Global Market News

Global equities down on the week

Global equities were slightly down on the week. The S&P 500 and Dow Jones dropped 0.57% and 0.07%, respectively, while the Nasdaq closed the week down 0.47%. Meanwhile, the yield on the US 10-year Treasury rose a few basis points to 1.37% and the price of a barrel of West Texas Intermediate crude oil jumped up more than 3% to $72.00. Volatility, as measured by the CBOE Volatility Index, closed the week at 20.6.

US retail sales exceed expectations, China’s growth slows

In a surprise to economists who predicted a sharp decline in August retail sales, data shows a rise in sales of 0.7%. If you remove auto sales from the equation, which have struggled due to global semiconductor shortages, sales rose 1.8%. In another positive sign for economic growth, US consumer prices leveled off in August, coming down from July highs. On the other hand, economic data out of China show a slowdown. August retail sales and industrial production missed estimates and dropped down from July’s pace as port closures and continued Covid-19 restrictions have constrained economic activity.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 219,000,000 Global Covid-19 deaths: 4,550,000

US Confirmed Covid-19 cases: 41,900,000 US Covid-19 deaths: 671,000

*As of Friday evening

FDA panel votes against Pfizer’s booster shot application

On Friday afternoon, the FDA voted overwhelmingly to reject Pfizer’s application to offer a third shot of its Covid-19 vaccine. The panel voted 16-2 against the booster shot for everyone age 16 or older, with many members citing potential safety risks for younger recipients, but indicated it was open to authorizing boosters for a narrower, older population. The rejection is a big blow to the Biden administration which had announced plans for a wide-ran

International Developments

US and UK pledge to help Australia acquire nuclear-powered submarines

The US, UK, and Australia jointly announced a partnership to help Canberra build a fleet of nuclear-powered submarines. The alliance, called AUKUS, will boost Australia’s military capabilities in the Indo-Pacific and allow it to acquire other advanced technologies. China criticized the deal, calling for the countries to “shake off their Cold War mentality.” France, which had been in talks with Australia about submarines, canceled a planned gala in Washington and recalled its ambassadors to the US and Australia in response to the deal.

China applies to join Pacific trade partnership

Ironically, China has applied to join the trade partnership that was originally promoted as a way to counter it. China has filed to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). However, it seems unlikely that China is admitted to the group as tensions with group member Australia have risen in recent months, and the group requires unanimous consent to add a new member. Former US President Barack Obama, one of the original designers of the trade partnership, sought to use the pact to limit Beijing’s growing economic and political influence in the region, but President Donald Trump formally withdrew the US from the agreement in 2017.

US Social & Political Developments

House Democrats propose tax hikes

House Democrats outlined their plan to raise revenues to fund the social and climate spending plans making their way through Congress right now. If approved, the proposal would raise the corporate income tax to 26.5% from 21%, impose a 3% surtax on those who earn more than $5 million a year, and raise the capital gains tax to at least 25%, up from 20%. Analysts predict these new tax measures would increase taxes on households earning more than $1 million by 10.6%. The tax hikes could face a tough road through the Senate as Democratic moderates Kyrsten Sinema and Joe Manchin have expressed opposition to the proposal.

Biden hosts climate meeting on methane emissions

President Biden hosted world leaders for a virtual meeting to urge countries to cut methane emissions. The US and Europe have pledged to work to cut global methane emissions by a third by the end of the decade and is encouraging others to do the same. Leaders of Argentina, Australia, Bangladesh, Indonesia, Italy, Japan, South Korea, Mexico, the UK, and leaders from the United Nations and the European Commission participated in the event, as well as a few other lower-level officials from China, Germany, Russia, and India. Methane emissions have been rising for several decades, and recent climate reports have indicated that one of the most effective ways to slow climate change would be to reduce methane emissions. The virtual meeting comes less than two months ahead of the United Nations climate change summit in Glasgow where nations are expected to announce more ambitious climate efforts.

Corporate/Sector News

Bank of America releases report on 14 “radical technologies”

Bank of America Global Research released a research report this week identifying 14 “radical technologies that could change our lives and accelerate the impact of global megatrends.” Included in the list is 6G networks, emotional artificial intelligence, wireless electricity, OceanTech, green mining, and carbon capture/storage. The 14 technologies reviewed in the report have a $330 billion market size today and are predicted to grow to $6.4 trillion by the 2030s.

Invesco in merger talks with State Street

Invesco Ltd. is in talks to merge with State Street Corp.’s asset-management business, State Street Global Advisors. State Street’s asset-management team manages about $4 trillion in assets, making this potential deal one of the largest in the industry’s recent history. Invesco manages $1.5 trillion in assets and has a large exchange-traded funds (ETF) business, which closely aligns with State Street’s status as a leading seller of ETFs. News of the talks sent Invesco shares up 8% in after-hours trading on Thursday while State Street shares rose more than 1%.

Senate demands cryptocurrency regulation

Appearing before the Senate Banking Committee on Tuesday, SEC Chairman Gary Gensler assured lawmakers that the SEC is working hard to create a set of rules to oversee cryptocurrencies. Lawmakers in Washington have become increasingly frustrated at the lack of supervision in crypto markets and the length of time it has taken to support them. As pressure from the Senate has increased, Gensler has become more vocal about regulation, calling the crypto markets “the Wild West”. However, he reiterated to the committee the enormity of the task which requires the evaluation of 6,000 novel digital projects to determine if they qualify as securities under US law. At the hearing, Gensler called for more funding for the regulatory agency so that it could be more effective at managing the $2 trillion digital currency market.

Recommended Reads

What the Semiconductor Shortage Has to Do With Corporate Bonds

EXCLUSIVE U.S., EU pursuing global deal to slash planet-warming methane -documents

Seven Possible Causes of the Next Financial Crisis

The Chinese control revolution: the Maoist echoes of Xi’s power play

The Biden doctrine: the US hunts for a new place in the world

Analysis Shows Facebook Allows 99% of Climate Disinformation to Go Unchecked

This week from BlackSummit

When Leo Caprivi Replaced Otto von Bismarck: Bellicose Transitions, Pivots, and the Markets – John E. Charalambakis

Geopolitical Challenges and Statecraft – Rachel Poole & Tyler Thompson

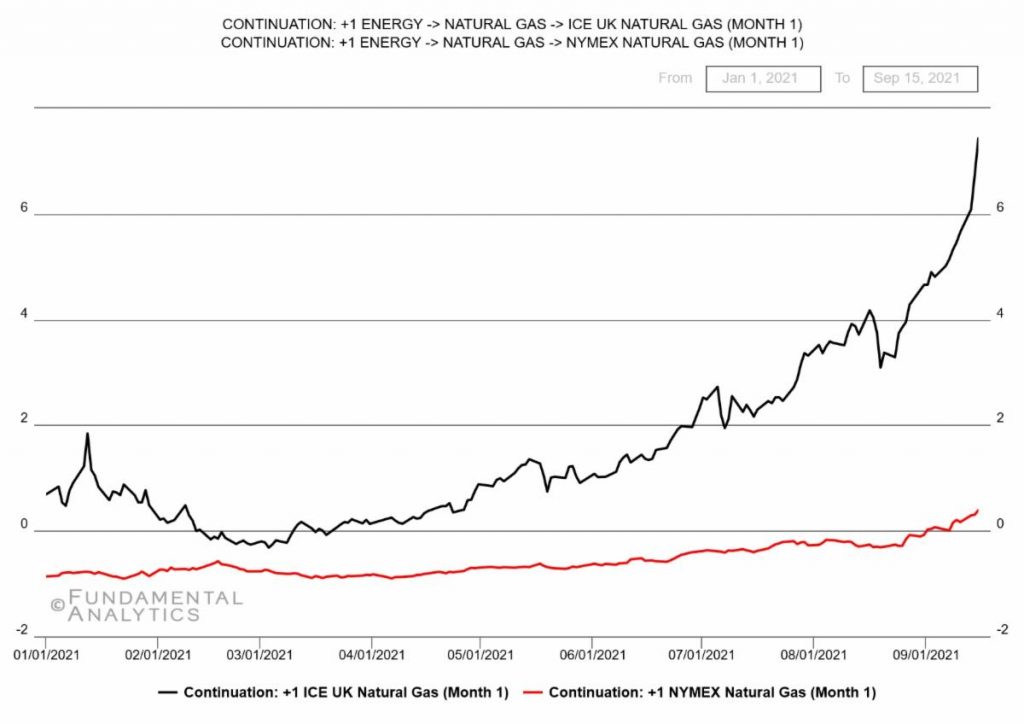

Image of the Week

Video of the Week

‘Chess in Slums’ gets Nigerian kids playing for keeps

Source: DW News