Global Market News

Global equities make gains

Global equities advanced this week, marking the seventh consecutive month of gains. The S&P 500 rose 0.58% on the week while the Dow Jones dropped slightly by 0.24%. The Nasdaq posted a 1.55% gain on the week and the yield on the US 10-year Treasury increased to 1.32%. The price of a barrel of West Texas Intermediate crude oil rose to $69.23 following oil production disruptions from Hurricane Ida. Volatility, as measured by the CBOE Volatility Index, remained relatively unchanged at 16.3.

Jobs report misses big

While initial unemployment claims, layoffs, and the unemployment rate dropped this month, job creation was a big disappointment. The US economy added only 235,000 positions missing expectations by more than 30%. Economists had forecasted a 750,000 increase for August following July’s rise of 943,000 jobs. The report triggered small moves in equity markets as investors had been weighing if a slowdown in hiring would make the Federal Reserve wait to taper its bond buying program.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 219,000,000Global Covid-19 deaths: 4,550,000

US Confirmed Covid-19 cases: 39,800,000US Covid-19 deaths: 646,000

*As of Friday evening

WHO reports new coronavirus variant

The World Health Organization (WHO) is now monitoring a new coronavirus variant called “Mu” which was first identified in Colombia but is now spreading through at least 39 countries. The WHO is also monitoring four other variants of concern: the Delta, the Alpha, the Beta, and the Gamma. As variants continue to pose a threat, especially among the unvaccinated, the European Union is recommending member states reinstate Covid-related travel restrictions and halt nonessential travel from the US. Also this week, White House chief medical advisor Dr. Anthony Fauci said he would not be surprised if the full regimen of Covid vaccines from Moderna and Pfizer-BioNTech becomes three doses instead of two. Data from Israel suggests Covid-19 immunity from the vaccine decreases after eight months and new variants pose additional risks to immunity.

International Developments

Japanese prime minister resigns

Japanese Prime Minister Yoshihide Suga has resigned from his position after just one year, withdrawing from an upcoming leadership election for the ruling Liberal Democratic Party (LDP). Though Suga was very popular at the beginning of his term, his public approval rating has fallen over his handling of the Covid-19 pandemic. His decision to move forward with hosting the Olympic Games this summer despite much opposition was particularly controversial. LDP is widely expected to win elections later this fall, but it will be moving forward with a new leader.

Venezuelan political parties begin negotiations in Mexico City

A delegation representing Venezuelan President Nicolas Maduro and a delegation representing the opposition have begun formal negotiations in Mexico City. It will be the 5th time the two parties have held formal negotiations since Maduro took office in 2013, though many are hopeful this round of negotiations will be more fruitful. Unlike previous talks, these negotiations are backed by international actors. Both Russia, which has close ties to Venezuela’s military, and the Netherlands, which sides with the opposition, have been present. Sparking some hope for progress in the days before heading to Mexico, Venezuelan opposition parties announced an end to a boycott on voting and said they would participate in November’s regional and municipal elections.

US Social & Political Developments

US completes Afghanistan withdrawal

Meeting its August 31st deadline, the US completed its military withdrawal from Afghanistan, formally ending the 20-year war and leaving the country in the control of the Taliban. US President Joe Biden called the evacuation an “extraordinary success” and declared an end to the US using its military power to “remake other countries”. Diplomatic talks are now underway to facilitate the reopening of Kabul’s airport so that Afghans who wish to leave can do so.

US and China meet to discuss climate action

US Special Presidential Envoy for Climate John Kerry traveled to China this week to meet with his Chinese counterpart Xie Zhenhua to discuss climate action. While there, Chinese Foreign Minister Wang Yi warned Kerry that poor relations could hinder cooperation on climate change and that it “cannot be separated” from the broader geopolitical environment. While the Biden administration is pursuing cooperation on the climate front, tariffs and sanctions from the Trump presidency remain in place. Kerry told reporters, “It’s not a matter of ideology or politics or geostrategic think. It’s a matter of mathematics and physics” and said he would urge China to move up its peak emissions targets.

Corporate/Sector News

GM, Ford, Toyota halt more production amid worsening chip shortages

The continued shortage of semiconductor chips is having a major impact on automakers, leading several companies to halt even more production in the coming months. General Motors (GM) has cut its September production at eight North American plants while Toyota is trimming planned global production by 40%. Ford announced additional production cuts to its F-150 truck model and reported that retail sales fell nearly 40% in August.

Beijing seeks to take control of DiDi

Beijing city is looking to take the Chinese ride-hailing company DiDi Global under state control. The city’s government has proposed that a government-run firm invests in the company. Under this preliminary proposal, some companies like Shouqi Group, which is part of the state-owned Beijing Tourism Group, would acquire a stake in DiDi Global so that the government could regain control over the company and, most importantly, the massive amounts of data it owns. Shares of DiDi rose following the news as some investors believe it could remove the regulatory uncertainty surrounding the company.

OPEC+ agrees to continue oil production increases

At a meeting this week, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to continue with its plan for gradual increases to monthly oil production output. The quick decision this time around is in stark contrast to the previous drawn-out negotiations of July. The group is in the process of rolling back the output cuts that were imposed in response to the initial global economic fallout caused by the Covid-19 pandemic last year. About 45% of the supply has already been revived while the remainder will be gradually returned by September 2022.

Recommended Reads

Bitcoin Uses More Electricity Than Many Countries. How Is That Possible?

In Leaving Afghanistan, U.S. Reshuffles Global Power Relations

Vietnam’s status as manufacturing powerhouse is shaken by Covid surge

Iran and Saudi Arabia Battle for Supremacy in the Middle East

Japan and Taiwan to hold talks to counter Chinese aggression

The Case for Stronger Russia Sanctions

Bolsonaro pushes the limits of democracy in Brazil

This week from BlackSummit

Digital Currencies, T.S. Eliot, and the Land of Endless Money: Part II

John E. Charalambakis

Geopolitical Challenges and Statecraft

Rachel Poole & Tyler Thompson

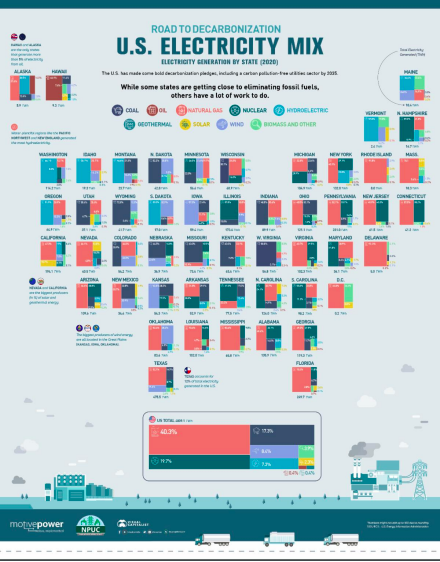

Image of the Week

Video of the Week

Hydrogen: how to harness a superfuel

Source: Financial Times