Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : October 5, 2019

Market Action

Global equities declined this past week amid signs of slowing US growth. The outlook for slower growth also pushed down the yield on the US 10-year Treasury note 14 basis points to 1.54%. The price of a barrel of West Texas Intermediate crude oil fell $2.50 to $53.10. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 18 from 16.5 a week ago. (The VIX reached 20 on Wednesday.)

The US Department of Labor released a mixed September employment report Friday morning, showing that the unemployment rate declined to 3.5%, the lowest level since 1969, but the pace of hiring continued to slow. Moreover, purchasing managers’ indices published this week showed the manufacturing sector slipping further into contraction (to its lowest level in 10 years) and the services sector slowing markedly as well.

Because of signs of slowing growth, markets are pricing in at least one rate cut by the end of 2019 — likely to come at this month’s meeting of the Federal Open Market Committee — with another cut potentially to follow in December.

The World Trade Organization authorized the US to impose $7.5 billion in tariffs on imports from the EU. Rather than strike back directly at Europe’s Airbus by imposing tariffs of up to 100% on their airplanes, the US will spread the tariffs across several sectors: Aircraft will be subject to a 10% duty while French wine, Scotch whiskey and other goods will be subject to levies of 25%. The EU is expected to have a similar claim against the US when the WTO decides a subsidy case concerning Boeing aircraft early next year.

Hong Kong invoked colonial era emergency powers for the first time in more than a half-century this week, banning the wearing of facemasks by protestors. The move comes after protests on October 1st — the 70th anniversary of the founding of the People’s Republic of China — turned violent and the police used live ammunition for the first time after months of protests.

The Reserve Bank of India, the latest central bank to react to the slowdown in global growth, lowered its repo rate 25 basis points, to 5.15%. The Reserve Bank of Australia also cut interest rates, by 0.25% to 0.75%, and indicated more cuts are expected; this is the Australian central bank’s third cut in the past five months.

What Could Affect the Markets in the Days Ahead

Polish voters vote on October 13 in a parliamentary election. The ruling nationalist Law and Justice (PiS) party under leader Jaroslaw Kaczynski has portrayed itself as the champion of the welfare state and traditional Polish values. Polls predict an election win for PiS, accused by the EU of undermining the rule of law and with a history of clashing with Brussels over judiciary reforms.

In Portugal, Socialist Prime Minister Antonio Costa looks set to retain power in a parliamentary vote on Sunday, October 6, even though his pledge doesn’t look much like a vote-winner in western Europe’s poorest country: No backtracking on tight spending controls.

Third-quarter earnings are around the corner. With Europe in a corporate recession and US earnings slowing, analysts are likely to be revising high forecasts for the fourth quarter and next year. That evokes a sense of deja vu from last October, when markets were riding high before the earnings season despite trade war and Brexit risks, but eventually started to fizzle out as companies sounded warning bells. Recently, dire factory activity data and surprise declines in services activity have spoiled the stock market party and raised concern that the slowdown is spreading beyond industrials.

This Week From BlackSummit

Crossroads: At the Intersection of Geopolitics and Geoeconomics

Rachel Poole

Recommended Reads

Why the Middle East Is More Combustible Than Ever

Communist China Turns 70 – WSJ

Slowing Trade Hits Global Manufacturing – WSJ

How fortunes reversed for Germany and Greece | Financial Times

Draghi backs calls for fiscal union to bolster eurozone | Financial Times

Low Yields Prove a Boon to This Stock-Bond Hybrid Market – WSJ

Video of the Week

Hong Kong Police Shot a Protester at Point-Blank Range, Here’s What Happened | Visual Investigations

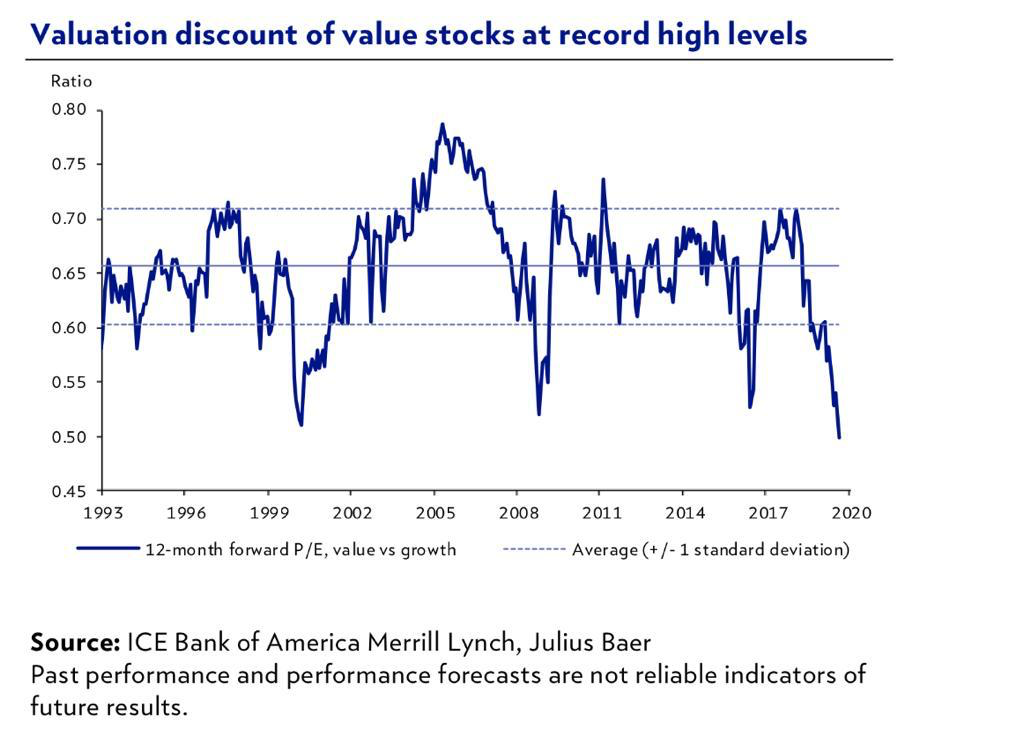

Image of the Week