Global Market News

Global equities make gains

Global equities made gains this week. Both the S&P 500 and Dow Jones were up 2.71% and 1.95% respectively, while the Nasdaq ended the week up 3.12%. The US 10-year Treasury dropped down a few bps to 1.66% at Friday’s close. The price of a barrel of West Texas Intermediate crude oil dropped more than 3%, closing the week at $59.30. Volatility, as measured by the CBOE volatility index, dropped to 16.6.

Yellen calls for global minimum tax

U.S. Treasury Secretary Janet Yellen has called for a global minimum tax on corporations. Such a tax, she says, would allow the global economy to “thrive” on a more level playing field. Yellen has encouraged countries to work together to avoid extreme tax competition and the “race to the bottom” attitude when it comes to taxation. While many countries have supported a global minimum tax, friction remains on a variety of taxation issues including whether to tax companies based on the location of their income or the location of their headquarters.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 134,000,000 Global Covid-19 deaths: 2,900,000

US Confirmed Covid-19 cases: 31,100,000 US Covid-19 deaths: 560,000

*As of Friday evening

All US adults to be eligible for Covid-19 vaccine this month

This week, President Biden announced that all US adults will be eligible to receive a Covid-19 vaccine by April 19th. The number of pharmacies contributing to the federal vaccination program is set to increase from the current 17,000 locations to 40,000 in order to fulfill the goal of having vaccination sites within 5 miles of where people live. While there is a lot of good news in the US surrounding the pandemic, President Biden warned “The virus is spreading because we have too many people who’ve seen the end in sight, think we’re at the finish line already. Let me be deadly earnest with you…We’re still in a life and death race against this virus.” Meanwhile, cases in India are surging to record highs and Brazil has set a new daily record for Covid-19 deaths.

Geopolitics Spotlight

Iran nuclear talks progress

The signatories of the 2015 nuclear agreement met in Vienna this week to discuss the US re-entering the deal. Furthermore, a separate working group is discussing how Iran can return to compliance with the agreement. Iranian Supreme Leader Ali Hosseini Khamenei has said the country will scale back its enrichment of uranium immediately after the US can verify that sanctions have been lifted, but he also added they were “in no hurry.” Both US and Iranian officials have called the talks “constructive” and have agreed to resume negotiations next week.

International community concerned over Navalny’s health

Concerns about Russian opposition leader Alexey Navalny’s health have risen over the last week. While Russian officials maintain that he is receiving adequate care, Navalny’s lawyers say otherwise. In the most recent report, Navalny’s lawyer said her client is losing feeling in his hands and has two spinal hernias. For the last several weeks, Navalny has complained of severe back pain and leg numbness, but nevertheless, has declared a hunger strike. Human rights watchdog Amnesty International alleges that Navalny is being held in torturous conditions. Several international actors, including Germany, continue calls for Navalny’s release.

US Social & Political Developments

US blacklists more Chinese companies

The US is continuing to crackdown on Chinese companies for threatening US national security. Most recently, the US added seven Chinese entities to an export blacklist for various destabilizing actions including building supercomputers for China’s military. These seven companies will be forbidden from using technology that originates in the US. Bilateral tensions between the US and China have been intensifying in the last few weeks over issues in the South China Sea, Hong Kong, and Xinjian region. The US Senate is expected to introduce new legislation next week that seeks to address some of these issues.

Biden’s infrastructure plan

Last week, President Biden announced his $2 trillion infrastructure plan to improve America’s roads and bridges and boost manufacturing in the US. The president has proposed hiking the corporate tax rate from 21 to 28 percent to help fund the plan but did signal this week that he is willing to negotiate this with Republicans. Upon the initial announcement, many Republicans said the plan was a nonstarter, criticizing the level of spending, tax increases, and the plan’s priorities.

Corporate/Sector News

Godzilla brings life back to movie industry

The premiere of Godzilla vs. Kong gave a boost to the movie industry this week. The film generated $48.5 million in the US and Canada in its first five days of release. It brought in an additional $71.6 million from its debuts abroad. The successful premiere is a sign that people have not lost their appetite for moviegoing. So far, more than 90% of US cinemas have reopened.

Taiwan Semiconductors to invest billions in chips

Taiwan Semiconductors is responding to the global chip shortage by planning to spend $100 billion over the next three years to expand its chip fabrication capacity. This investment is in addition to the $25-28 billion the company, whose notable customers include Apple and Qualcomm, plans to spend to develop and produce advanced chips this year alone.

Grab goes public

Southeast Asia’s most valuable startup, Grab, is ready to go public. The company was founded as a ride-hailing group in 2012, but it has since expanded into payments and food delivery. Grab has also been granted a digital banking license in Singapore, allowing it to offer digital loans and insurance. Its consumer market of 655 million people spans across Southeast Asia including Indonesia, Thailand, and Vietnam.

Recommended Reads

US economic sanctions against human atrocities in China and Myanmar UN chief warns of coming debt crisis for developing world Biden’s Infrastructure Plan Visualized: How the $2.3 Trillion Would Be Allocated Global economy poised to expand faster, buoyed by vaccinations What the WHO Investigation Reveals About the Origins of COVID-19 Europe’s third wave: ‘It’s spreading fast and it’s spreading everywhere’ China looks to rein in lending to cool property boom

This week from Black Summit

Considering the Economic & Portfolio Costs of Free Money: Modern Monetary Theory (MMT) & Practice – John E. Charalambakis & Dale Ahearn

Crossroads: At the intersection between geopolitics and geoeconomics – Rachel Poole

Covid-19 and the Day After – Rachel Poole & Tyler Thompson

Image of the Week

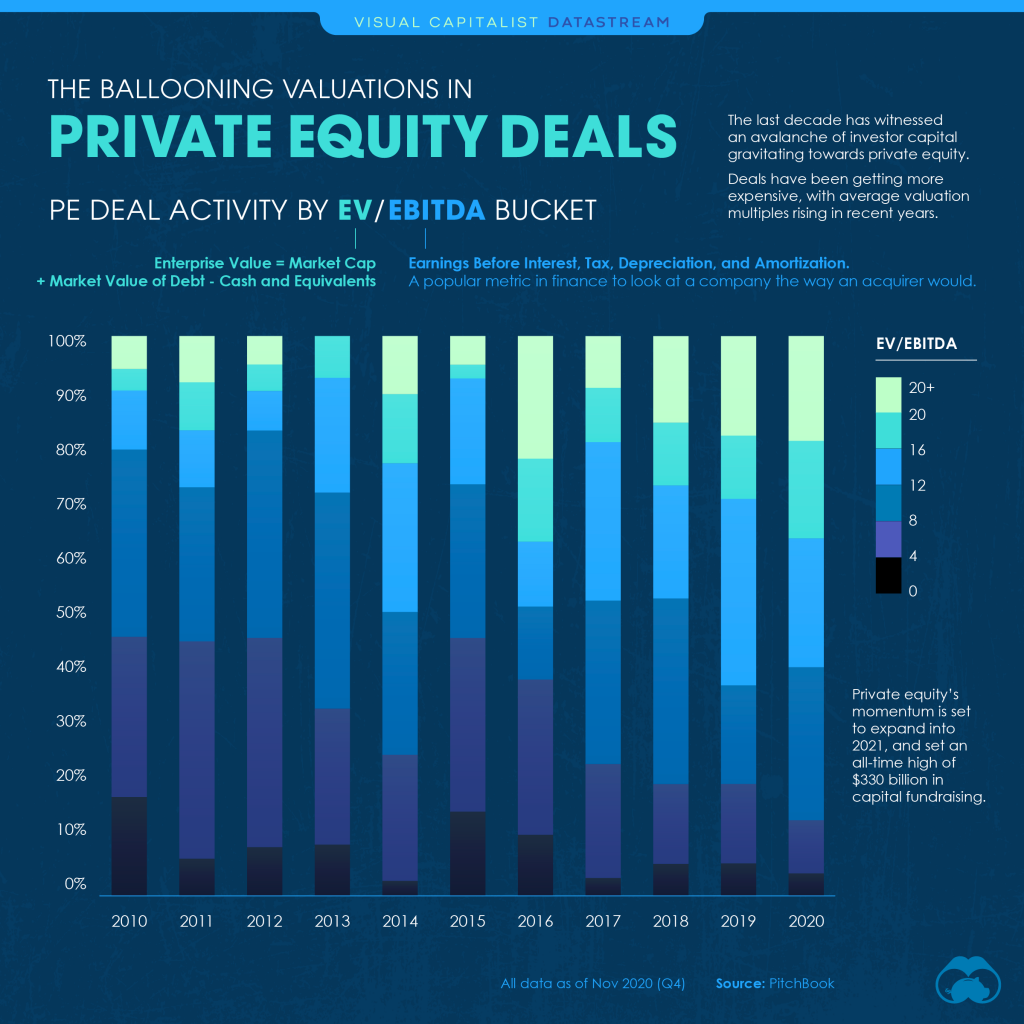

The Ballooning Valuations In Private Equity Deals

Video of the Week

Video: Is Russia about to launch a fresh offensive in eastern Ukraine?

Source: DW News