Global Market News

Global equities make gains

Global equities regained ground this week as Omnicron fears toned down. The S&P 500 and Dow Jones closed the week up 3.82% and 4.02%, respectively, while the Nasdaq rose 3.61%. The yield on the US 10-year Treasury note decreased slightly to 1.49%, and the price of a barrel of West Texas Intermediate crude oil began creeping back up, ending the week at $72.02. Volatility, as measured by the CBOE Volatility Index, came down over the week to 18.7.

Inflation continues to climb

According to November data from the consumer price index, inflation in the US surged 6.8% from a year ago. This is the fastest pace of inflation in 39 years and is also the sixth month in a row that consumer prices have risen more than 5%. Surging prices in food, energy, and housing accounted for much of the increase. Food prices have risen more than 6% this year, while energy prices have jumped more than 33% since November 2020.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 269,000,000 Global Covid-19 deaths: 5,290,000

US Confirmed Covid-19 cases: 49,700,000 US Covid-19 deaths: 794,000

*As of Friday evening

NYC mandates vaccines, Omnicron variant apparently less severe

New York City (NYC) has become the first US city to mandate vaccines for private-sector workers. NYC Mayor Bill de Blasio said the mandate would be effective beginning December 27th and called it a “preemptive strike” to prevent another surge in Covid-19 cases. Meanwhile, multiple reports came out this week saying the Covid-19 Omnicron variant is very contagious but not as severe or as dangerous as other variants, including the Delta strain. In South Africa, there has been a surge in case numbers but no significant jump in hospitalizations or deaths.

International Developments

US tries to ease Russian-Ukrainian tensions

In an effort to ease tensions between Russia and Ukraine, US President Joe Biden held separate phone calls with Ukrainian President Volodymyr Zelensky and other Eastern European leaders. Russia has built up its troops on the country’s shared border with Ukraine in recent weeks, sparking fears of a Russian attack on Ukraine. The US, as well as several leading NATO members, have pledged their support to Ukraine. On their phone call, Biden reassured Zelensky of this and reiterated that the US and its allies would impose economic sanctions on Russia and increase defensive aid to Ukraine and NATO allies nearest to Russia in the event of an invasion.

Biden hosts summit for democracy

As pledged, President Biden held a two-day Summit for Democracy this week to bring together countries to discuss “the challenges and opportunities facing democratic governments.” At the event, leaders discussed a wide range of issues from protecting press freedoms to countering corruption. However, the Biden administration has received quite a bit of criticism for the summit. Many critics claim that the US is not in a position to preach democracy as it is facing a democratic backsliding itself, while others say the invite list was inconsistent. China and Russia were not invited to the event, a move that their ambassadors called “a product of Cold War thinking.”

US Social & Political Developments

Republicans pave the way for Democrats to raise the debt ceiling

Ten Republican senators voted for a bill that would allow Democrats to raise the debt ceiling by a simple majority vote instead of a two-thirds majority. The bill allows for a one-time suspension of the Senate rule requiring 60 votes to pass legislation to raise the debt limit, but it requires that Democrats raise the debt limit by a specified amount instead of just suspending it. Once the bill is signed by President Biden, Democrats in both chambers of Congress will need to pass a second bill to actually raise the debt limit.

House Passes $768 billion defense bill

The House of Representatives passed a $768 billion defense policy bill this week. The bill includes measures for the procurement of new aircraft and ships and incorporates significant increases for initiatives intended to counter China and strengthen Ukraine. The bill also includes a measure that gets rid of the authority for military commanders to prosecute sexual assault cases and excludes a repeal of the 2002 authorization for the Iraq war. The legislation is expected to easily pass through the Senate in the coming weeks, underscoring the bipartisan consensus that the government should continue spending large amounts of money on defense initiatives.

Corporate/Sector News

Fitch declares Evergrande “in default”

Fitch Ratings has become the first to declare Chinese developer Evergrande “in default.” The heavily indebted company failed to make $82.5 million in coupon payments by Monday, the ending date of the grace period. Fitch’s downgrade triggers fears that the company will also default on the $19.2 billion it owes across international bond markets and raises concern on the impact Evergrande’s default will have on China’s $5 trillion property sector. To subdue fears of domestic financial instability, China’s central bank has freed up $188 billion of liquidity for the banking system and has pledged to have flexible monetary policy in 2022.

AWS outage causes major complications

Amazon Web Services (AWS) went down for several hours on Tuesday, causing major complications across the US across. While the outage primarily affected the “US-East-1” region hosted by Northern Virginia, it spanned several major cities including Boston, Chicago, and Houston. Many warehouses and delivery workers could not scan packages or access delivery routes, Ring devices went offline, and many popular websites and streaming services, including Robinhood, McDonald’s, Delta, Netflix, and Disney+ had major complications. Amazon has not revealed the exact cause of the outage. While Amazon’s stock price was unaffected by the event, it has brought AWS customers to the edge of their seats, nervous that such outages could become more common.

China drawing up a blacklist as its tech crackdown continues

China is reportedly drawing up a blacklist that will make it harder for domestic technology companies to receive foreign funding and be listed on exchanges abroad. This is a clear continuation of China’s crackdown on its tech sector which began in November of last year when it forced Jack Ma’s Ant Group was forced to cancel what would have been the world’s largest IPO. The blacklist is expected to include startups that use a so-called variable interest entity structure (VIEs). These VIEs have been used by Chinese tech groups, like Alibaba and Tencent, to get around foreign investment restrictions and raise funds internationally.

Recommended Reads

Dollar Strength Gives Wall Street Something New to Worry About

Who ordered the Uyghur genocide? Look no further than China’s leader.

Erdogan’s Obsession With Low Interest Rates Could Be His Downfall

Fighting Inflation Without Getting Carried Away

Investors can no longer ignore China-US decoupling threat

The Drums of War in Taiwan and Ukraine

This week from BlackSummit

Thinking about the Markets’ Paedagogus: Maxwell’s Demon and Hermas Contemplate the 2022 Trajectory – John E. Charalambakis

Crossroads: At the Intersection of Geopolitics and Geoeconomics – Rachel Poole

Geopolitical Challenges & Statecraft – Rachel Poole & Tyler Thompson

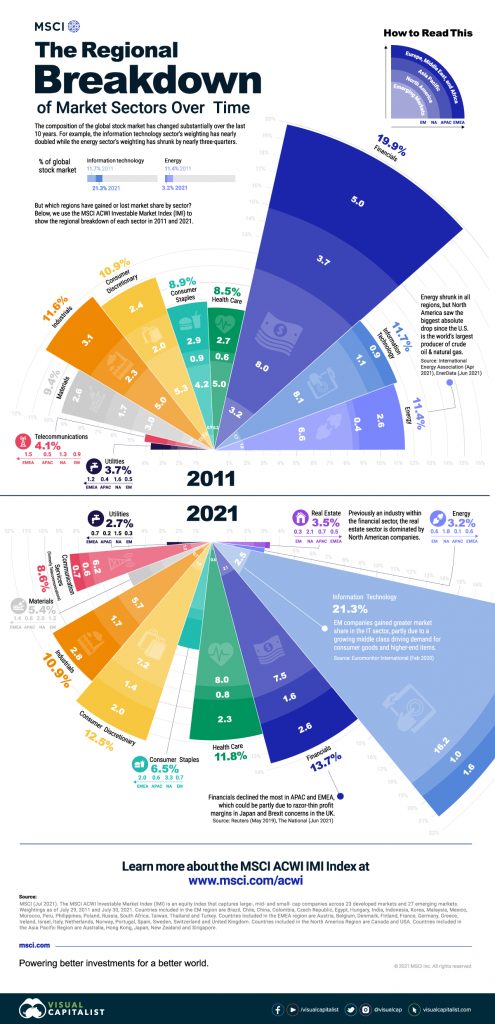

Image of the Week

Video of the Week

The power of the seas: Energy for the future?

Source: DW News