Global Market News

Global equities make gains – Global equities made gains this week. The Nasdaq Index hit a new record this week, surpassing 11,000. The yield on the 10-year US treasury note improved slightly to 0.56% while the price of a barrel of West Texas Intermediate crude oil rose more than 3% to $41.51. Volatility, as measured by the Cboe Volatility Index (VIX), continued to fall this week, dropping to 22.8 from 25.6 a week ago.

July sees 1.76 million jobs added – The US labor market continued its rebound this month despite an uptick in the number of confirmed Covid-19 cases. 1.76 million jobs were added in July, causing the U-6 unemployment rate to fall to 10.2% from 11.1%. However, the number of added jobs in July is significantly lower than the 4.8 million increase we saw in June.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 19,200,000 Global Covid-19 deaths: 716,000

US Confirmed Covid-19 cases: 4,910,000 US Covid-19 deaths: 160,000

*As of Friday evening

Africa exceeds 1 million cases – The number of confirmed Covid-19 cases in Africa now exceeds 1 million. However, the World Health Organization warns that this number could be even a hundred times higher due to low testing rates and poor government reporting. The number of reported cases on the continent more than doubled in July, marking a grave turning point of the pandemic’s impact.

Geopolitics Spotlight

New details in Beirut explosion investigation – There were 2 devastating explosions in Beirut, the capital city of Lebanon, on Tuesday. The blasts killed at least 137 people, injured 5,000 and caused nearly $15 billion in damages. The explosions are widely attributed to massive quantities of ammonium nitrate which had been sitting in Beirut’s port for multiple years. In a recent update from the government’s investigation, Lebanese officials have detained 16 port workers and have frozen the assets of 7 port and customs officials. International support for Lebanon has poured in since the incident. French President, Emmanuel Macron, has pledged “unconditional aid” on behalf of France and has called for economic and political reform to stabilize the country which has been beset by economic crisis and social unrest.

Greece and Egypt sign new maritime deal – Greece and Egypt have signed a new maritime border deal, demarcating their borders in the Mediterranean Sea after 15 years of talks over sea boundaries. Turkey is outraged over the deal which invalidates a 2019 border agreement between Libya’s UN-backed government and Turkey. Turkish officials claim the area discussed in the new agreement “lies within the Turkish continental shelf.” Tensions between Greece and Turkey have been high in recent months after a navy stand-off between the two countries occurred off the coast of Greek island Kastellorizo.

US Social and Political Developments

Talks on next US relief package stall – Congressional Republicans and Democrats still remain at odds on the size and scope of a fifth coronavirus relief package. Republicans are pushing for a $1 trillion package while Democrats are fighting for $3 trillion in additional spending. President Donald Trump is considering signing an executive order to redeploy unused funds from the CARES Act to state governments, impose a partial moratorium on evictions, and suspend payroll taxes.

Trump bans TikTok and WeChat – On Thursday, President Trump signed an executive order to ban Chinese-owned apps TikTok and WeChat on national security grounds. The order will go into effect in 45 days, giving Microsoft only a few weeks to negotiate the purchase of TikTok with its parent company, ByteDance. The White House fears that Chinese authorities are capturing user data through the apps and using it to their advantage. Media outlets in China have deemed President Trump’s move the beginning of a “digital cold war”.

Corporate/Sector News

Relief coming to US airline industry – The White House is bringing another wave of relief to airlines. Reportedly, there is bipartisan support for an additional $25 billion in aid to US airlines. In March, $25 billion was set aside for US carriers in the $2.2 trillion CARES Act on the condition that no jobs would be cut through September 30th. The new proposal would most likely extend these protections through March 2021. This would be a big win for the airline industry as many carriers have announced planned job cuts for October.

BP and Disney make earnings headlines – About 89% of S&P 500 constituents have reported second quarter earnings. Currently, blended earnings per share shows that earnings growth is at -33.8%. However, 84% of those companies are beating consensus earnings estimates. Making headlines this week was BP and Disney. BP reported a record $6.7 billion loss overnight as they halved their dividend to $5.25 per share. Though Disney+ now has 100 million streaming subscribers, Disney continues to feel the brutal impact from Covid-19, reporting an 85% decline in revenues from its park business.

Recommended Reads

The Beirut Blast Is Lebanon’s Chernobyl

Blame for Beirut Explosion Begins With a Leaky, Troubled Ship

Erdogan gambles on fast recovery as Turkey burns through reserves

Fitch Is Warning About U.S. Debt. Treasury Yields Are at Record Lows.

To Counter China, Look to Canada and Mexico

This week from Black Summit

If FAANG is the Answer, then what are the Questions? – John Charalambakis

Crossroads: At the Intersection of Geopolitics and Geoeconomics – Rachel Poole

Covid-19 and the Day After – Tyler Thompson and Rachel Poole

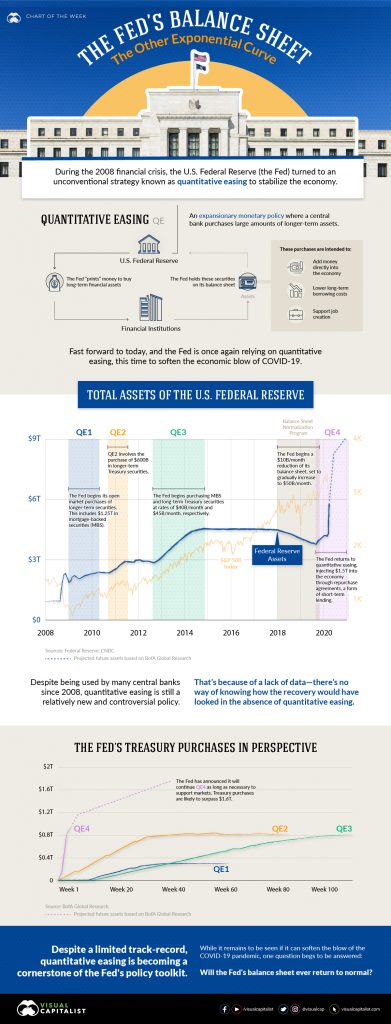

Image of the Week

The Fed’s Balance Sheet: The Other Exponential Curve

Video of the Week

Beirut: Why has there been crisis after crisis in Lebanon?

Source: BBC News