Jeff Bezos and Bill Gates, is set to being drilling in Greenland. The company uses artificial intelligence and machine learning to search for raw materials critical to the production of electric vehicles. KoBold acquired a 51% stake in the Disko-Nuussuaq project on the country’s west coast last year. The project is operated by a London group named Bluejay Mining. Bluejay’s CEO said “The objective is to target massive nickel, copper, cobalt and platinum group metals…The recent unfortunate geopolitical developments clearly show that the Western world needs new deposits of these critical metals.”

Recommended Reads

Top oil trades warn prices could breach $200 a barrel

The World’s Deadliest War Isn’t in Ukraine, But in Ethiopia

Heatwaves at both of Earth’s poles alarm climate scientists

China’s Information Dark Age Could Be Russia’s Future

Putin’s War on Ukraine Is About Ethnicity and Empire

The Global South’s Looming Debt Crisis—and How to Stop It

Who are the Russian oligarchs?

This week from BlackSummit

Erratic Markets in the Garden of Opis: The Linear and Non-Linear Interpretation, Part I – John Charalambakis

The Day After & the Era of Transformation – The BlackSummit Team

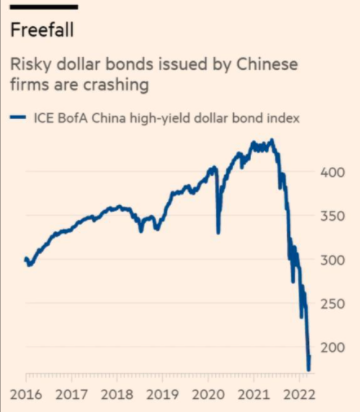

Image of the Week

Video of the Week

They sequester CO2, mop up pollution and have double the protein content of meat.

Source: World Economic Forum