Market Action

Re-emerged fears over the spread of the coronavirus seem to be the cause of the fall of global equities this week. The yield on the US 10-year Treasury note fell 11 basis points to 1.46% while the yield on the US 30-year Treasury bond hit a record low of 1.89%. On the other hand, gold prices are rising as global risks are rising. The price of a barrel of West Texas Intermediate crude oil rose a dollar to $53.10. Volatility, as measured by the Cboe Volatility Index (VIX), rose to 17.6 from 14.1 last week.

The coronavirus infection rates in China have slowed this week, but new infection reports, as well as deaths are being reported in at least 26 countries outside of China. The number of cases has risen sharply especially in Iran and South Korea, heightening fears of global spread. World markets are hoping the virus impact will be V-shaped, a sharp economic decline followed by a swift rebound. However, others, such as International Monetary Fund director Kristalina Georgieva, speculate the impact will more likely be “U”-shaped, where the impact is somewhat longer. As of Friday afternoon, the number of people infected globally with the virus was 75,000 and the number of deaths was 2,236.

Japan is likely to fall into a recession as tourism, factories, and consumer demand struggles. The country was already moving towards a recession, but the spread of the coronavirus has exacerbated their economic and financial problems as cases increase in Japan and its neighbor, China, struggles with economic slowdown as well. This week the Japanese yen fell around 2% versus the US dollar, giving the impression that the currency is losing its safe haven status.

Morgan Stanley announced on Thursday that it would buy E-Trade for $13 billion, signaling the increasing convergence of Wall Street and Main Street and marking the biggest takeover by a major American lender since the 2008 global financial crisis. This deal gives Morgan Stanley a large share of the online trading market, 5.2 million customer accounts, and $360 billion in assets.

The US and the Taliban have agreed to a week-long reduction in violence in Afghanistan. The deal opens the door for the US and Taliban to sign a more official agreement with the militant group on February 29th. If all goes well over the next week, the Afghan government plans to launch its own direct talks with the Taliban to forge an agreement to bring an end to an 18-year war.

What Could Affect the Markets in the Days and Weeks Ahead

Iran’s parliamentary election results will be announced next week. A vetting committee, loyal to Iran’s Supreme Leader Ali Khamenei, have prohibited thousands of candidates from running. The Islamic Revolutionary Guard Corps and top religious clerics are hoping for a high voter turnout to support the conservative regime of Khamenei. A victory for the conservatives would weaken moderate President Hassan Rouhani. Protestors, who continue their demonstrations throughout the country, are calling for a boycott of the elections.

World leaders and finance ministers from the Group of 20 (G20) will meet in Saudi Arabia next week. On the top of the agenda will be the economic impact of the coronavirus and a proposed agreement to tax tech giants.

The Nevada caucuses are Saturday night, with Bernie Sanders the favorite to claim victory as the top Democratic nominee once again. According to the New York Times’ poll watch, Sanders leads the current national Democratic polls followed by Joe Biden and Michael Bloomberg.

This Week From BlackSummit

Debt, Aristotle, and the Fed: A Virtuous Vice?

John E. Charalambakis

Recommended Reads

US 30-year yield falls to record low as investors seek safety

Beijing’s Great Leap Backward

Euro Is Swept Up in Global Funding Frenzy, Set for More Pain

Lebanon’s Yields Hit 1,000% as Government Calls in Bond Advisers

‘A horrifying new level’: UN says 900,000 displaced in northwest Syria since December

‘It’s Like the End of the World’

The EU Can’t Widen and Deepen at the Same Time

Video of the Week

Surviving China’s Uighur camps

Source: DW

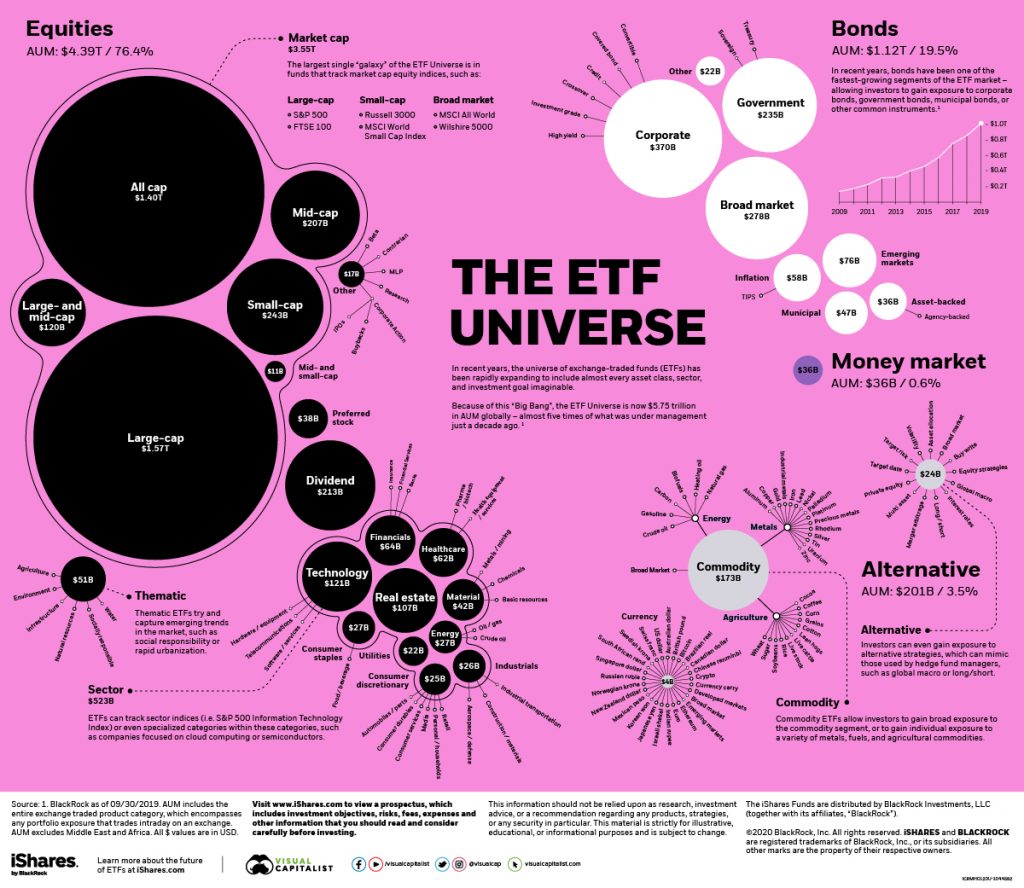

Image of the Week

Visualizing the Expanse of the ETF Universe

Source: Visual Capitalist