Global Market News

Global equities rally

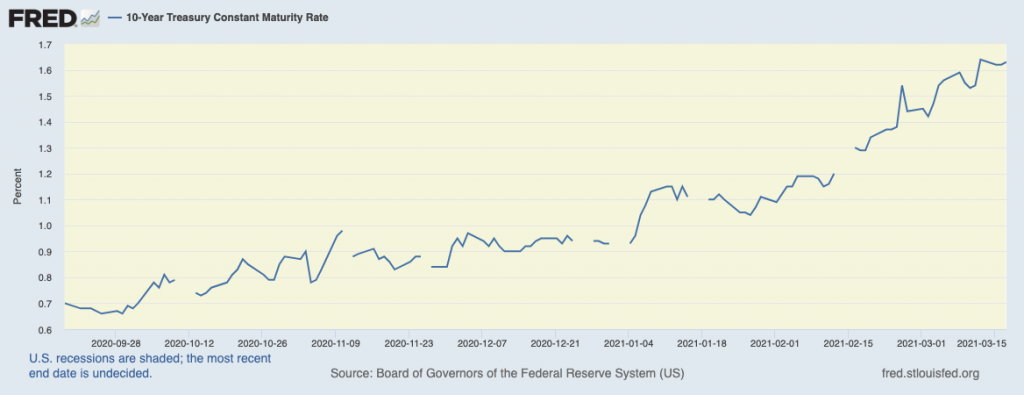

Global equities were slightly down on the week. The S&P 500 and Dow Jones lost 0.77% and 0.46% respectively, while the Nasdaq decreased 0.79% on the week. The US 10-year Treasury continued to rise, closing Friday at 1.72%. The price of a barrel of West Texas Intermediate crude oil dropped more than 6%, landing at $61.42. Volatility, as measured by the CBOE volatility index, remained relatively unchanged at 21.3.

Federal Reserve issues positive economic forecast

The Federal Reserve issued a positive economic forecast while also signaling that rates will remain unchanged until 2024. The Federal Open Market Committee, the central bank’s monetary policy making body, predicts the US economy will grow by 6.5% in 2021, unemployment will decrease to 4.5%, and that inflation will be at 2.4% this year. Treasury yields have continued to rise this week as concerns over an uptick in inflation continue.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 122,000,000 Global Covid-19 deaths: 2,690,000

US Confirmed Covid-19 cases: 29,700,000 US Covid-19 deaths: 540,000

*As of Friday evening

Medical experts urge that the AstraZeneca vaccine is safeMedical experts in Europe are trying to calm fears that AstraZeneca’s Covid-19 vaccine unsafe. Several European countries suspended use of the vaccine after some recipients reported blood clots. Less than 40 people out of 17 million who have received the vaccine reported blood clots, providing very little to no evidence that the vaccine causes blood clots. The European Medicines Agency, as well as the World Health Organization, maintains that the shot is safe to use and that the vaccine’s benefits outweigh any potential side effects. The attention the media has brought to the issue has caused a greater mistrust of vaccines, especially in Europe. While 35% of the United Kingdom’s population and 22% of the US’ population have received the first dose of a vaccine, only 7.7% of the European Union’s population can say the same thanks to a slow rollout and mistrust.

Geopolitics Spotlight

Russia recalls US envoy after Biden interview

Russia recalled its ambassador to the US this week after President Joe Biden agreed in a television interview that Russian President Vladimir Putin is a “killer”. In response to the interview, Russia’s embassy in Washington warned that bilateral relations were “under the threat of collapse” while President Putin himself responded with “I know you are, but what am I” and has challenged President Biden to a live broadcasted debate. The interview comes shortly after a US intelligence report that found Russia sought to influence the 2020 US presidential election was released. The US also announced this week that it is expanding the sanctions recently imposed on Russia in response to the poisoning and imprisonment of Russian opposition leader Alexey Navalny.

EU launches legal action against the UK over Brexit

The European Union (EU) has taken legal action against the United Kingdom (UK), accusing the country of breaching their Brexit agreement. Earlier this month, the UK took action to unilaterally ease trading conditions for business in Northern Ireland which the EU has called a violation of not only their agreement but also of international law. The UK insists its actions do not breach its commitments to the agreement, but the EU’s step towards legal action could result in the UK being called before the European Court of Justice and facing trade sanctions.

US Social & Political Developments

US and China have first high-level meeting under Biden administration

The two-day meeting between US and Chinese officials in Alaska this week began with an exchange of criticisms that were open to the media. US Secretary of State Antony Blinken expressed concern of China’s suppression of Hong Kong and cyberattacks, among other issues, while Chinese diplomat Yan Jiechi’s criticized the US on several fronts, including racism and for interference in China’s affairs. On the other hand, closed-door discussions were reported to be “substantive, serious, and direct” according to a senior US official.

House of Representatives passes Dream Act bill

On Thursday, the House of Representatives passed two bills that, if passed by the Senate, would establish paths to citizenship or legal status for millions of undocumented migrants in the US. The first measure will offer a pathway to obtain a green card for migrants up to the age of 18 who were brought into the US illegally as children. A second bill would permit migrant farmers who have worked in the US for the past two years to get certified agriculture worker status. The bills face an uphill battle in the Senate which is divided along party lines. The democrats will need 10 Republican votes to pass the bills.

Corporate/Sector News

Value stocks experiencing new momentum

There is a rotational shift occurring in the markets where value stocks are beginning to overlap with tech-based momentum stocks. According to Bernstein strategists, “there are a number of autos, banks, materials, and energy stocks which are screening as both value and momentum”. Since the $1.9 trillion stimulus package was passed, investors have begun moving towards financials, energy, and industrials and away from tech. Strategists say the shift is being driven by the reopening of trade, an improving macro-outlook, the steepening of the yield curve and increasing expectations of inflation.

Vaccine rollout rejuvenates entertainment and travel sectors

As the number of vaccinations increase in the US, many entertainment venues are finally reopening their doors after more than a year. Disneyland in Anaheim, California will be reopening on April 30th at 15% capacity. AMC Entertainment made plans to open 98% of its US locations this week, after coming very close to filing for bankruptcy in 2020. In addition to the entertainment industry, the travel sector is experiencing a windfall from the vaccine rollout and declining Covid-19 case numbers. According to TSA, more than 2.5 million travelers passed through airports nationwide last weekend, making it the busiest day for air travel since before the pandemic. Major airline stocks such as, American Airlines and United Airlines, rose on Monday in response.

India to join the list of countries banning Bitcoin

Bitcoin prices dropped this week after India announced it would propose a law banning cryptocurrencies. The bill would criminalize possession, issuance, mining, trading, and transferring crypto assets. India is not the first country to take action against Bitcoin. It joins the list of other countries with similar bans including China, Pakistan, Russia, Bolivia, Morocco, and North Macedonia. One of the primary concerns is that Bitcoin’s decentralized system will make it difficult for central banks to create their own digital currencies.

Recommended Reads

Russia Remains Top Threat to U.S. Homeland, General SaysTiny Town, Big Decision: What Are We Willing to Pay to Fight the Rising Sea?Electric Cars Are Coming. How Long Until They Rule the Road?Feeble growth and chunky debt piles hold back emerging economiesThe Coming Battle Over Rare EarthsChina Is Not Ten Feet TallJoe Biden and the new era of big government Will the EU emerge from the coronavirus crisis stronger or weaker?

This week from BlackSummit

Heroes, Heroines, Villains, and Disruptors: Market Dancing to the Music of an Avatar Reproduction – John E. Charalambakis

Geopolitical Challenges and Statecraft – Rachel Poole & Tyler Thompson

Image of the Week

10-Year Treasury Constant Maturity Rate

Video of the Week

Whales are vital to curb climate change – this is the reason why

Source: World Economic Forum