Global Market News

Global equities narrowly gain

Global equities narrowly gained after a volatile week. The S&P 500 and Dow Jones increased 0.51% and 0.62%, respectively, while the Nasdaq closed the week up only 0.02%. The yield on the US 10-year Treasury soared to 1.45% after ending last Friday at 1.37% while the price of a barrel of West Texas Intermediate crude oil jumped up more than 8% to $73.99. Volatility, as measured by the CBOE Volatility Index, reached a high of 28.8 this week but fell back down to 17.7 by market close on Friday.

Fed signals rate increases could come sooner than expected

At its September meeting, the Federal Reserve bumped up the timeline on rate hikes, cut back the economic outlook for this year, and indicated it will start tapering asset purchases soon. New economic projections from the Federal Open Market Committee (FOMC) see the first rate hike happening as early as 2022 if inflation continues to rise. Estimated core inflation numbers for 2021 increased from a previous forecast of 3% to a new estimate of 3.7%. Inflation will likely be the Fed’s determining factor for rate increases. While the Fed did not specify when it would begin tapering asset purchases, tapering is expected to end around mid-2022 which means it is likely to begin before the end of the year. Additionally, FOMC members have pulled back their growth estimates and now forecast a 5.9% rise in GDP for this year instead of a 7% increase as forecasted in June.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 219,000,000 Global Covid-19 deaths: 4,550,000

US Confirmed Covid-19 cases: 42,700,000 US Covid-19 deaths: 685,000

*As of Friday evening

FDA approves boosters for some adults, US ends travel bans

The FDA granted Pfizer/BioNTech emergency use authorization for its booster dose of the Covid-19 vaccine for adults 65 years of age and older, people who work in healthcare settings, and for adults in high-risk categories. Also this week, the US announced it will allow air travel by vaccinated travelers beginning in November, effectively ending the pandemic travel bans that have sparked tensions with some international allies.

International Developments

World leaders convene at UN General Assembly

Speeches by world leaders kicked off on Tuesday at the United Nations General Assembly in New York City. Much of the conversation centered around boosting Covid-19 vaccination rates worldwide and fighting climate change. Several leaders, like Peruvian President Pedro Castillo and Turkish President Recep Tayyip Erdogan, made new climate pledges, as did Beijing which said it would cease financing coal-fired power plants abroad. US President Joe Biden said the US would double its green funding to developing countries and was taking steps to help the world vaccinate 70% of the global population by September 2022. In the wake of tensions over Australia’s submarine deal with the US and UK, French President Emmanuel Macron did not attend and sent his foreign minister in his place.

Germany to hold elections on Sunday

Germany will hold much-anticipated parliamentary elections on Sunday to select a successor to Chancellor Angela Merkel who has led Germany for the last 16 years. In recent weeks, Merkel’s party, the conservative Christian Democratic Union (CDU) has lost significant ground in the polls, giving the center-left Social Democratic Party (SPD) a lead for the first time in 15 years. Whatever party wins the election will have to form a coalition government to secure enough seats in parliament and choose the next chancellor.

US Social & Political Developments

Quad meets in Washington for first in-person meeting

The US hosted its co-members of the Quadrilateral Security Dialogue – India, Australia, and Japan – for the group’s first in-person meeting. In addition to collaboration on security issues, Covid-19 vaccines, and infrastructure and technological cooperation were on the agenda. The summit was a clear signal to China of the four countries’ united front against Chinese aggression in the Indo-Pacific region. US President Biden will also hold bilateral talks with Indian Prime Minister Narendra Modi and Japanese Prime Minister Yoshihide Suga.

Deportation of Haitian migrants sparks controversy

This week, US authorities began flying hundreds of Haitian migrants out of a Texas border town and back to Haiti, sparking controversy over the Biden administration’s handling of “Trump-era” immigration policies. 13,000 refugees, primarily from Haiti but also from Cuba and a few South American countries, have gathered under a bridge connecting Del Rio in Texas to Mexico’s Cuidad Acuña. Title 42, a public health order, allows US authorities to deport most migrants before they can claim asylum. The US special envoy to Haiti resigned in protest of the deportations.

Corporate/Sector News

Evergrande misses payment

Chinese property developer Evergrande created market turmoil this week as it announced it would likely default on its debt payments. Evergrande is the world’s most indebted developer with liabilities of $300 billion. The company was due to pay $83 million in interest payments on Thursday for a $2 billion bond that is set to mature in March. As of Friday, Evergrande had not yet made a payment, but the developer has 30 days to make the payment before it technically defaults. Chinese authorities have signaled that it will only step in at the last minute to prevent spillover effects of Evergrande’s demise, otherwise, it does not plan to bail out the company. Some analysts fear the company’s crisis could send shockwaves through the Chinese economy as real estate and related industries make up 30% of the country’s GDP. Evergrande, listed in Hong Kong and based in Shenzhen, is one of China’s largest real estate developers, employs nearly 200,000 people, and helps sustain more than 3.8 million jobs each year.

China’s crackdown on cryptos

Cryptocurrencies plummeted on Friday after the People’s Bank of China banned all cryptocurrency-related activities. The central bank said services offering trading, order matching, token issuance, and derivatives for digital currencies are prohibited. It also said the use of foreign crypto exchanges is illegal and issued a nationwide ban on cryptocurrency mining. The crackdown comes as the People’s Bank of China has been testing its own digital currency.

Conoco Phillips to purchase Shell’s Permian Basin Assets

ConocoPhillips will purchase Shell’s assets in the Permian Basin for $9.5 billion, making it the second-largest oil and gas producer in the lower 48 states of the US. The purchase will add an estimated 200,000 barrels of oil to the company’s daily output. The increased production levels will propel Conoco past competitors like Chevron and Occidental Petroleum and bring it right behind Exxon Mobil which is expected to produce about 1 million barrels per day from the lower 48 states this year.

Recommended Reads

How Beijing’s Debt Clampdown Shook the Foundation of a Real-Estate Colossus

Robert Nisbet’s Degradation of the Academic Dogma at 50

Supply chain issues add to stagflationary winds

‘Diesel vs doughnuts’: new biofuel refineries stir up US food industry

Inflation splits emerging countries in doves and hawks

This week from BlackSummit

Flawed Assumptions – Joel Charalambakis

The Day After & the Era of Transformation – Rachel Poole & Tyler Thompson

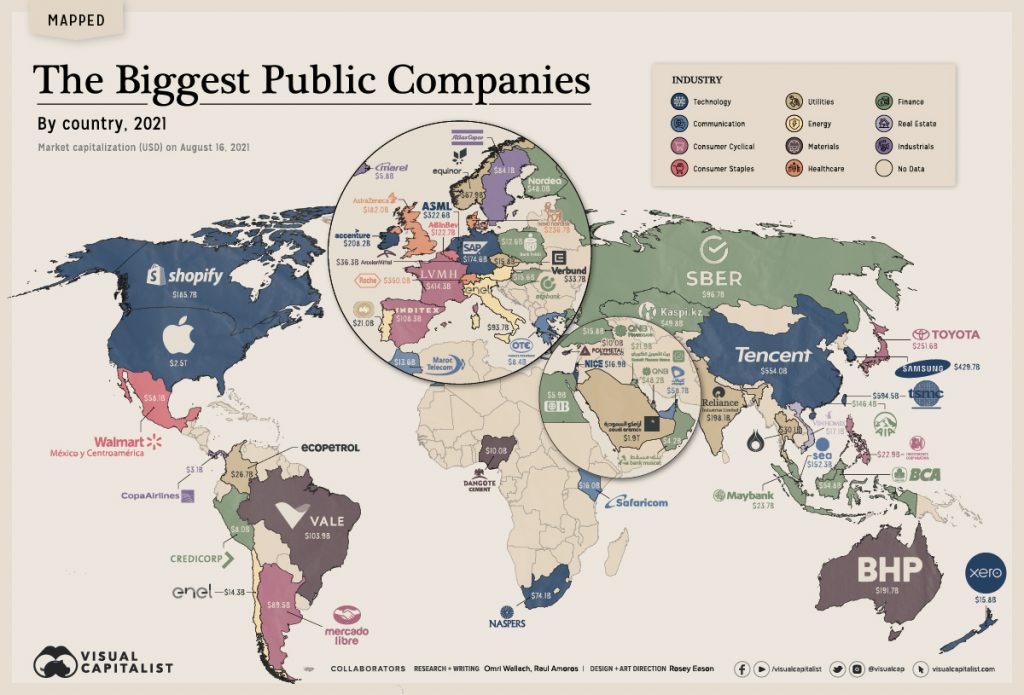

Image of the Week

Video of the Week

Is now a good time to open a new restaurant?

Source: Financial Times