Global Market News

Global equities gain

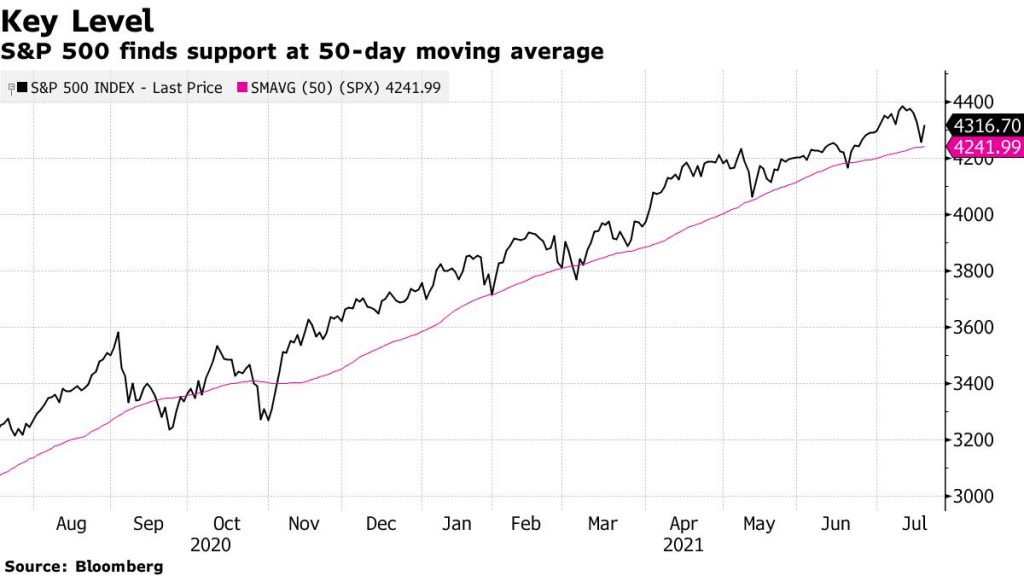

Global equities posted impressive gains this week even after a steep drop on Monday. The S&P 500 and Dow Jones gained 1.96% and 1.08% respectively. The Nasdaq had an even better week, closing 2.84% up. On the other hand, the yield on the US 10-year Treasury fell once again, closing Friday at 1.28%. The price of a barrel of West Texas Intermediate crude oil increased slightly to $72.04. Volatility, as measured by the CBOE Volatility Index, dropped down to 17.2 by week’s end.

ECB vows to keep rates lower for longer

At the European Central Bank’s (ECB) meeting this week, President Christine Lagarde said rates will remain at present or lower levels until inflation moves closer to its target of 2% and added that the central bank was willing to let inflation run “moderately above target”. The announcement suggests the ECB won’t start to raise rates until 2024 or 2025, diverging from the US Federal Reserve’s policy which is a bit more hawkish. Analysts say the ECB’s shift in policy reflects the new revisions unveiled by the bank a couple of weeks ago which broaden the powers it has to stimulate the economy when inflation is too low. At the meeting, the ECB also confirmed its commitment to buy eurozone debt through March 2022 as part of an emergency bond-buying program. The euro fell to around $1.1780 this week in response to these developments.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 193,000,000 Global Covid-19 deaths: 4,140,000

US Confirmed Covid-19 cases: 34,300,000 US Covid-19 deaths: 610,000

*As of Friday evening

US sees rise in daily Covid-19 cases and Delta variant infections

While the rate of vaccinations in the US is slowing to about 500,000 per day, the number of daily Covid-19 cases is rising to around 40,000 new cases per day. The uptick can be attributed to the Delta variant which is more transmissible and is now making up an estimated 83% of new infections. The developments have prompted the White House and CDC to consider urging vaccinated Americans to wear masks in more settings. Since the CDC eased mask guidelines for the fully vaccinated in May, the percentage of people who wear a mask in public regularly has fallen from 84% to 52%, according to an Axios-Ipsos poll released on Tuesday. Shares of mask making companies, like Lakeland Industries and Alpha Pro Tech, were up this week.

International Developments

US and Germany reach a deal on Nord Stream 2

Just a week after US President Joe Biden and German Chancellor Angela Merkel met in Washington, the US and Germany have reached a deal on the Nord Stream 2 pipeline which has been the source of tension between the two countries for the last few years. Washington has opposed the pipeline because of concerns that it would give Russia too much leverage over European energy security. As part of the agreement, Germany will invest in and promote Ukrainian energy security and committed to sanctioning Russia if it uses energy as a weapon.

OPEC+ reaches oil production agreement

After failing to come to an agreement a few weeks ago due to a dispute between Saudi Arabia and the United Arab Emirates, OPEC+ has reached a deal to increase oil production beginning in August. The new agreement aims to boost global oil supply about 2% by the end of the year as the world recovers from the pandemic. The move has eased pressure on climbing oil prices.

US Social & Political Developments

US and allies accuse China of cyberattacks

The US and several allies, including the European Union and NATO, have jointly condemned China for widespread cyberattacks such as those on Microsoft which have affected tens of thousands of organizations. The US and the United Kingdom have explicitly said the Chinese government was directly involved in the cyberattacks while most of the other European countries accuse Beijing of only allowing the hackers to operate. Unsurprisingly, China has denounced the allegations.

US imposes new sanctions on Cuba

The Biden administration has announced new sanctions against Cuba tied in response to its recent crackdown on protests. The sanctions specifically target the country’s defense minister and a group of government security forces for alleged human rights violations committed during the recent widespread anti-government protests in Cuba. On the other hand, the US government is also considering allowing some remittances to Cuba after they were restricted by the Trump administration.

Corporate/Sector News

NASDAQ to develop platform for trading private company stocks

NASDAQ has joined with a coalition of large banks, including Citigroup, Goldman Sachs, and Morgan Stanley, to develop a platform for buying and selling stocks in private companies. While there are several players in the space already, no clear go-to platform has yet emerged, a status NASDAQ hopes to disrupt with this project. The company is planning to appeal to the accredited investors capable of buying shares in private companies by spinning out its Private Markets segment to create an “institutional-grade, secondary trading venue” with considerations for liquidity and company quality.

Mercedes-Benz unveils plans to go all-electric

Mercedes-Benz announced Thursday that it would transition to all electric vehicles by 2025. The plan amounts to over €40B in investments by 2030, with much of that focusing on battery cell capacity, electronic drivetrains, and charging infrastructure, among other electric vehicle architectures. The company asserted that it would pursue its sustainability goals while maintaining profit margins through vertical integration and ramping up its global production network. The luxury automaker’s plan called for the installation of batteries with capacities over 200 GWh and the construction of eight “Gigafactories” across three continents.

Comcast and Viacom reportedly in talks of streaming partnership

The CEO’s of Comcast and ViacomCBS reportedly met last month to discuss possibilities for an international streaming partnership between the two telecom giants. The move comes as both companies look to expand their streaming services overseas to compete with Netflix and Disney+. While both companies have previously expressed disinterest in the merger & acquisition route, Viacom chairwoman Shari Redstone said she would “do what’s right for shareholders” and that should the right deal come along, Viacom would pursue it.

Recommended Reads

Hariri’s stepping aside sets stage for more chaos in Lebanon

‘No One Is Safe’: Extreme Weather Batters the Wealthy World

The Build Back Better World Partnership Could Finally Break the Belt and Road

Get Ready for a Spike in Global Unrest

China must cut emissions to avoid climate ‘chaos’, warns US envoy Kerry

This week from BlackSummit

Some (More) Thoughts About Inflation – Joel Charalambakis

Geopolitical Challenges and Statecraft – Rachel Poole & Tyler Thompson

Image of the Week

Video of the Week

Markets ‘Dangerously High’ Given Inflation: Aswath Damodaran

Source: Bloomberg News