Global Market News

Global equities lower on the week

Global equities were lower on the week while the US 10-year Treasury note gained a little bit in price as the yield dropped to 0.64% as of Friday late afternoon. On the other hand, the price of a barrel of West Texas Intermediate crude oil rose to about $29.20 from $24.50 last week. Volatility, as measured by the Cboe Volatility Index (VIX), also increased, hitting 34.5 as compared to 29.5 last Friday.

The Fed rules out negative policy rates

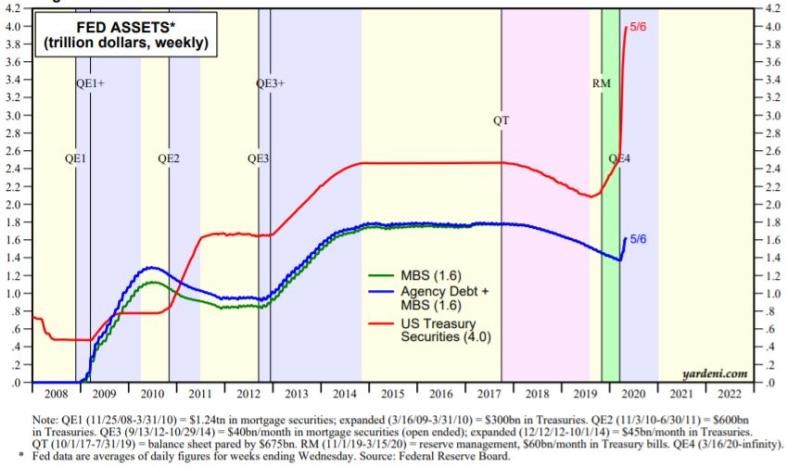

In a press conference this week, US Federal Reserve Chair Jerome Powell ruled out the use of negative policy rates but did say the central bank’s response to the pandemic “may not be the final chapter”. After the Chair’s remarks, the yield on the 10-year Treasury note fell. However, the markets seem to be pricing in expectations that rates will eventually be pushed negative. In other Fed news, the central bank used one of its new tools for the first time by purchasing investment-grade and high-yield bond ETFs! As a result of the extraordinary measures taken by the central bank to support the market amidst the pandemic, the Fed’s balance sheet has neared $7 trillion dollars, representing about 33% of America’s GDP, while the equivalent percentages are 50% and 133% for the ECB and Japan’s central bank respectively.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 4,480,000 Global Covid-19 deaths: 304,000

US Confirmed Covid-19 cases: 1,470,000 US Covid-19 deaths: 87,774

*As of Friday evening

Latin American outbreak is reaching Europe-levels

The coronavirus outbreak in Latin America has surged, becoming comparable to the worst in Europe or the US. Deaths from all causes have doubled in some Latin American cities, including Lima, Peru and tripled in places such as Manaus, Brazil. Ecuador has quickly become one of the hardest hit countries in the world as their deaths have reached five times the normal number for this time of year. In contrast to Europe and the US, the region is having to face the virus with fewer medical and economic resources.

Modi announces $260 billion rescue package

India’s Prime Minister Narendra Modi announced a rescue package worth more than $260 billion dollars. The amount equates to 10 percent of India’s GDP. Though the details of the package have not been specified, it is going to help all classes of businesses. Though they have relatively few Covid-19 cases considering the size of India’s population, the economic impact has been severe. The country has been under a strict nationwide lockdown since late March which is set to expire May 18th.

African countries unite to fight virus

According to the Africa Union’s division for Disease Control and Prevention, many African countries are uniting to fight the coronavirus pandemic. A system to pool orders for diagnostic and medical equipment is being developed so that countries can coordinate their purchases of necessary medical supplies. It is the hope that this system will increase testing availability across the continent.

Geopolitics Spotlight

US-China relations become strained…again

The US and China engaged in another round of tit for tat threats as the finger-pointing over Covid-19 continues. This week, US intelligence agencies accused China of conducting cyberattacks to steal research on Covid-19 vaccines, treatments, and testing resources. Though officials from both countries said last week that the phase-one trade deal is still on, US President Trump has dismissed any discussion of renegotiating the agreement. Furthermore, President Trump’s administration is looking into Chinese firms listed on US stock exchanges that may not be following US accounting rules, and the White House has stonewalled a plan that would’ve allowed US government employee retirement plans to invest in an index fund with Chinese equity exposure. In retaliation for the US’ moves, China is considering countermeasures against US states and politicians who seek damages from China over the pandemic. Additionally, China reported the country could activate its unreliable entities list if the US were to try and block technology sales to Huawei.

Afghanistan resumes “offensive” stance towards Taliban Announced by President Ashraf Ghani this week, Afghanistan’s military will move from “active defense” to an “offensive” stance against the Taliban. The move comes after a string of deadly attacks attributed to the terrorist group. The most recent violent incidents in the country include attacks on a hospital’s maternity ward and a funeral which killed forty people. Though the two parties had been progressing in negotiations and initiating confidence-building measures, the increase in Taliban attacks has brought the progress to a grinding halt. The Taliban have called Afghanistan’s latest announcement a “declaration of war”.

Recommended Reads

The Great Decoupling

W.T.O. Chief Quits Suddenly, Adding to Global Turmoil

A world in crisis even without the pandemic: Five looming problems

Turkey blames ‘foreign powers’ for fresh currency woes

US government pension fund halts plan to buy Chinese stocks

Druckenmiller Says Risk-Reward in Stocks Is Worst He’s Seen

Latin America’s Outbreaks Now Rival Europe’s. But Its Options Are Worse

The Humbling of Emmanuel Macron

This Week from BlackSummit

Covid-19 and the Future of the Eurozone

John E. Charalambakis

Covid-19 and the Day After

Rachel Poole and Tyler Thompson

Image of the Week

Video of the Week

Amsterdam trials ‘Covid-safe’ restaurant

Source: BBC News