Global Market News

Global equities continue their fall

Global equities fell on the week as Covid-19 cases surged in the US and Europe. The yield on the 10-year US Treasury note surprisingly rose a few basis points, ending the week at 0.88%. On the other hand, oil prices took a tumble. The price of a barrel of West Texas Intermediate crude oil dropped more than 10% over the week to $36.79. As Covid-19 cases continue to increase and election day is just around the corner, it is unsurprising that volatility rose almost 10 points over the week. Volatility, as measured by the Cboe Volatility Index (VIX), increased to 38.05 from 28.50 last week.

US growth rates rebounded in Q3 but the full economic outlook is still grim

The US economy reported a 33.1% annual growth rate for Q3 and the number of U.S. workers filing initial claims for unemployment insurance fell to 751,000 last week, the lowest level since the start of the pandemic. The US economy may be on the road to recovery but real GDP growth is estimated to be down about 3% year-over-year, and may deteriorate further given the slowdown of the recovery. A rebound to pre-Covid GDP levels are not expected until at least the middle of 2021, if not later.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 45,300,000

Global Covid-19 deaths: 1,180,000

US Confirmed Covid-19 cases: 9,080,000

US Covid-19 deaths: 229,000

*As of Friday evening

France announces month-long lockdown

On Thursday, France announced a month-long nationwide lockdown in response to the second wave of the Covid-19 pandemic. Close to 60% of the British population is also on lockdown, with London soon to follow if cases continue rising. Germany’s restrictions are less severe but it has closed bars, restaurants, gyms, and theaters.

Geopolitics Spotlight

France on high alert after terrorist attack

France is under the highest-level security alert after three people were killed at a church in Nice on Thursday. A guard outside the French consulate in Saudi Arabia was also wounded in a knife attack on the same day, but investigators do not know if the two incidences are connected. French President Emmanuel Macron has described the killing at the church an “Islamist terror attack.” The tragedy comes amid tensions between France and several Muslim countries after a French teacher was beheaded for showing students cartoons depicting the Prophet Mohammed, which is forbidden by the religion.

Erdogan threatens military action in Syria

President of Turkey, Recep Tayyip Erdogan, has threatened to launch a new offensive in northern Syria if Kurdish forces are not removed from the Turkey-Syria border. The announcement comes after an airstrike was launched, allegedly by Russia who supports the armed Kurdish groups, on Turkey-backed Syrian rebels.

US Social & Political Developments

Next stimulus package delayed until after election

Talks between Democrats and Republicans broke down this week, resulting in no agreement on the next Covid-19 stimulus package. Negotiations will have to wait until after the presidential election. If the Democrats sweep next week’s elections we can expect to see a rather large rescue package.

Millions vote early as the presidential election approaches

As of October 30th, more than 85 million Americans have voted early, either by mail or in person, according to the US Elections Project. With just a few days left before November 3rd, Biden continues to lead in the polls.

Corporate/Sector News

LVMH will take over Tiffany

LVMH and Tiffany have reached an agreement after a bitter legal dispute which nearly went to court. LVMH will take over Tiffany for a slightly lower price. LVMH had argued that Tiffany should have a lower valuation due to the pandemic. The total price tag agreed upon is $425 million less than what was originally reported, bringing the purchase price of Tiffany to $15.8 billion.

Beijing imposes sanctions on US companies

China has placed sanctions on several US defense companies, including Lockheed Martin, Boeing, and Raytheon, over $1.8 billion arms sales to Taiwan. Despite the sanctions, the US State Department has approved a potential $2.4 billion sale of additional anti-ship missiles to Taiwan.

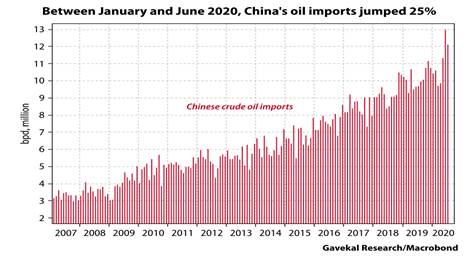

Oil prices take a hit

Oil prices took a major hit this week despite the fact that hurricane Zeta slammed into the Gulf Coast. Up to 85% of offshore Gulf of Mexico oil production and 58% of its natural gas output was halted to weather the storm. However, investors’ anxiety over rising Covid-19 cases and the implications for slower economic activity led oil prices to drop nearly 10% over the week.

Recommended Reads

Trump vs Biden: essential reading

Post-COVID Capitalism

Russia Faces a Reckoning on Its Periphery

As the World Burns: Climate Change’s Dangerous Next Phase

Why China’s GDP rebound is not all that great

Covid condemns value investing to worst run in two centuries

Covid-19: The global crisis — in data

What Brexit will do to the City of London

This Week from BlackSummmit

Waiting for Godot at the Foothill of History: The Market and the Wilderness of Mirrors – John E. Charalambakis

Covid-19, US Elections, and the Day After – Tyler Thompson and Rachel Poole

Images of the Week

Video of the Week

How the US 2020 election will determine the balance of power in Asia

Source: Financial Times