Global Market News

Global equities surge

Global equities made significant gains this week. Promising results from the monthly labor report, which we break down further below, fueled gains on Friday. The Dow Jones and the S&P 500 rose 6.7% and 5.4% respectively, while the yield on the US 10-year Treasury note skyrocketed 24 basis points to 0.90%. The price of oil continued its rise this week, with the price of a barrel of West Texas Intermediate crude oil increasing from $33.50 to $38.97 on expectations of improved demand. Volatility, as measured by the Cboe Volatility Index (VIX) dropped from 29.5 to 24.5.

Deciphering the unemployment reports

The US labor market rebounded in May, adding an unexpected 2.5 million jobs. According to the US Labor Department’s report, the U-3 unemployment rate dropped from 14.7% in April to 13.3% in May. However, this rate does not reflect the true impact Covid-19 has had on labor. The U-3 rate does not include those who have been reduced to part-time hours, temporarily laid off, absent from work for “other reasons”, etc. When these left-out persons are taken into consideration the true unemployment rate exceeds 25%. While Friday’s labor report was better than economists had expected, the damage to our workforce and economic activity is substantial.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 6,420,000 Global Covid-19 deaths: 383,000

US Confirmed Covid-19 cases: 1,930,000 US Covid-19 deaths: 111,000

*As of Friday evening

ECB approves stimulus package

Surprisingly, the European Central Bank nearly doubled the size of its Pandemic Emergency Purchase Program (PEPP) from an anticipated €750 billion to €1.35 trillion. Furthermore, the duration of the program was extended by six month and is now set to end mid-2021. Adding to the surprises, Germany added an additional €130 billion in government spending to offset the decline from the Covid-19 lockdown.

AstraZeneca to produce 2 billion vaccine doses

AstraZeneca is already gearing up to produce 2 billion doses of a coronavirus vaccine. 400 million of those doses will go to the US and the United Kingdom alone and 1 billion will be reserved for those in low and middle-income countries. Distribution is expected to start in September or October with most of the vaccine deliveries to be made by early 2021. It seems strange to talk about distribution plans without having an official vaccine, but it is believed by the company that the vaccine named AZD1222 has a probability of success high enough to support the manufacturing at-risk.

Geopolitics Spotlight

Protests against racial injustice continue

Protests against racial injustice continue to spread, not just in the US, but across the world. Though there have been incidents of rioting and looting, the protests have been primarily peaceful, bringing about a powerful sense of unity in a time of much uncertainty. All four of the officers that participated in the arrest of George Floyd, who died as a result of the officers’ actions against him, have been charged. This was a big win for protesters who have been demanding charges be brought against the officers for nearly two weeks. The fight to bring about greater systemic equality rages on.

Phase one trade deal is still on Despite the increasing political tensions between the US and China, progress is being made on the phase one trade deal, according to US trade Representative Robert Lighthizer. This week, Lighthizer said he feels “very good” about the progress and dismissed media reports that China is not honoring their commitments on soybean purchases. Uncertainty over the trade deal arose after China imposed a national security law on Hong Kong, which has resulted in the revocation of the territory’s special trading status and sparked international outrage. In response to the China’s crackdown, British Prime Minister Boris Johnson has offered three million Hong Kong residents a path to citizenship in the United Kingdom.

Corporate/Sector News

Oil continues its upward trend The upward trend in the oil markets is defying the significant accumulation of supply in reserves. However, the global economy is re-opening and more people are leaving their homes which has led to higher demand for oil, therefore pushing prices higher. In other oil sector news, OPEC+ and its allies are close to signing a deal to extend production cuts through the end of July. After nearly a week of talks, Saudi Arabia and Russia have reached a tentative agreement with Iraq, which did not make its assigned cutbacks last month. Current fundamentals indicate that WTI prices may range between $33-47 in the next 2-4 weeks.

Recommended Reads

The Economic Pain That the Unemployment Rate Leaves Out

Fed Promised to Buy Bonds but Is Finding Few Takers

With Israel’s annexation plans looming, an hour of decision for Jordan’s Hashemites

CBO Says Economy Could Take Nearly 10 Years to Catch Up After Coronavirus

Citi warns markets are out of step with grim reality

Can America’s Middle Class Be Saved from a New Depression?

Stung by Past Mistakes, Eurozone Takes a Page From U.S. to Fight Crisis

This Week From BlackSummit

Firepower and Moral Suasion: Market Abnormalities – John E. Charalambakis

Crossroads: At the intersection of geopolitics and geoeconomics – Rachel Poole

Covid-19 and the Day After – Rachel Poole and Tyler Thompson

Image of the Week

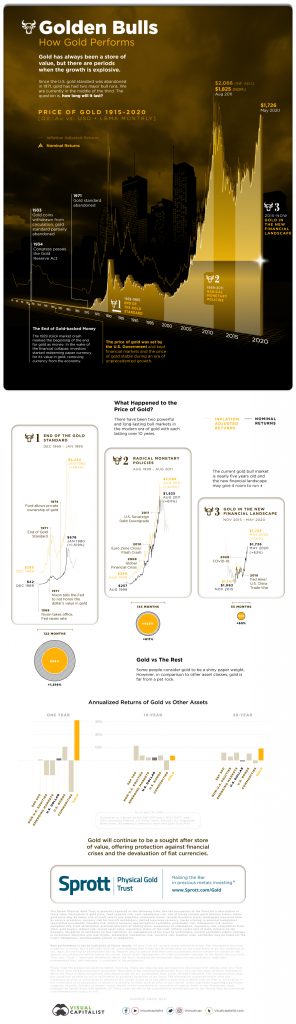

Golden Bulls: Visualizing the Price of Gold from 1915-2020

Video of the Week

Hong Kong protesters seek refuge abroad

Source: DW News