Market Action

Amidst the renewed hope for a US-China trade agreement and the receding fears of a recession, major US equity indices are set to close at record highs. The S&P 500 Index, the Dow Jones Industrial Average and the Nasdaq Composite all set record highs this week. The yield on the US 10-year Treasury note dropped 1- basis points to 1.83% over the week and the price of a barrel of West Texas Intermediate Crude oil rose $0.90 to $57.15. Volatility remained little changed from last week at 12.6, as measured by the Chicago Board Options Exchange Volatility Index (VIX).

Tensions in Hong Kong have escalated further this week leading to significant disruptions for schools, transit systems, and businesses. There is a rumor that Hong Kong’s chief executive, Carrie Lam, will impose a weekend curfew in an effort to quell the violence. Chinese President Xi Jinping has warned that the continued anti-government protests threaten the “one country, two systems” agreement that gives Hong Kong a degree of autonomy. In response to Hong Kong’s crisis, US lawmakers have renewed efforts to pass legislation that would annually certify that Hong Kong is autonomous enough to continue to be eligible for special US trading considerations that reinforce the region’s status as global financial center.

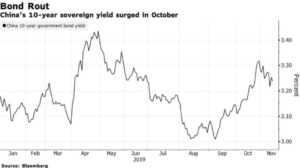

Chinese economic indicators continue to slow. Chinese industrial product rose less than expected in October, only increasing 4.7% year over year compared to 5.8% in September. Furthermore, retail sales are only rising 7.2% which is down from 7.8% last month and fixed asset investment is expanding 5.2% year over year, down from 5.4% in September. Investment growth has reached record lows as exports continue to fall and factory output slows.

Germany narrowly avoided a recession, defined as two consecutive quarters of negative growth, as third quarter gross domestic product expanded 0.1% quarter over quarter. Economic sentiment has rebounded this month due to an improved trade outlook and the fading of no-deal Brexit risk.

Once again, US President Trump has decided to postpone his decision on imposing tariffs on imported autos on national security grounds. He has now missed the November 14th deadline and is expected to delay the decision another 6 months.

US Federal Reserve Chairman Jerome Powell said in a testimony on Capitol Hill this week that monetary policy is likely to remain appropriate and also repeated warnings that the federal budget is on an unsustainable path. In addition, Vice Chairman Richard Clarida said there is little evidence that rising wages is putting unnecessary upward pressure on price inflation as inflation expectations remain at the low end of the Fed’s acceptable range.

What Could Affect the Markets in the Days Ahead

While there is optimism that the US and China will reach the first phase of a trade agreement by the end of the year, there are still challenges that remain. China continues to be wary of US demands as the US continues to resist the rollback of tariffs. US President Donald Trump said this week that a phase one deal could happen soon, but that the US would only accept it if it is good for US workers.

The public phase of impeachment hearings against US President Donald Trump commenced this week. At the moment, there seems to be high probability that the House will impeach him but a low likelihood that the Senate will convict him to be removed from office, but the uncertainty the proceedings bring to the nation could affect the markets in the weeks ahead.

China’s rough third quarter and dismal start to the fourth quarter will undoubtedly force the Chinese government to respond to their major economic slowdown. Adding to the pressure on President Xi Jinping’s administration is the continued escalation of anti-government protests in Hong Kong. The world waits in anticipation of the mainland’s next move.