Global Market News

Global equities down on the week

Global equities lost ground this week. The S&P 500 and Dow Jones dropped 1.69% and 2.15%, respectively, while the Nasdaq closed the week down 1.61%. The yield on the US 10-year Treasury increased slightly to 1.34%. and the price of a barrel of West Texas Intermediate crude oil remained relatively unchanged at $69.58 amid lingering supply disruptions from Hurricane Ida. Volatility, as measured by the CBOE Volatility Index, increased from 16.3 last week to 20.9.

Central banks prepare to taper

The US Federal Reserve is reportedly planning to begin tapering its bond-buying program in November, according to the Wall Street Journal. Federal Reserve officials may use the upcoming meeting in September to announce the plan to begin reducing purchases. On Wednesday, New York Fed President John Williams reiterated the comments from Fed Chairman Jerome Powell’s July speech that it could be appropriate to start reducing monthly asset purchases this year so that the central bank meets its goal of concluding asset buying by mid-2022. The European Central Bank (ECB) announced this week that it would slow its pace of asset purchases starting in the fourth quarter of this year

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 219,000,000 Global Covid-19 deaths: 4,550,000

US Confirmed Covid-19 cases: 40,800,000 US Covid-19 deaths: 658,000

*As of Friday evening

COVAX falls short of vaccine target

The United Nations-backed global Covid-19 vaccine program, COVAX, said it will not be able to meet its original delivery target. By the end of the year, the program will only deliver 1.4 billion doses of the 1.9 billion goal largely due to manufacturing constrictions. World Health Organization Director General Tedros Adhanom Ghebreyesus has called for a global moratorium on booster shots until the end of the year so that all countries can get their vaccination levels to 40% of their populations. Low- and lower-middle-income countries are struggling to acquire enough vaccines to inoculate their populations. While 81 percent of shots administered globally have been in high- and upper-middle-income countries, less than one percent have been given to low-income countries.

International Developments

Taliban announces caretaker government

The Taliban announced its caretaker government this week which includes many individuals who held authority when the group ruled Afghanistan in the 1990s. The group has been criticized for the new government’s lack of inclusivity as much of the new cabinet come from the Pashtun ethnic group. In addition, many are designated global terrorists by the US and the United Nations. The cabinet choices of Supreme Leader Sheikh Haibatullah Akhundzada signal that the conservative and theocratic core of the group has remained largely unchanged. Some Afghan citizens, including groups of women, are protesting the Taliban’s government despite an increasingly violent crackdown on peaceful protesters.

Guinean military carries out coup against president

Last weekend, soldiers from the Guinean military carried out a coup against Guinean President Alpha Conde. Since overthrowing the president, military officers have assumed political leadership. President Conde’s recent actions to change the constitution and extend his two-term limit in 2020 created political turmoil and sparked protests throughout the nation. The US, United Nations, and the African Union have condemned the coup and have called for the immediate return of civilian rule. The Economic Community of West African States (ECOWAS) has threatened sanctions against the country.

US Social & Political Developments

Biden mandates vaccinations for private companies

US President Joe Biden announced new Covid-19 vaccination and testing mandates that will affect nearly 100 million Americans. Private companies with more than 100 employees must mandate vaccines or weekly testing while government and health care workers are required to get vaccinated and will not have an option for regular resting. The Occupational Safety and Health Administration (OSHA) is still developing the emergency regulation, but some officials say employers could face fines up to $14,000 per violation. The announcement comes as vaccinations rates have slowed and the country continues to record at least 1,000 Covid-19 deaths per day

US and Mexico relaunch economic dialogue

The US and Mexico have reopened high level talks on trade, infrastructure, and migration that began under the Barack Obama administration but were cut off under President Donald Trump whose hardline immigration policies strained the country’s relationship with Mexico. The dialogue was started by Biden in 2013 when he was vice president. Vice President Kamala Harris officially relaunched the talks on Thursday alongside top advisors to President Biden and Mexican President Manual López Obrador

Corporate/Sector News

Solar energy to power 40% of US electricity by 2035

According to a newly released plan from the US Department of Energy, solar energy has the potential to power 40 percent of America’s energy by 2035. In 2020, the US installed a record amount of solar – 15 gigawatts, which is equivalent to three percent of the nation’s current electricity supply. In order to accomplish the 40 percent goal, the US would need to install an average of 30 GW of solar capacity per year until 2025 and 60 GW per year from 2025-2030. The bipartisan infrastructure bill making its way through Congress includes billions of dollars for clean energy projects, which would include beefing up the country’s solar energy capabilities

Intel to build semiconductor production facilities in Europe

Intel plans to invest $95 billion over the next decade to build semiconductor production plants in Europe as the company seeks to become a major player amid the global chip shortage. The CEO of Intel, Pat Gelsinger, said the company would announce the locations of the facilities by the end of the year. Currently, Intel is the biggest maker of processor chips for PCs and data centers, and seeks to start producing chips for automakers in the coming months.

French shipping line caps rates as prices soar

French shipping line CMA CGM, the world’s third-largest container carrier, has frozen its spot market prices for shipping goods as supply chain disruptions have caused freight costs to skyrocket. The company announced the rates would be held at current levels for the next five months, even though prices are expected to continue increasing because it wants to prioritize its long-term relationships with customers in the face of industry challenges. Less than two years ago, it cost $3,000 to ship a standard 40-foot container from China to the east coast. Today, that same standard container costs $20,000 to ship.

Recommended Reads

Inflation Is Popping From Sydney to San Francisco. It May Be a Good Sign.

German election: Could there soon be a left-wing government?

Minxin Pei on why China will not surpass the United States

Two Hundred Years of Muddling Through – the end of British hegemony

China and Big Tech: Xi’s blueprint for a digital dictatorship

The troubling parallels between supply chains and securitization

Wealthy nations under pressure to pass IMF stimulus on to poor countries

This week from BlackSummit

Crossroads: At the Intersection of Geopolitical and Geoeconomics – Rachel Poole

The Day After & the Era of Transformation – Rachel Poole & Tyler Thompson

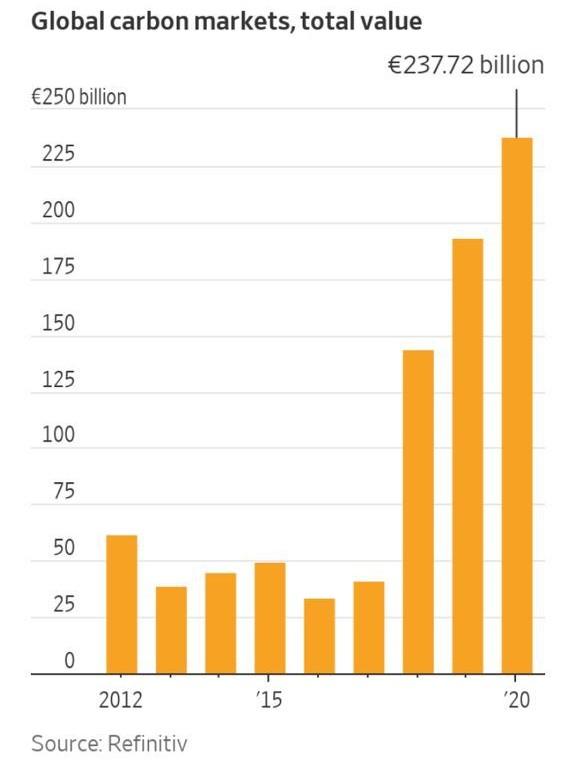

Image of the Week

Video of the Week

How a farm-to-plate restaurant coped with Covid

Source: Financial Times