Global equities continued their decline this week amid the continuation of the COVID-19 global health crisis. Volatility remained extremely high, reaching 85 on Wednesday before dropping back down to 63 on Friday. The yield on the US-Treasury note rose 0.16% to 1.08% over the week while a barrel of West Texas Intermediate crude oil dropped $7 to $24.75 amid continued concerns of global growth and the ongoing price war between Saudi Arabia and Russia.

Government and health officials have tightened restrictions across the world this week in an effort to slow the spread of COVID-19. In Europe, Italy and Spain have declared national lockdowns. In the US, social distancing has led to the closing of businesses, schools, and cultural institutions. California and New York have imposed statewide shutdowns, ordering citizens to stay in their homes, mandating businesses to close, and only allowing travel to grocery stores, pharmacies, and medical facilities. Though the measures should hinder the spread of the virus, fear and uncertainty continue to rule the markets.

Central banks have unveiled a variety of measures to combat the COVID-19 pandemic. The US Federal Reserve cut interest rates 100 basis points to near zero and pumped massive amounts of liquidity into commercial paper and money markets. The European Central Bank added a new €750 billion asset purchase program to support the euro, while the Bank of England restarted its quantitative easing program by cutting its base lending rate to 0.10%. Government bond yields spiked globally as some investors sold off their most liquid assets and demand for the US dollar rose in foreign exchange markets.

Relations between China and the US became more strained this week after a tit-for-tat expulsion of journalists. China promptly expelled journalists from the New York Times, Wall Street Journal, and Washington Post after the US designated five Chinese media outlets as foreign missions and restricted the number of Chinese nationals that can work for them. Tensions further escalated after accusations over the origin of COVID-19 were exchanged. A Chinese political official accused the US of bringing the virus to Wuhan and President Trump has repeatedly blamed china for the pandemic, even calling COVID-19 the “Chinese virus.” The heightened political tensions only exacerbate investor anxiety during an already volatile and uncertain time.

What could affect the markets in the weeks ahead?

A variety of events, including summits and high-profile meetings between world leaders, are being postponed around the world due to the coronavirus pandemic. For example, Brexit negotiations have been postponed for the time being which may also delay the December 2020 deadline for an agreement. An anticipated summit between Turkey and the European Union to discuss a refugee deal will now be held virtually. A major cultural event in question is the 2020 Summer Olympics, scheduled to be held in Tokyo, Japan.

Former Vice President, Joe Biden, has surged past Vermont Senator Bernie Sanders in the race for the Democratic nomination. Biden will most likely win the nomination to battle against President Donald Trump for the presidency. This week, Biden pledged to choose a female running mate if he indeed beats out Sanders.

Recommended Reads

Containing the Dollar Credit Crunch

America Needed Coronavirus Tests. The Government Failed.

The Coronavirus Could Reshape Global Order

Think twice about emptying your portfolios

Businesses Face a New Coronavirus Threat: Shrinking Access to Credit

Why Are Markets So Volatile? It’s Not Just the Coronavirus.

How the Federal Reserve has moved to support the financial system — explained

The low price of oil will test governments in the Middle East and AfricaUnderstanding SARS-CoV-2 and the drugs that might lessen its power

This week from Black Summit

Crisis Mode, Portfolios, and Responses: A Buffer or an Amplifier?

John E. Charalambakis

Image of the Week

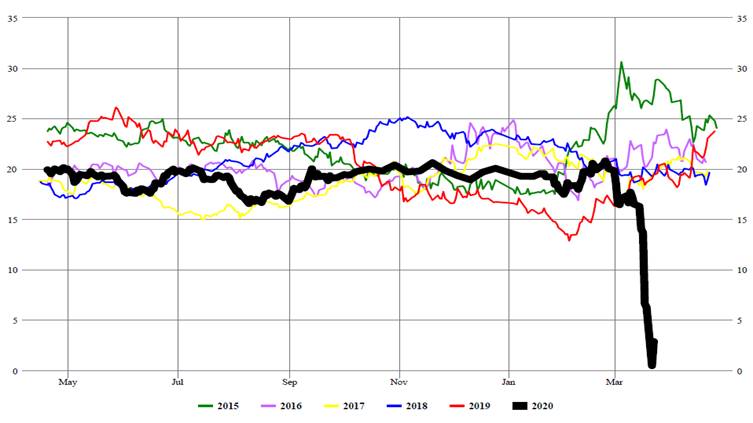

The image above displays a crack spread between gasoline and crude oil (May 2020 futures market). As you can see, It looks like it is falling off a cliff. The crack spread is the refinery’s profit (the difference between the price that the refiner pays for a barrel of oil and the price of gasoline per gallon multiplied by 42, given that there are 42 gallons in the barrel). A rising spread implies either rising demand for gasoline or rising oil prices. When the crack spread falls off a cliff it implies that economic activity may be coming to a standstill.

Source: Fundamental Analytics

Video of the Week

Solidarity in the time of Coronavirus

Source: DW News