Global Market News

Global equities tumble

Global equities tumbled this week as the US reported weak sales data and the Federal Reserve announced it is considering tapering its bond purchases. The S&P 500 and Dow Jones both decreased 0.59% and 1.11% respectively, while the Nasdaq closed 0.73% down. The yield on the US 10-year Treasury declined to 1.26% and the price of a barrel of West Texas Intermediate crude oil fell yet again, dropping nearly 9% over the week to $62.32. Volatility, as measured by the CBOE Volatility Index, ticked up to 18.3.

Economic data points to slowdown in China’s growth

China’s factory output and retail sales growth missed expectations in July, signaling that the economic rebound is losing steam. Industrial production was expected to rise 7.8% in July after growing 8.3% in June, but it only increased 6.4% year-on-year. Retail sales increased 8.5% which is 3% lower than analyst’s expectations. New restrictions due to Covid-19 outbreaks and severe weather disrupted the country’s factory output. Also adding to the pressure is China’s regulatory crackdown on several sectors.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 210,000,000 Global Covid-19 deaths: 4,410,000

US Confirmed Covid-19 cases: 37,500,000 US Covid-19 deaths: 626,000

*As of Friday evening

US to offer Cvid-19 vaccine boosters

The White House announced it will offer Covid-19 booster shots to fully vaccinated adults beginning September 20th. Americans age 18 and older who have received either the Pfizer-BioNTech or Moderna vaccines are eligible for a booster shot eight months following their second dose. The announcement strays away from initial conversations that only immunocompromised and elderly adults would be offered booster shots. The move has sparked criticism from the World Health Organization (WHO) and other health experts who have warned wealthy countries against offering boosters when large parts of the world have yet to receive even a single vaccine dose. In response to the criticism, US President Joe Biden assured that the US would ramp up its vaccine donations.

International Developments

Afghanistan collapses to Taliban

Last weekend Afghanistan’s government collapsed as the Taliban took control of Kabul, the capital city. The swift takeover shocked the world and triggered absolute chaos at Kabul’s airport as various embassy staff and Afghan citizens tried to evacuate the country. Afghan President Ashraf Ghani fled the country and released a message on Sunday acknowledging the Taliban’s victory while the interior minister said a peaceful transfer of power had been agreed to. US President Biden defended the ongoing withdrawal of US troops despite the “messy” situation and stood by the decision to end the US’ involvement in Afghanistan’s war. Thousands of US troops have been sent to assist with securing Kabul’s airport so that evacuations can continue. The US is committed to support the exit of Afghans who aided its military efforts over the last 20 years and several countries, including the United Kingdom and India, are offering Afghans a safe haven.

Earthquake devastates Haiti amid political crisis

More than 2,000 people were killed by a 7.2 magnitude earthquake in Haiti last Saturday and tens of thousands have been displaced. To make matters worse, a tropical storm ripped through the island just days following the earthquake, complicating relief efforts. Aid workers have also been faced with armed gangs who have blocked major roads and have attacked aid convoys. The disaster compounds the problems facing Haiti as it grapples with a deep political crisis following the assassination of its president last month.

US Social & Political Developments

States and cities become embroiled in mask mandate controversy

A growing number of health experts are calling for the resumption of mask mandates as the Covid-19 delta variant surges across the US, even among the vaccinated. Just two months after the CDC said vaccinated individuals did not need to wear masks in most settings, governors are being faced with the decision to bring back mask mandates or not. The growing calls for renewed mask mandates has sparked controversy especially as schools across the country are set to begin the new school year. At the center of such controversy, Texas Governor Greg Abbott, who just tested positive for Covid-19, is locked in a battle with local leaders over his ban on mask mandates in schools. President Biden has ramped up the fight with governors banning school mask mandates by ordering the Department of Education to “assess all available tools” to ensure governors don’t stand in the way of a “safe return to school for our Nation’s children.

Kamala heads to Vietnam and Singapore

US Vice President Kamala Harris has traveled to Vietnam and Singapore, highlighting the Biden administration’s major foreign policy objective of strengthening partnerships in the Indo-Pacific region to counter China’s rising influence in South-east Asia. Her trip reaffirms the country’s commitment to revitalizing alliances and comes on the heels of Secretary of Defense Lloyd Austin’s visit to Singapore, Vietnam, and the Philippines last month where he reinforced military ties.

Corporate/Sector News

Automakers face renewed chip shortages

Several of the world’s largest automakers are facing renewed chip shortages as a new wave of Covid-19 cases is sweeping across southeast Asia where many semiconductors are produced. The shortages are weighing heavily on the recovery plans for many automakers. Toyota, the world’s largest automaker, said it would have to cut production by 40% in September while Volkswagen has also warned of output cuts. Ford said it will shut down the assembly of its F-150 pick-up truck for a week at one of its plants and General Motors will halt assembly of its all-electric Chevrolet Bolt as it extends downtime at production lines in North America. The new disruptions could eventually lead to increased prices at dealerships and could affect the recovery plans of manufacturers.

Retail sector posts gains following positive earnings reports

The retail sector posted impressive gains this week after several companies reported earnings data that exceeded expectations. For example, both Macy’s and Kohl’s stocks soared this week after reporting increases of 61% and 25%, respectively, in same-store sales for the second quarter. Shares of Macy’s, Kohl’s, Nordstrom, Dillard’s, Express, Abercrombie & Fitch, and Guess rose even higher after Amazon announced it was planning to open several brick-and-mortar retail locations. On the other hand, retail sales for July did not meet forecasts, falling 1.1% over the month as the delta variant is dampening economic activity and government stimulus is drying up.

China continues regulatory crackdown

China approved a strict data privacy law this week as it continues its regulatory crackdown. The news prompted the fall of stock prices for many Chinese companies and funds, like Alibaba and the Hang Seng TECH Index. The bill takes aim primarily at online fraud, information theft, and data collection by domestic tech companies. China’s market regulator also announced new draft rules at stopping unfair competition on the internet. This week’s events were the latest in a series of moves China has taken in the last several months to crackdown on, primarily, its tech sector.

Recommended Reads

Chinese Bad-Debt Manager Huarong to Be Bailed Out by State-Owned Companies

Pakistan’s hand in the Taliban’s victory

Chip shortage deepens supply problems at global carmakers

Fed Officials Weigh Ending Asset Purchases by Mid-2022

India and Iran Will Have Their Hands Full on Afghanistan

How a Rising China Has Remade Global Politics

This week from BlackSummit

The Two Types of Corrections – Joel Charalambakis

Geopolitical Challenges and Statecraft – Rachel Poole & Tyler Thompson

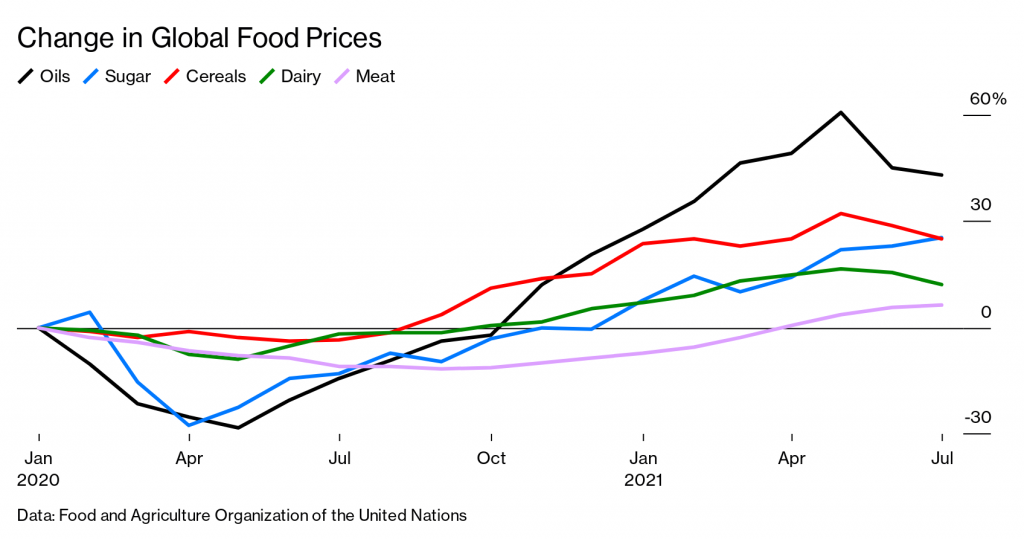

Image of the Week

Video of the Week

The former coal town leading the race for clean energy

Source: Financial Times